Tax Exemption with Alternate Taxes

Setup a Tax Exemption that applies alternate taxes in RMS.

Steps Required

Have your System Administrator complete the following.

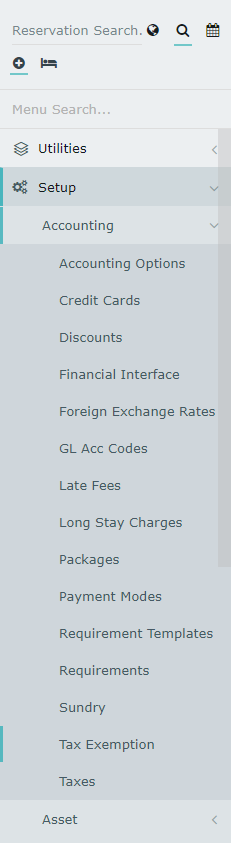

- Go to Setup > Accounting > Tax Exemption in RMS.

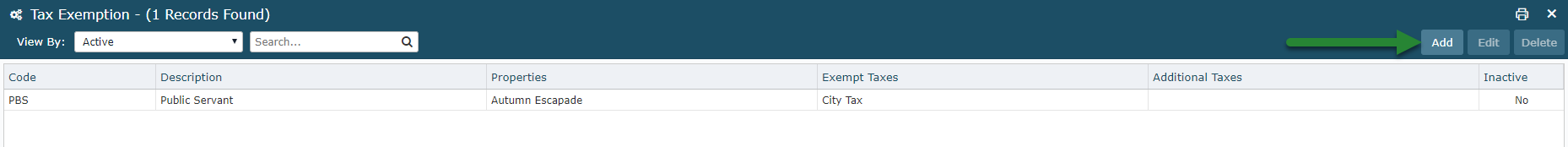

- Select 'Add'.

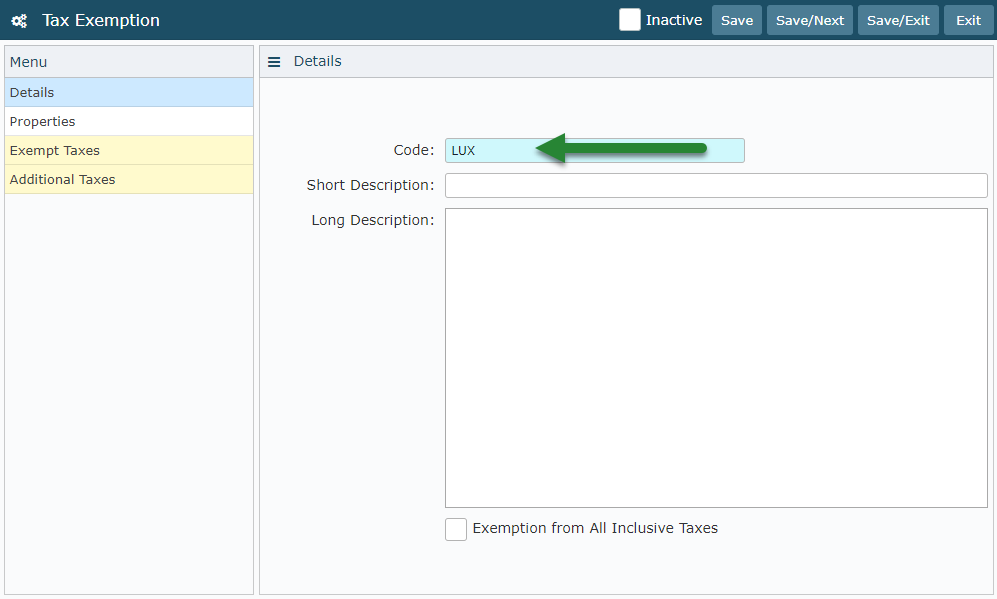

- Enter a Tax Exemption Code.

- Enter a Short Description.

- Enter a Long Description.

- Select if Tax Exemption excludes Inclusive Taxes.

- Navigate to the 'Properties' tab.

- Select the required Properties.

- Save.

- Navigate to the 'Exempt Taxes' tab.

- Select the required Exclusive Taxes for the exemption.

- Navigate to the 'Additional Taxes' tab.

- Select the required Alternate Taxes to be applied.

- Save/Exit.

