Tax Examples by Country

Examples of tax setup by country in RMS.

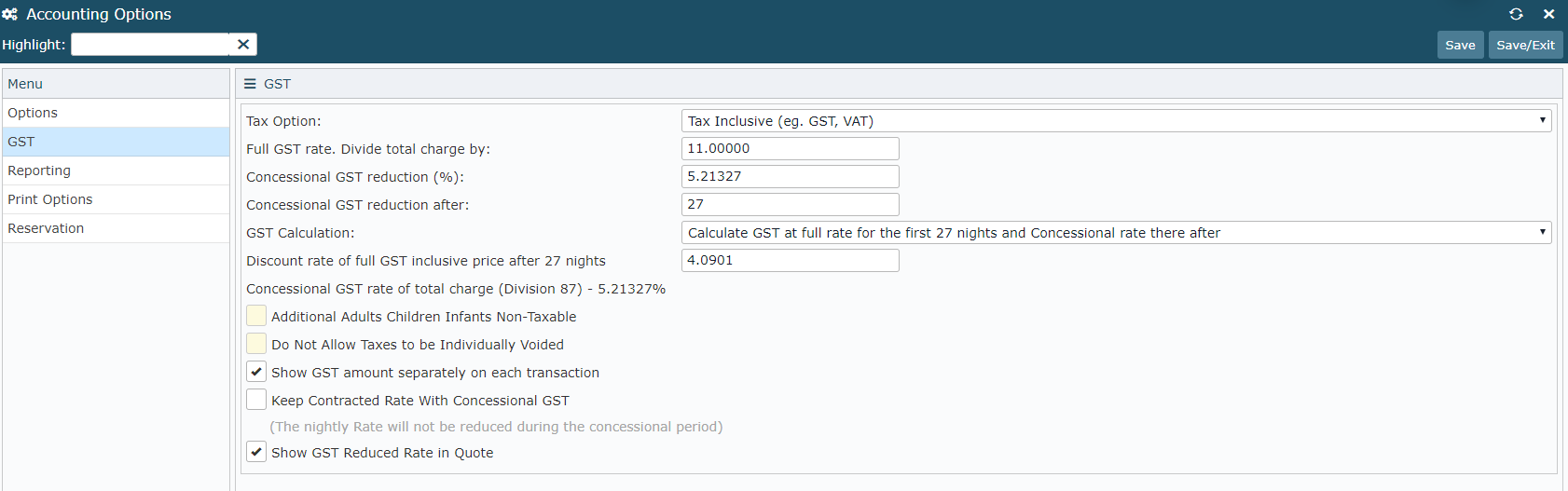

Australia

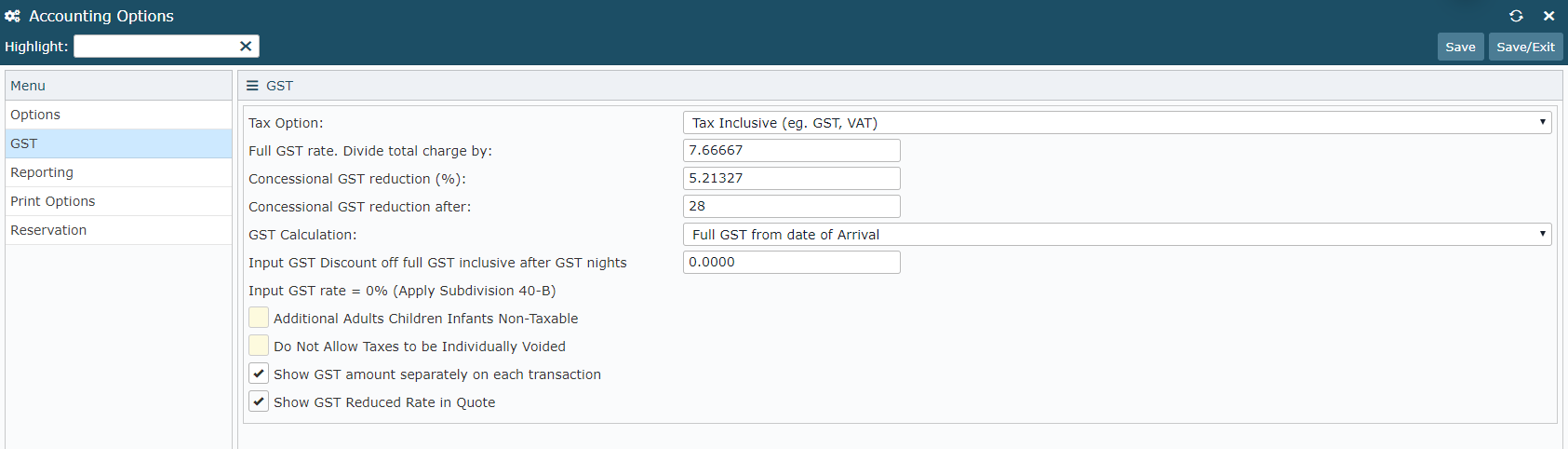

Australia is a tax inclusive country using a GST percentage for all goods and services where GST should be applied.

The current Full GST level in Australia is 10% and can be setup to calculate correctly in RMS by entering the following in Accounting Options.

Concessional GST may be applicable to certain types of accommodation for stays greater than 28 days.

