GST Free

Information on setting items GST Free in RMS.

The following areas of RMS can be set as GST Free to accommodate scenarios where GST is not to be charged without affecting the property's overall tax setup in Accounting Options.

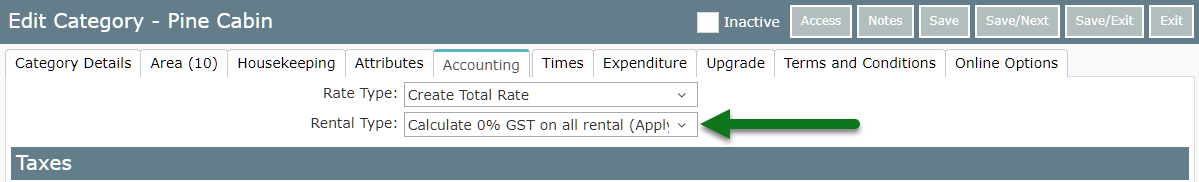

Rental Category

Properties setting up a Category where subdivision 40-B is applicable can select this option for the Rental Type on the Category setup without affecting the Global Accounting Setup or remaining Categories at the property.

When this option has been selected a the Category level, any reservation created for this Category and its associated Rate Types will be posted without any GST calculated on the account.

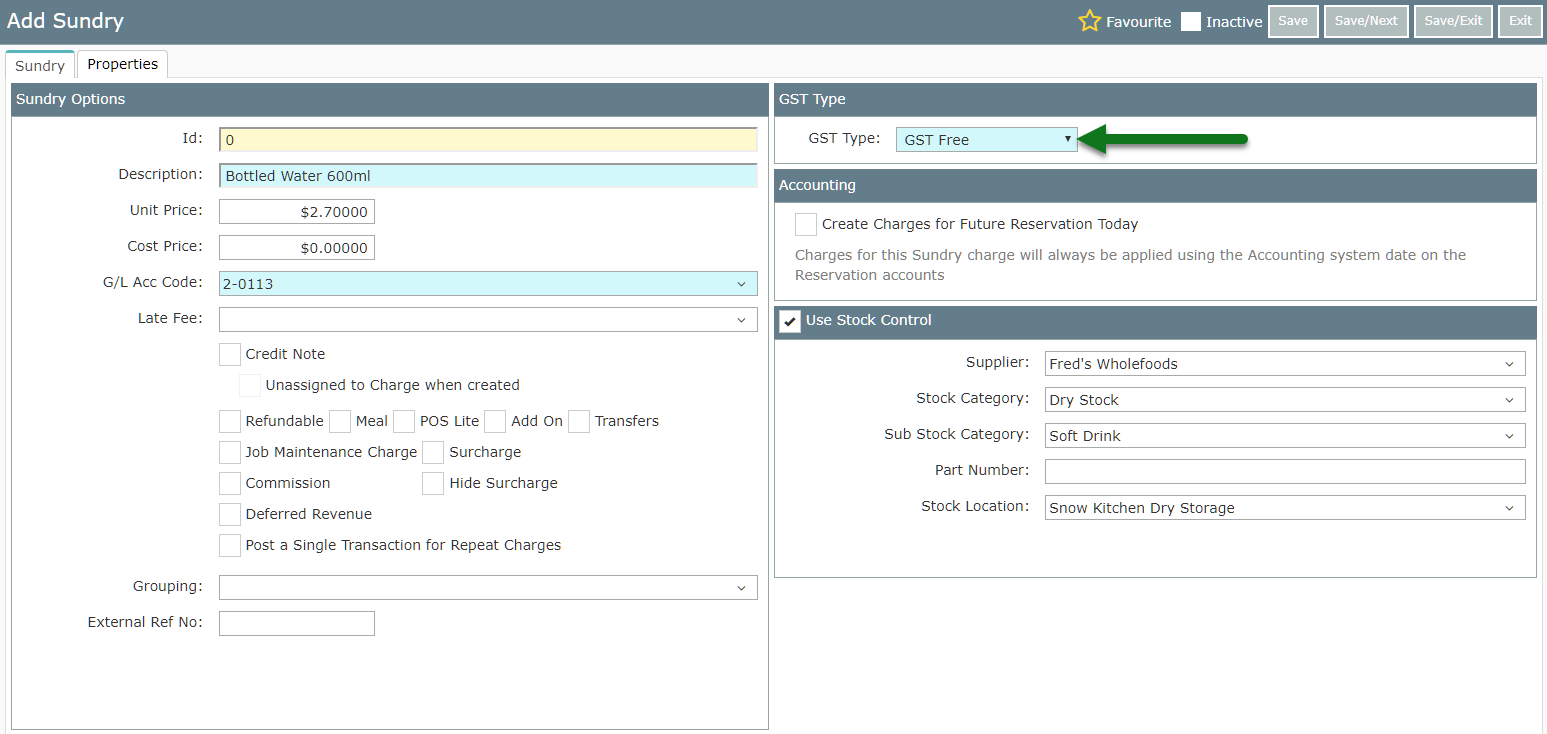

Sundry Charge

Incidental charges that do not incur GST should be setup in RMS with the Tax Type of GST Free to ensure that there is no GST calculated when this charge is selected to post to an account.

Selecting GST Free as the Tax Type on a specific Sundry Charge does not affect the Global Accounting Setup or other Sundry Charges setup at the property.

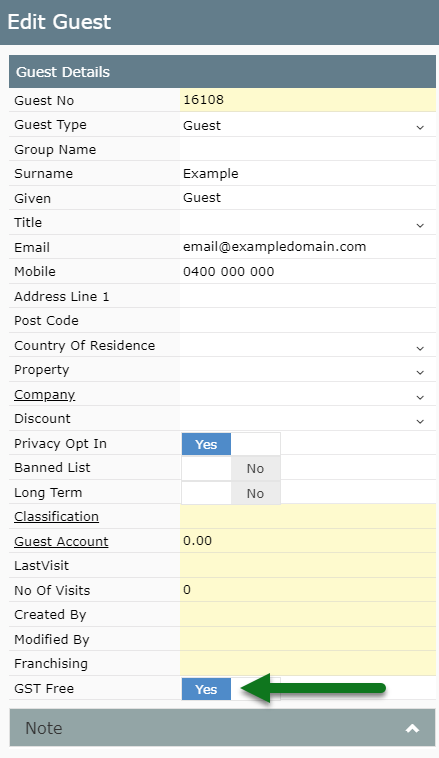

Guest Profile

Setting a Guest Profile as GST Free prompts RMS to remove any GST calculations on any charges applied to their Guest Account as well as set any Reservation with this profile attached as GST Free.

Using this option on a Guest Profile will override any accounting setup on a Category when this Guest Profile is associated to the Reservation.