Visual Guide

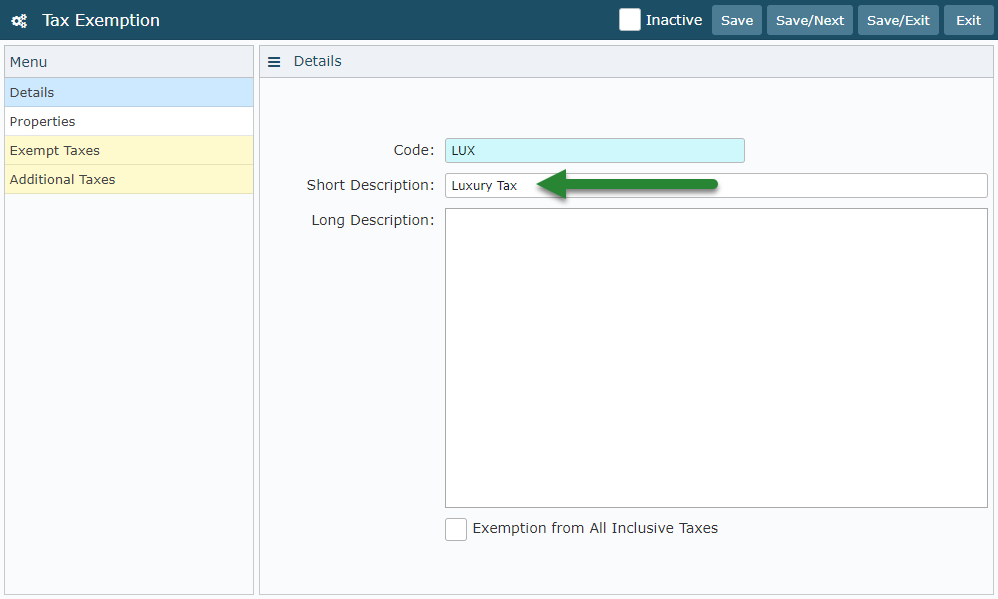

Go to Setup > Accounting > Tax Exemption in RMS.

Select 'Add' to create a new Tax Exemption.

Enter a Tax Exemption Code.

Enter a Short Description.

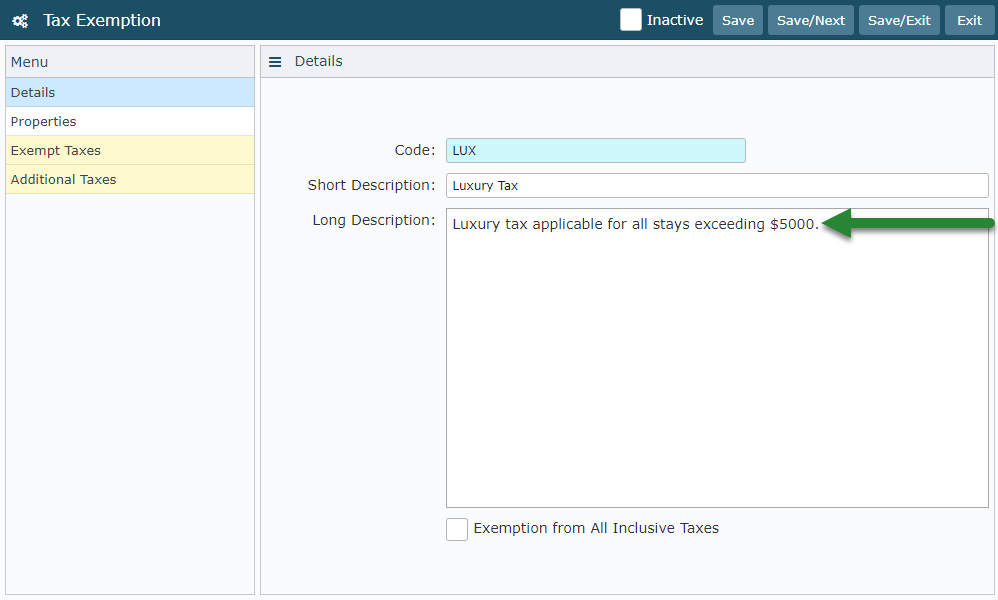

Enter a Long Description.