Canada

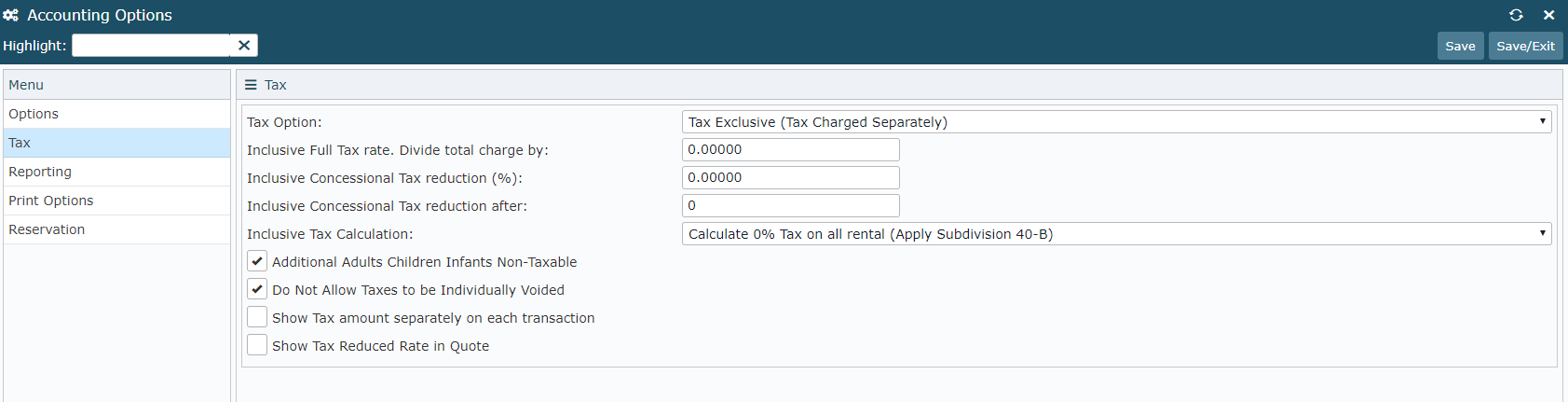

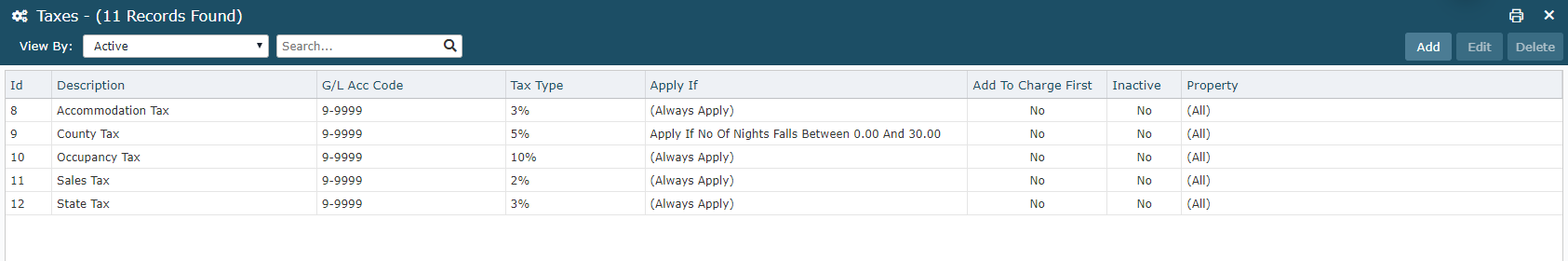

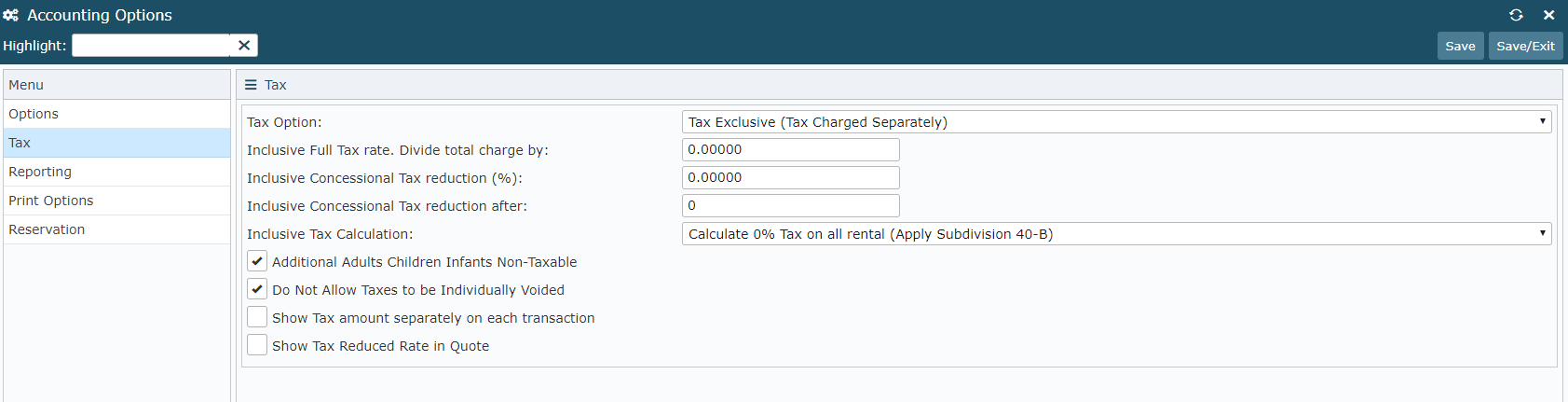

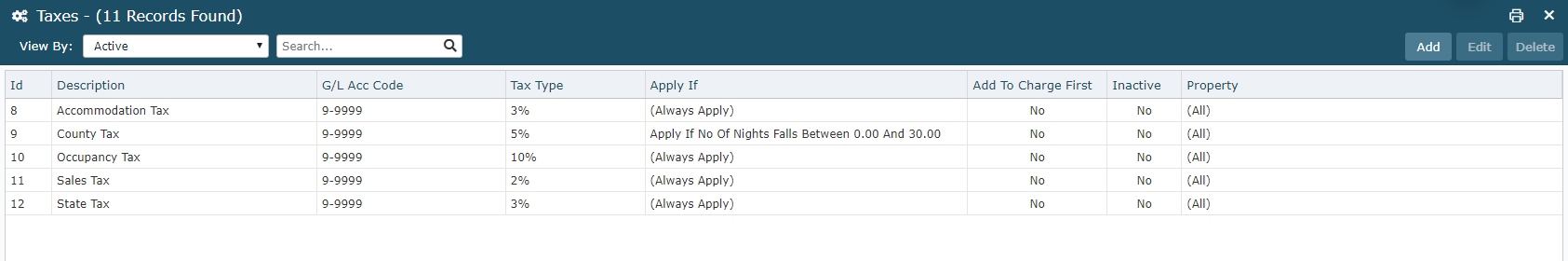

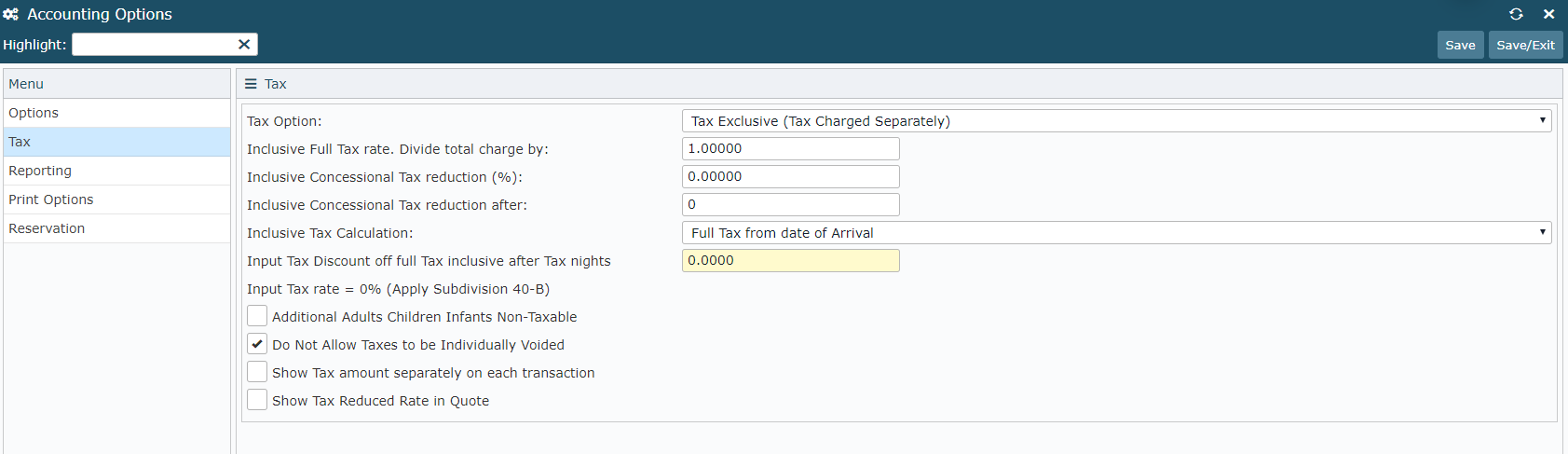

Canada is a tax exclusive country with tax amounts varying per state.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.

China

