Setup Mandatory Tax Invoice for Check-out

Setup to not allow check-out when no Tax Invoice has been generated on the account in RMS.

Steps Required

Have your System Administrator complete the following.

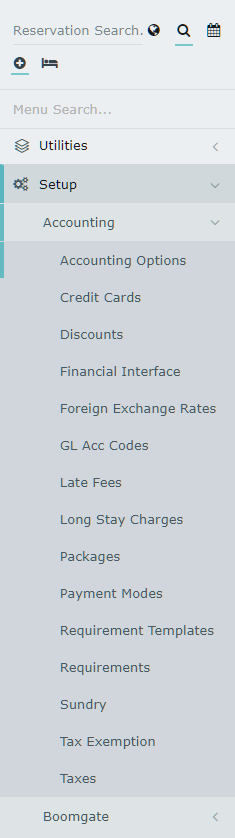

- Go to Setup > Accounting > Accounting Options in RMS.

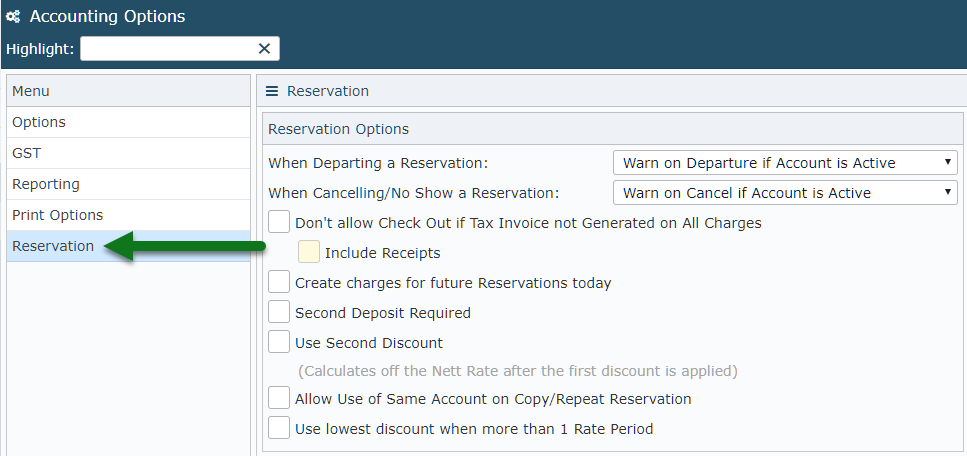

- Navigate to the 'Reservations' tab.

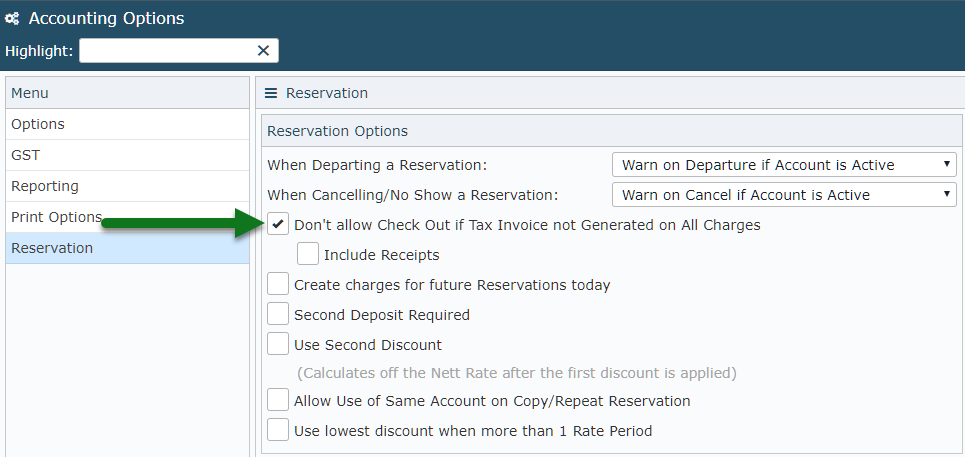

- Select the checkbox 'Don't allow Check Out if Tax Invoice not Generated on All Charges'.

- Optional: Select the checkbox 'Include Receipts'.

- Save/Exit.