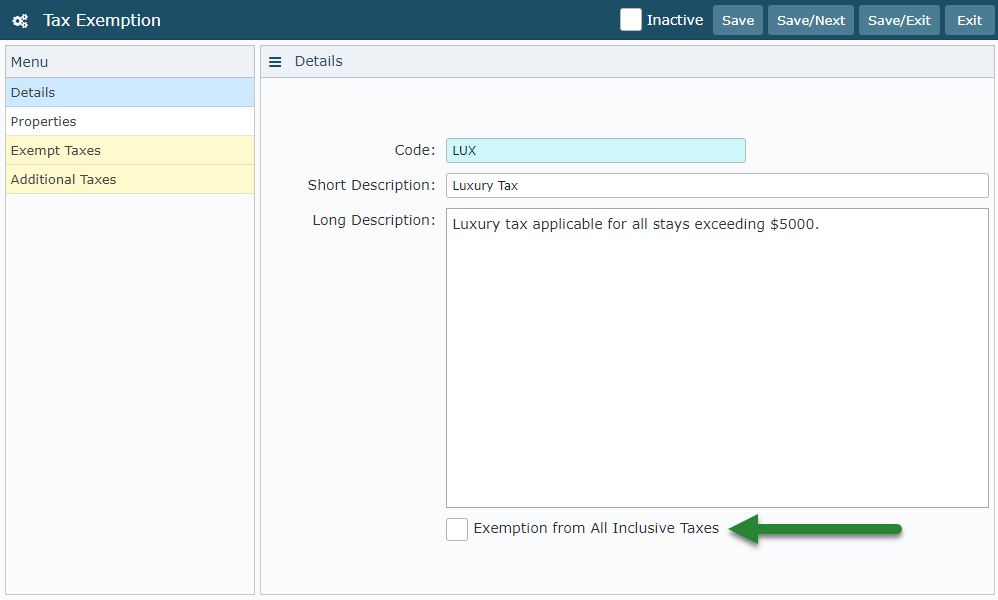

Select if Tax Exemption excludes Inclusive Taxes.

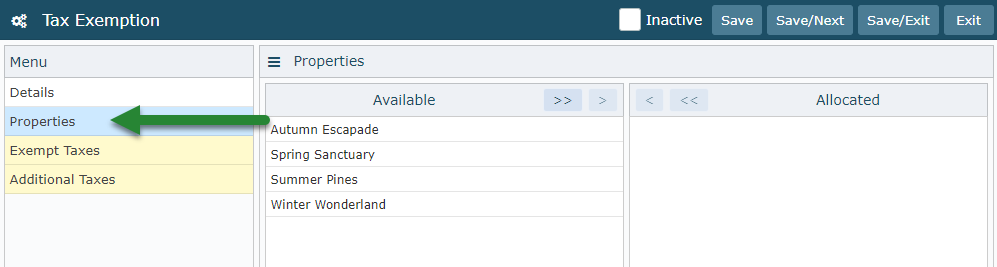

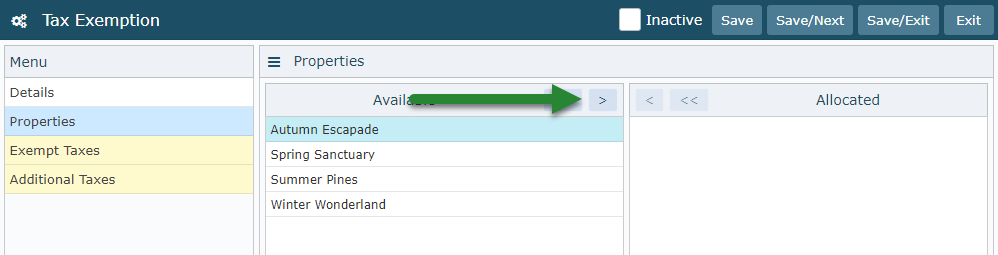

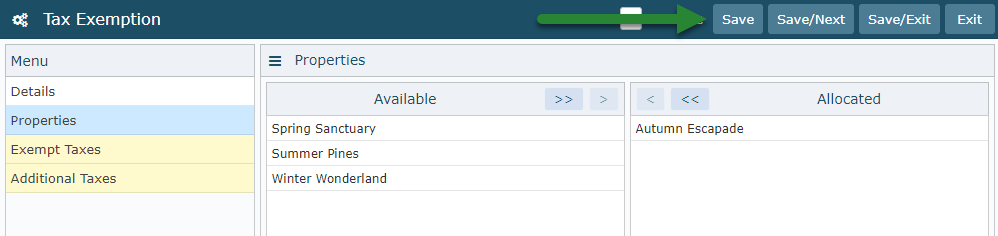

Navigate to the 'Properties' tab.

Select the required Properties.

Select 'Save' to create the Tax Exemption.