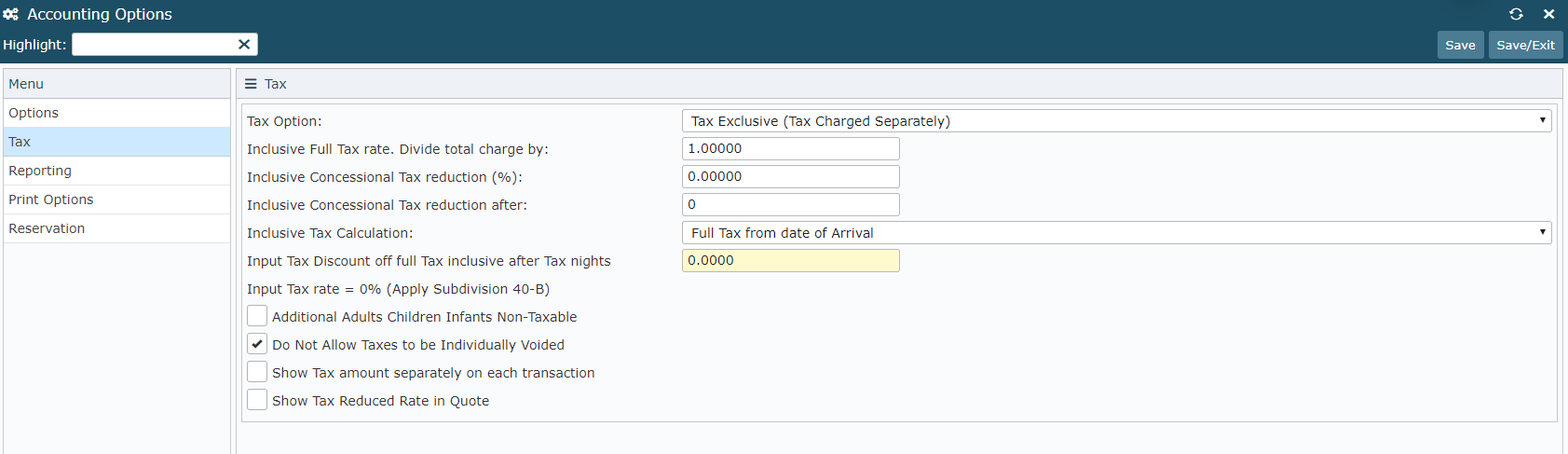

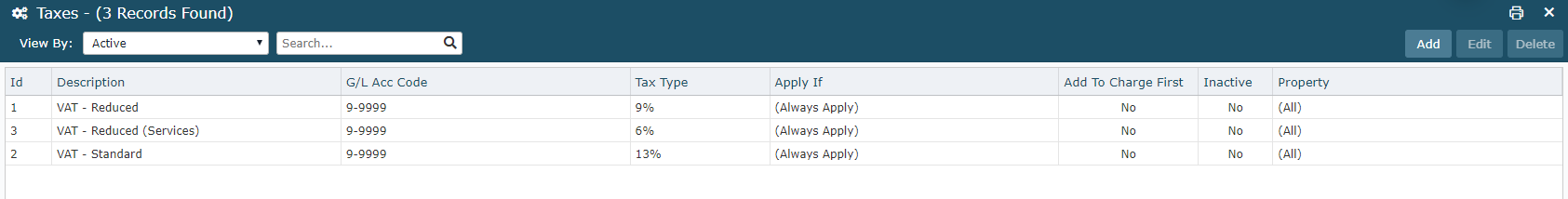

China is a tax exclusive country with a standard Value Added Tax (VAT) of 13%.

In addition to the Standard VAT of 13% there are also reduced rates of 9% and 6% based on the goods or services being provided.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.

