Enable Custom Tax Invoice Dates

Enabling additional date options on custom Tax Invoices in RMS.

Steps Required

Have your System Administrator complete the following.

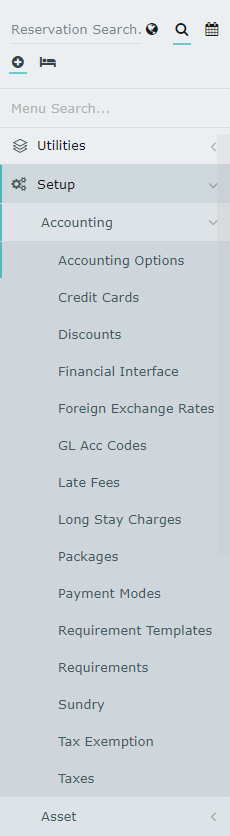

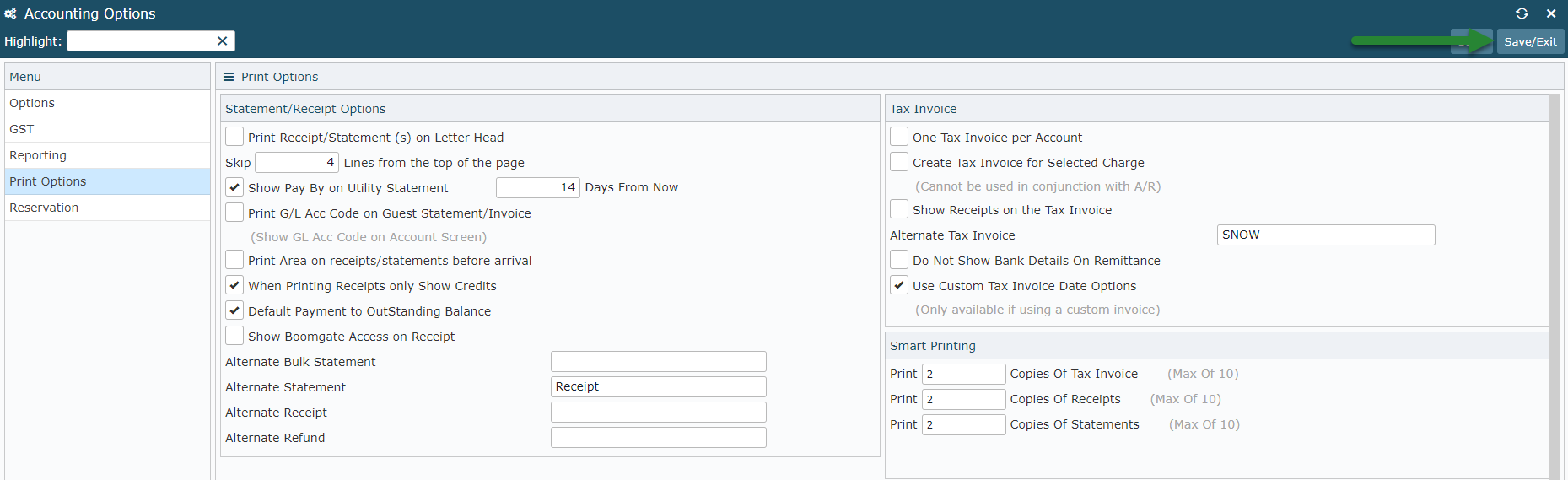

- Go to Setup > Accounting > Accounting Options in RMS.

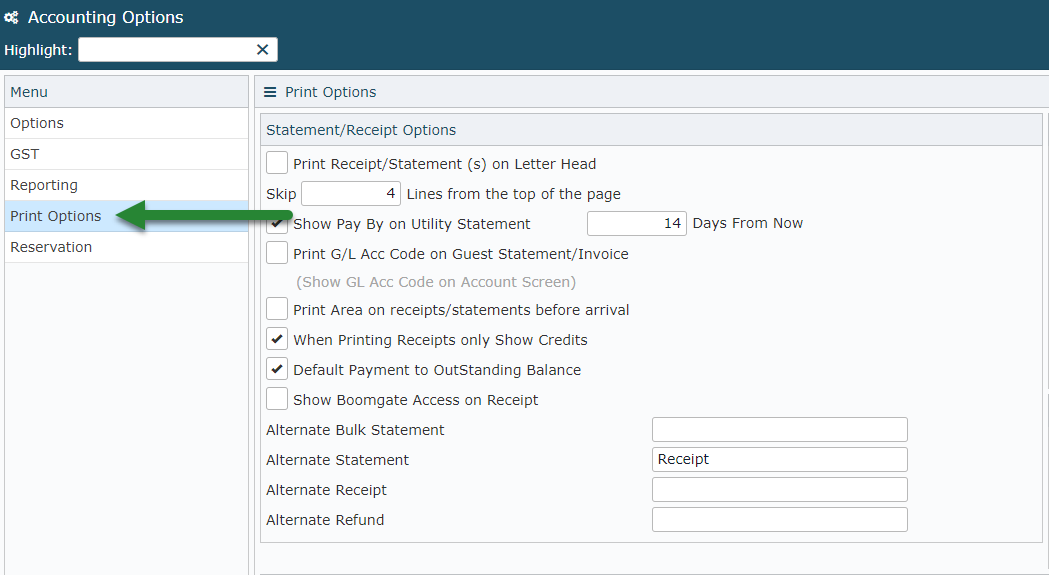

- Navigate to the 'Print Options' tab.