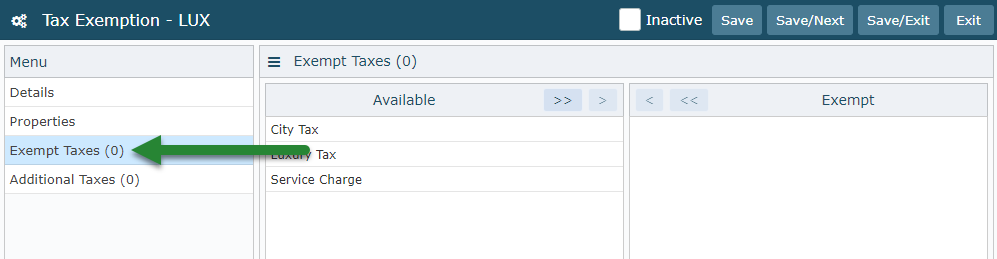

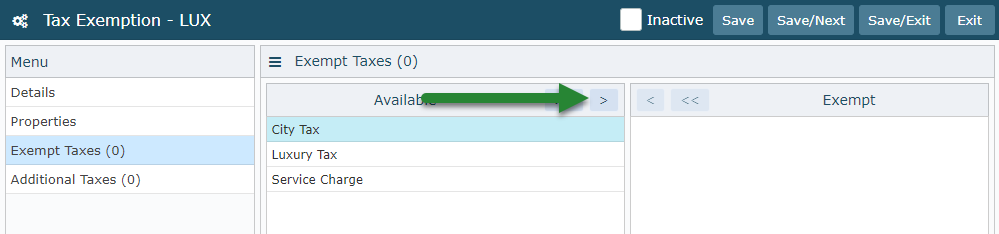

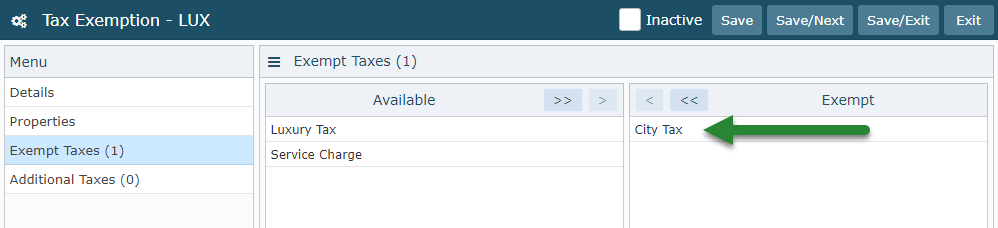

Navigate to the 'Exempt Taxes' tab.

Select the required Exclusive Taxes for the exemption.

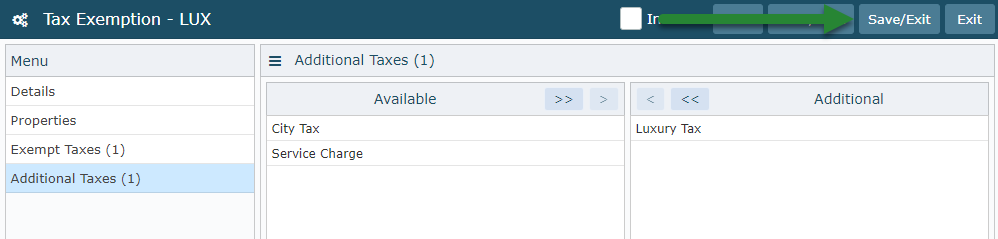

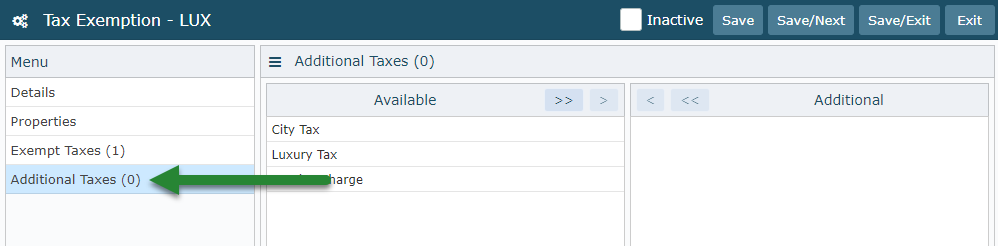

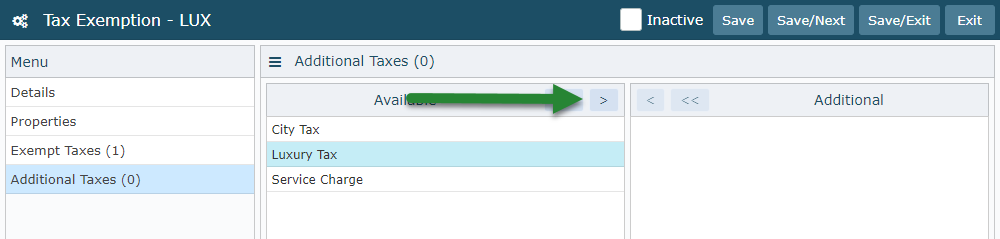

Navigate to the 'Additional Taxes' tab.

Select the required Alternate Taxes to be applied.

Select 'Save/Exit' to store the changes made.