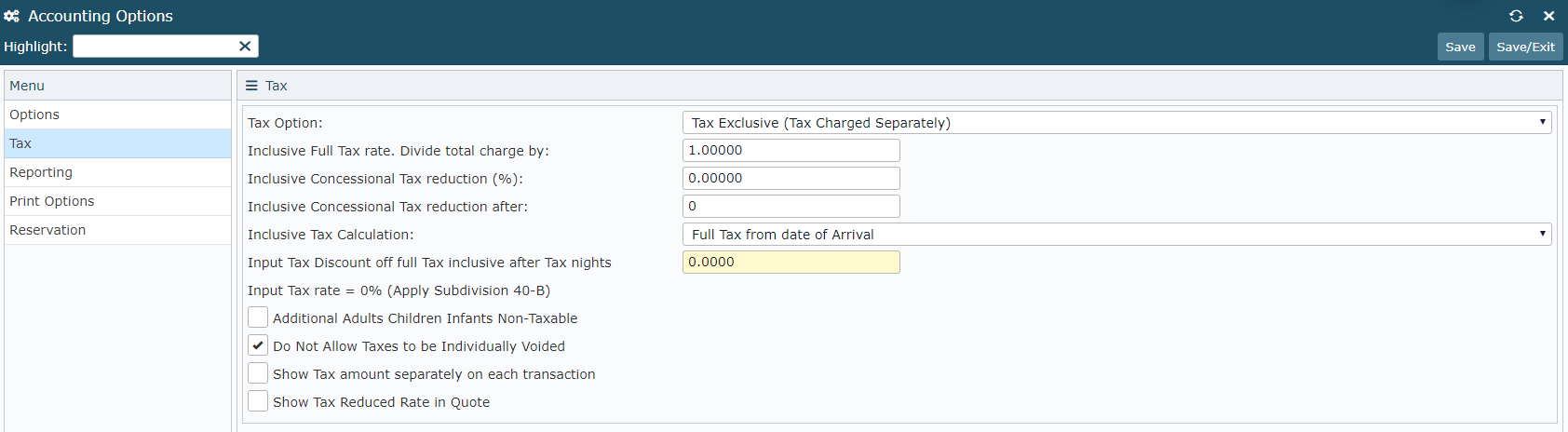

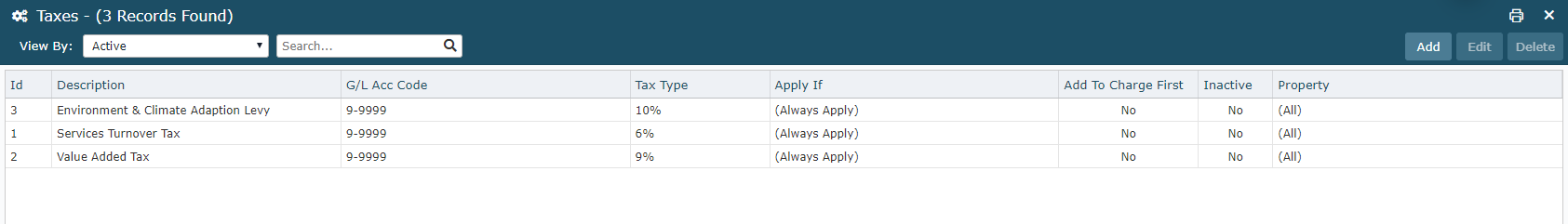

Fiji

Fiji is a tax exclusive country with a combination of Value Added Tax (VAT), Services Turnover Tax (STT) and Environment & Climate Adaptation Levy (ECAL).

In addition to the current VAT of 9% for all goods & services in Fiji, the following taxes apply to accommodation venues.

- 6% of Room Rate SST

- 10% of Room Rate ECAL

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options & Taxes Setup.

Additional service fees such as a Resort Service Fee may also be setup in Taxes to calculate automatically on all reservations.