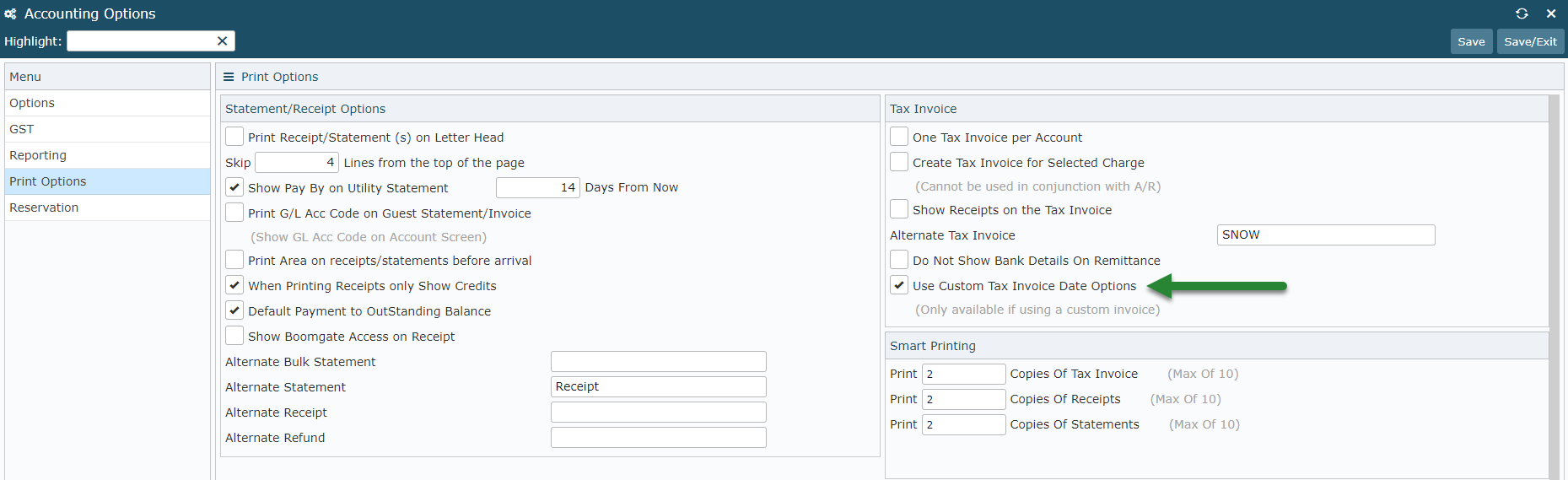

- Select the checkbox 'Use Custom Tax Invoice Date Options'.

- Save/Exit.

- Log out of RMS.

Visual Guide

Go to Setup > Accounting > Accounting Options in RMS.

Navigate to the 'Print Options' tab.

Select the checkbox 'Use Custom Tax Invoice Date Options'.

Select 'Save/Exit' to store the changes made.

Log out of RMS to allow the database to update with the changes made.

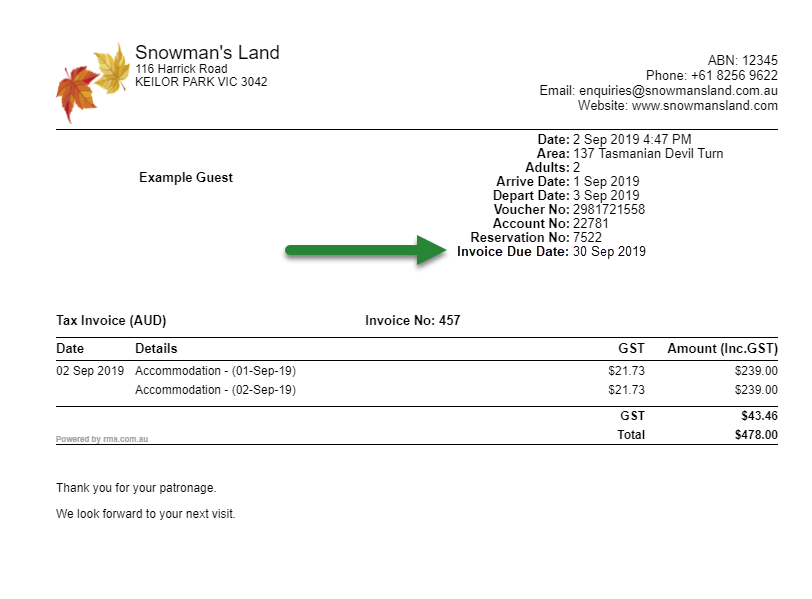

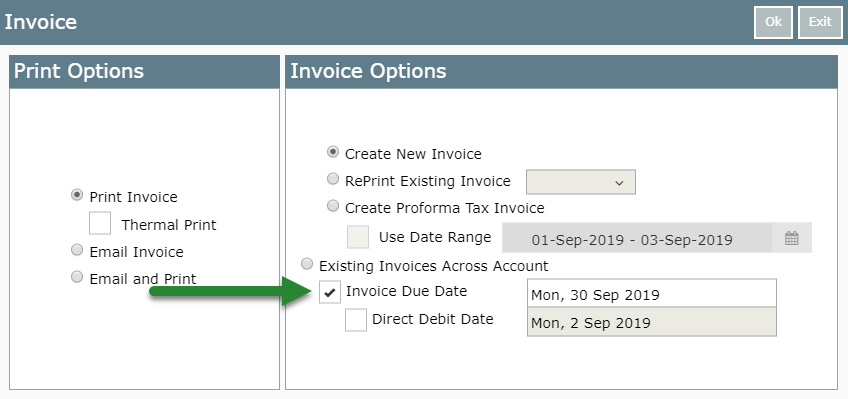

With a Custom Tax Invoice including the Invoice Due Date and/or Direct Debit Date fields in the template, users will have the option to set a date when creating a Tax Invoice in RMS.

The date set will then populate in the specified field located on the template where the property has requested during the development of their custom invoice.