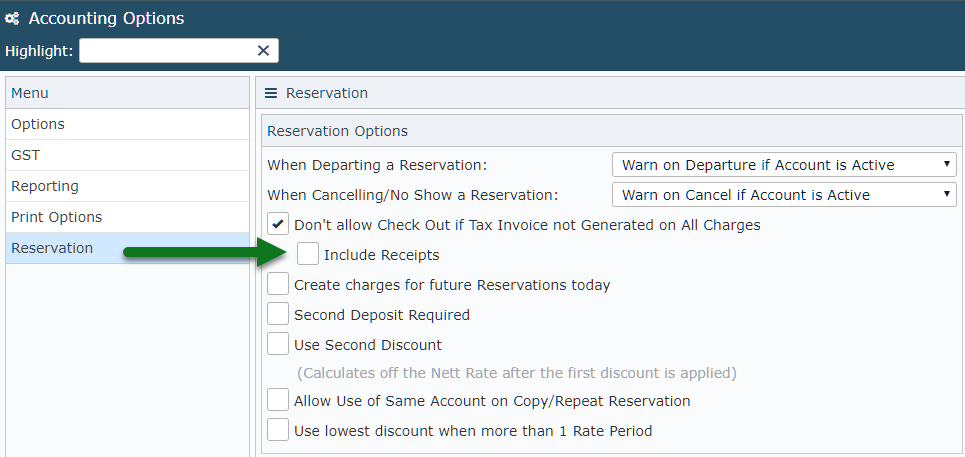

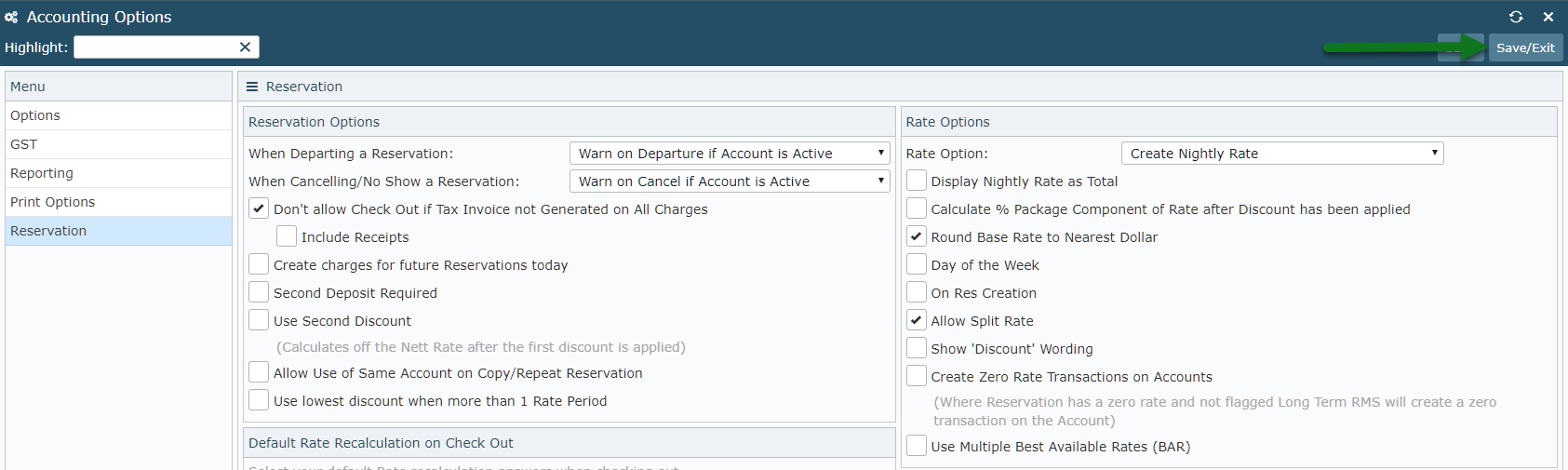

Visual Guide

Go to Setup > Accounting > Accounting Options in RMS.

Navigate to the 'Reservations' tab.

Select the checkbox 'Don't allow Check Out if Tax Invoice not Generated on All Charges'.

Optional: Select the checkbox 'Include Receipts'.

Select 'Save/Exit' to store the changes made.

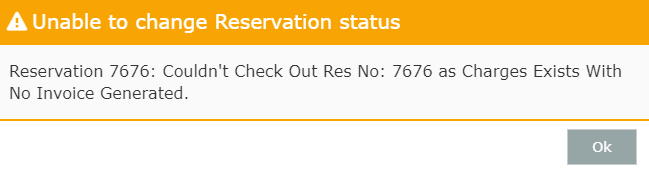

A warning preventing departure will display to users when 'Check-out' is selected and no Tax Invoice has been created for transactions on the Reservation Account.