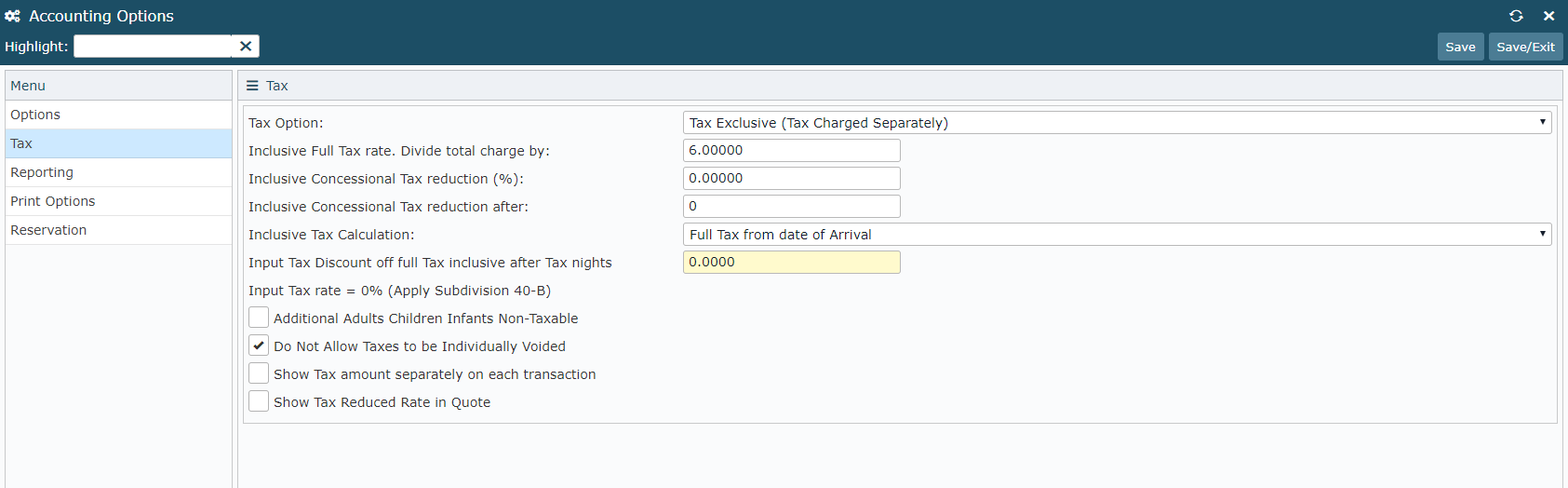

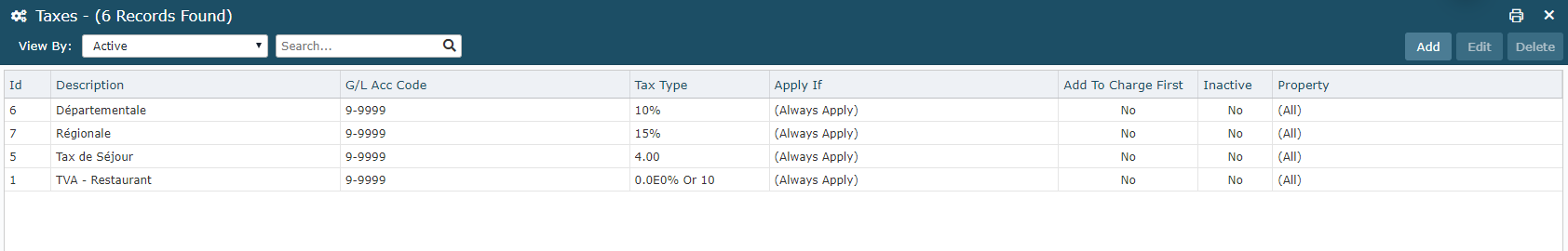

France

France is a country operating with inclusive Value Added Tax (VAT) referred to as TVA and exclusive combination taxes.

The standard VAT amount in France is 20% with a reduced VAT amount of 10% applicable to restaurant food and 33% for luxury items.

In addition to Value Added Tax, accommodation venues throughout France will apply a Tax de séjour (Tourist Tax) which can vary based on the type of accommodation offered. Tourist Taxes are charged as per person, per night. Additionals and Regional Taxes may also be applicable.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.

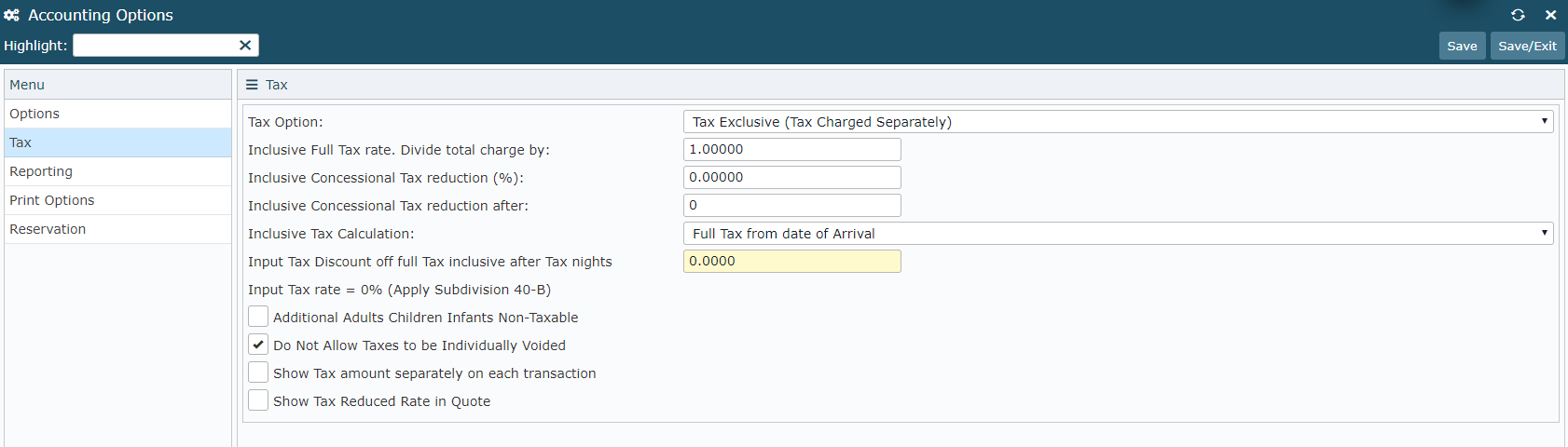

Tax Exclusive with Inclusive 20% TVA

Tax Exclusive with Inclusive 20% TVA

Exclusive Taxes Setup

Exclusive Taxes Setup

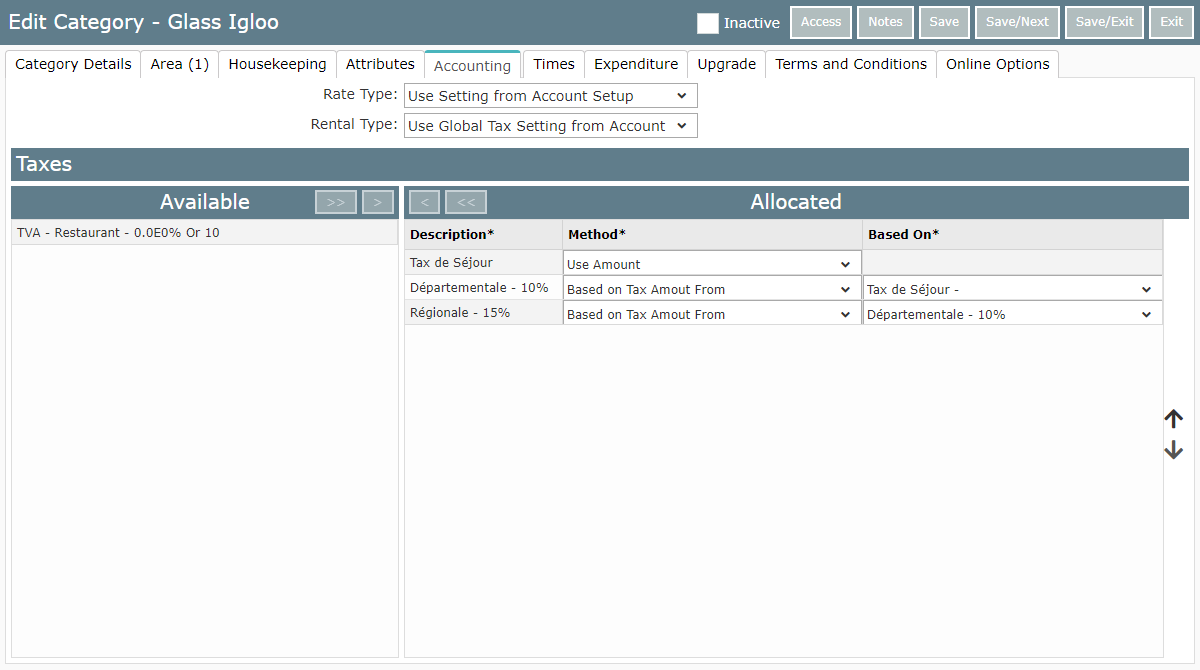

Compounding Taxes on Category Setup

Compounding Taxes on Category Setup

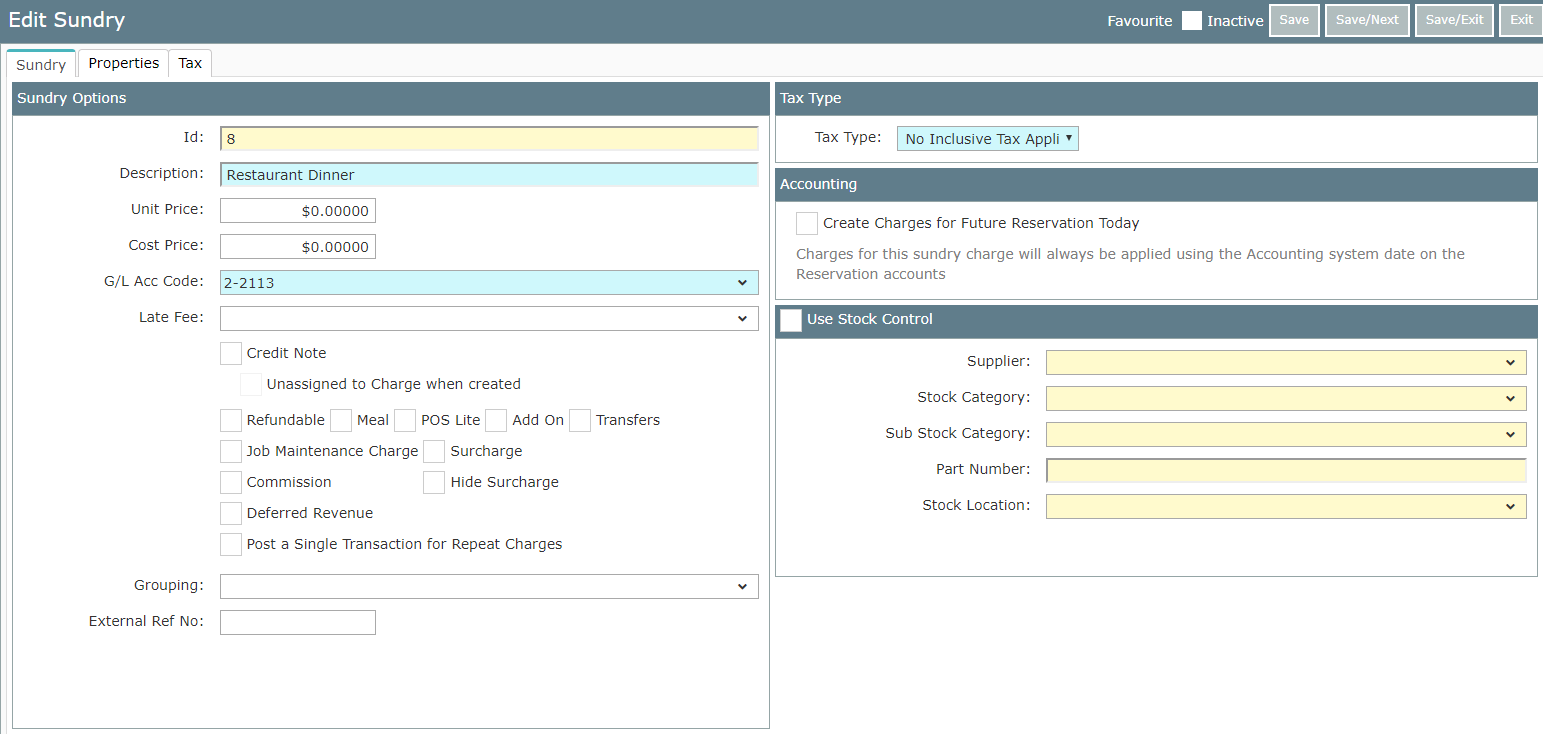

Sundry Charge for Restaurant Food Set to Ignore 20% TVA from Accounting Options

Sundry Charge for Restaurant Food Set to Ignore 20% TVA from Accounting Options

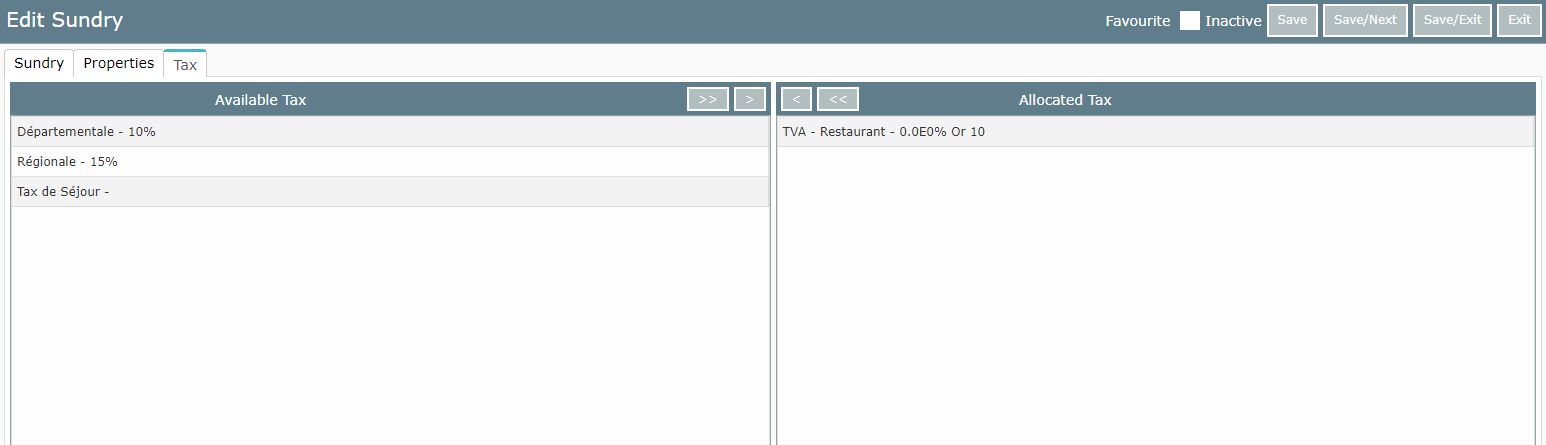

Sundry Charge for Restaurant Food Assigned 10% Inclusive TVA

Sundry Charge for Restaurant Food Assigned 10% Inclusive TVA

India

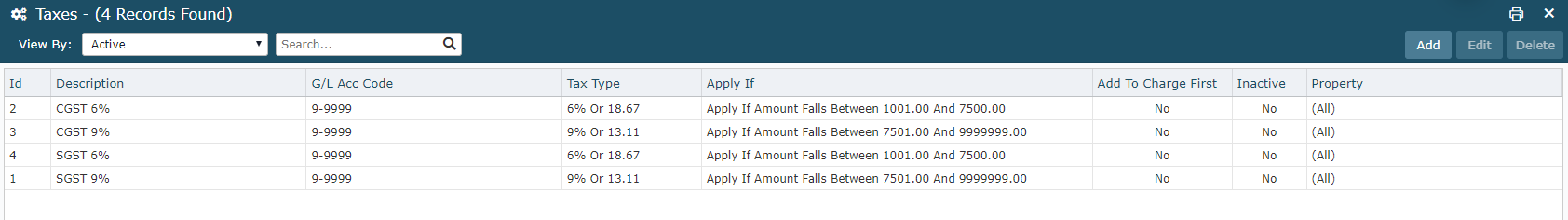

India operates with four tiers of GST, referred to as 'slabs'.

The 4 slabs of GST are currently 5%, 12%, 18% and 28% and consist of CGST & SGST components.

For accommodation venues, the GST slab of 12% & 18% apply based on the Rate Amount.

- Rate Amount Between 1-1000 - GST Free

- Rate Amount Between 1001-7500 - 12% GST (CGST 6% + SGST 6%)

- Rate Amount ≥ 7501 - 18% GST (CGST 9% + SGST 9%)

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.

New Zealand

New Zealand is a tax inclusive country using a GST percentage for all goods and services where GST should be applied.

The current Full GST level in New Zealand is 15% and can be setup to calculate correctly in RMS by entering the following in Accounting Options.

Concessional GST may be applicable to certain types of accommodation for stays greater than 28 days.

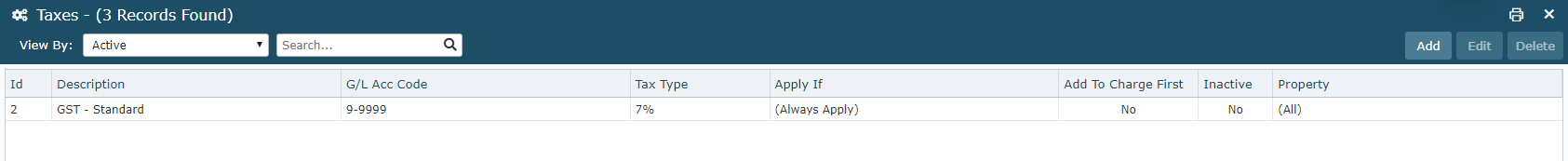

Singapore

Singapore is a tax exclusive country with a standard Goods & Services Tax (GST) of 7%.

In addition to the 7% GST properties may be required to setup GST for telecommunications services or choose to apply a Service Charge in addition to the standard GST.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.

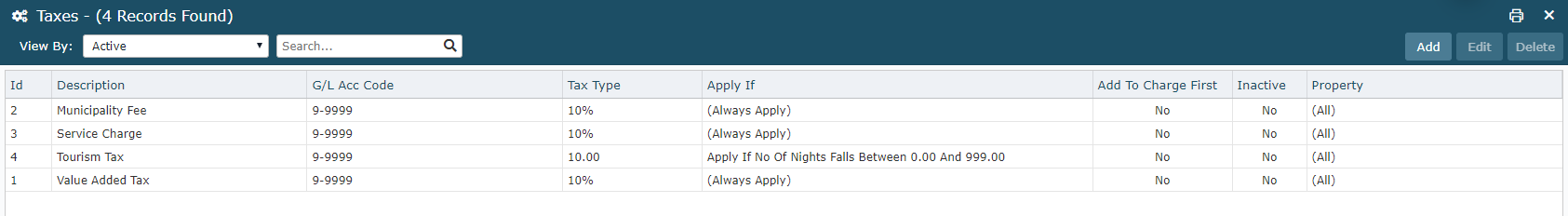

United Arab Emirates

The UAE is a tax exclusive country with a standard Value Added Tax (VAT) applicable to all goods & services.

In addition to the current standard 5% VAT across the UAE, the following taxes apply to restaurants and accommodation venues with variations in each emirate:

- 10% Room Rate Tax

- 10% Service Charge

- 10% Municipality Fees

- 6-10% City Tax

- 6% Tourism Fee

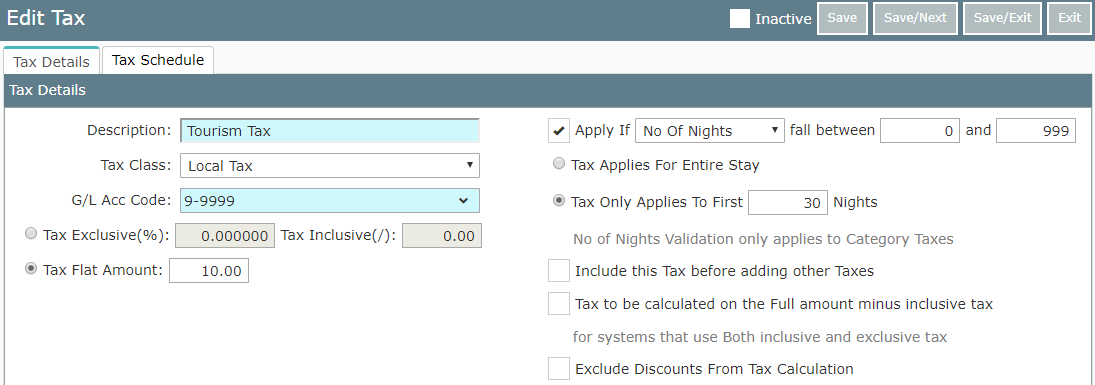

Dubai includes a Tourism Dirham Fee per room, per night up to 30 nights that varies depending on the classification of the accommodation venue.

Abu Dhabi includes a tax of 4% of the Total Rate with an additional flat fee per room, per night.

Ras Al Khaimah accommodation venues include a flat rate tourism fee per room, per night.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options & Taxes Setup.

United Kingdom

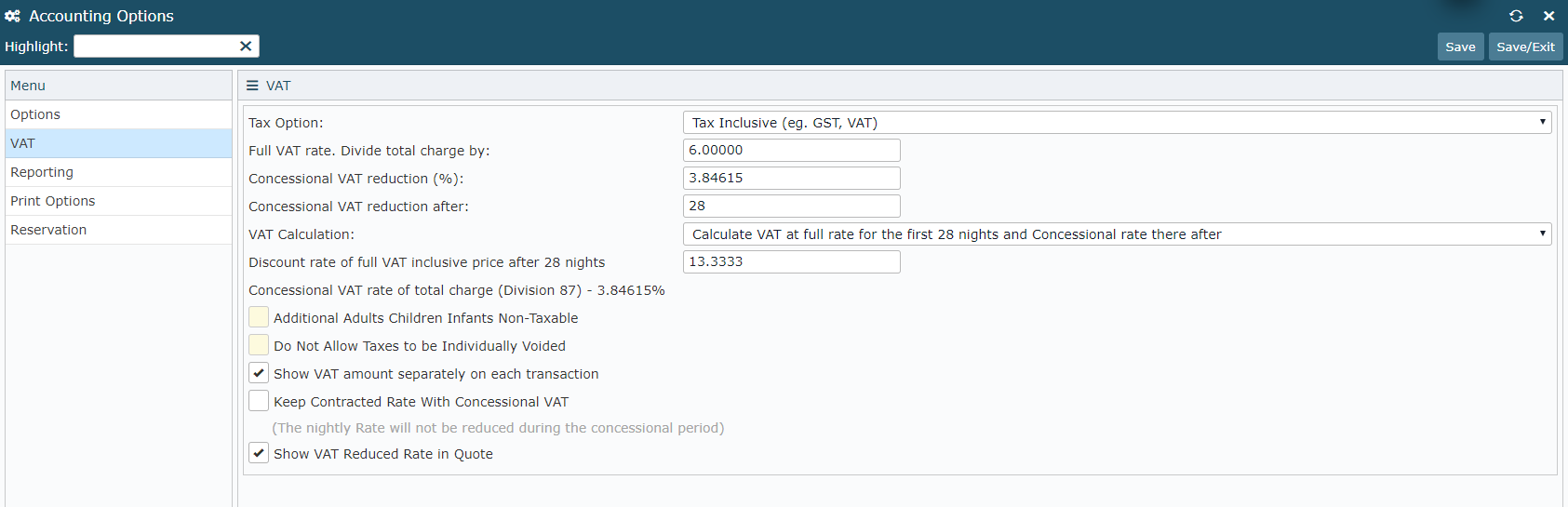

The UK is a tax inclusive country using one VAT percentage for all goods and services where VAT should be applied.

The current Full VAT level in the United Kingdom is 20% and can be setup to calculate correctly in RMS by entering the following in Accounting Options.

Reduced Rate VAT may be applicable to certain types of accommodation for stays greater than 28 nights.

United States

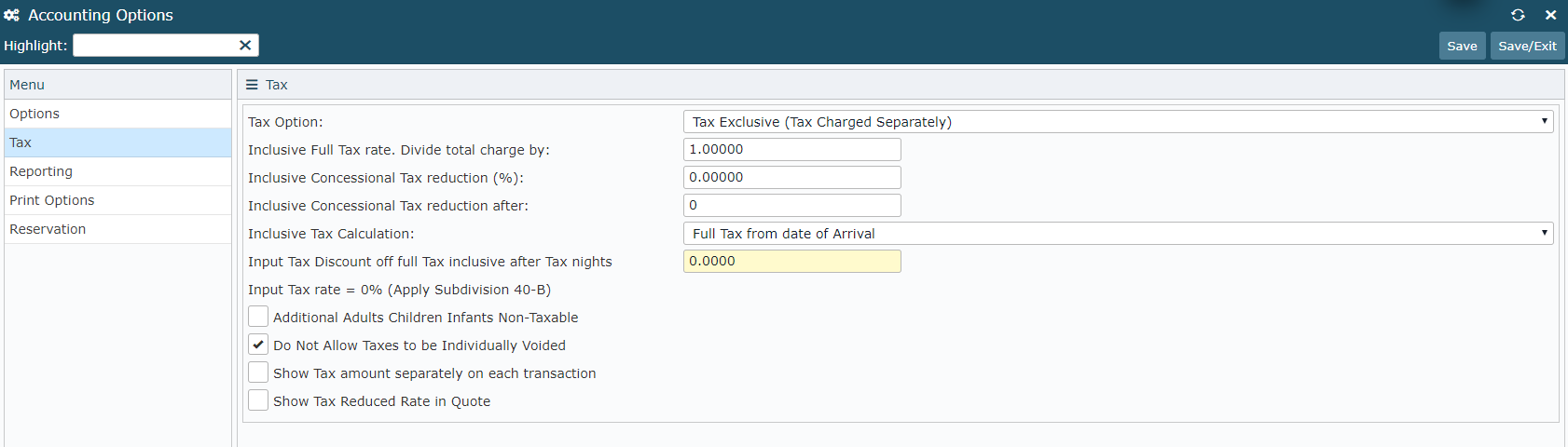

The US is a tax exclusive country with tax amounts varying per city, county or state.

These taxes can be setup to calculate correctly in RMS by entering the following in Accounting Options and Taxes Setup.