Cancel a Tax Invoice

Cancelling a Tax Invoice on an Account in RMS.

A Tax Invoice can be cancelled to release the charges for amendments.

-

Information

-

Use

- Add Button

Information

A Tax Invoice can be cancelled to release the charges for amendments.

A Tax Invoice is an itemised invoice of taxable charges on an account with a unique Invoice Number.

All transactions itemised on a Tax Invoice will be locked from changes unless the Tax Invoice is cancelled.

A list of all Invoice Numbers for cancelled Tax Invoices can be viewed using the Invoice List report.

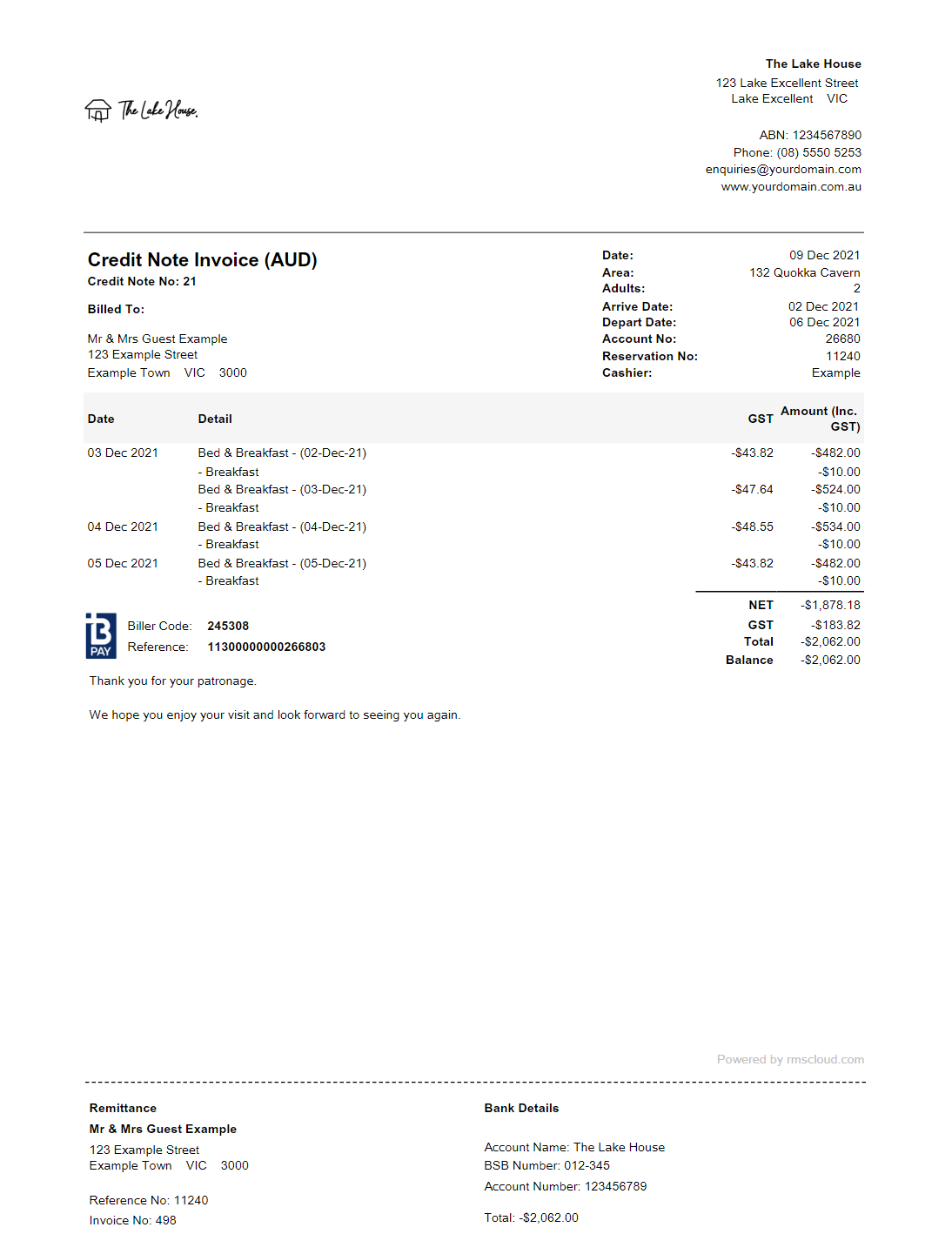

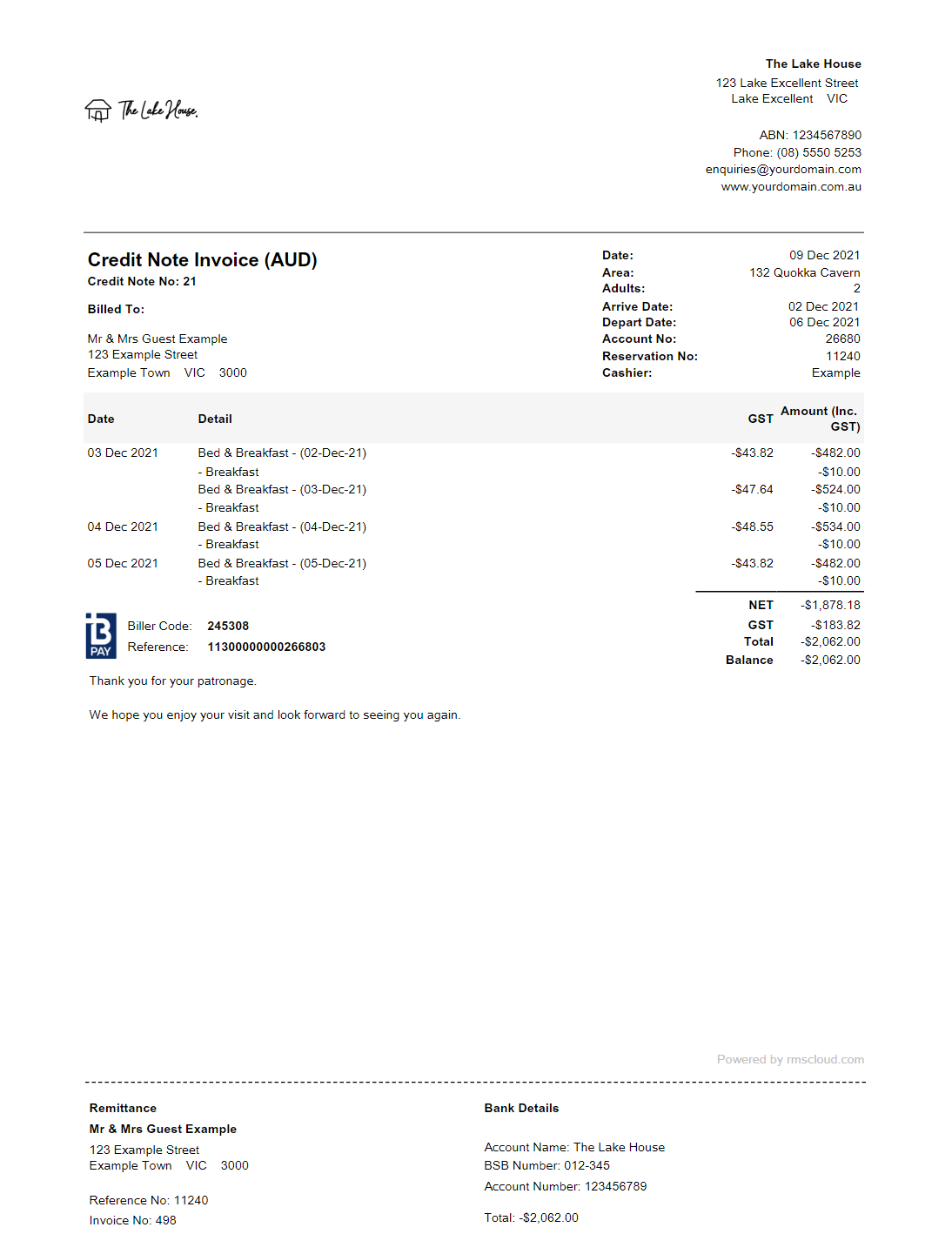

A Credit Note can be generated when cancelling a Tax Invoice to indicate the cancellation of the previously issued invoice and related charges.

Credit Notes generated for a Property in France will be assigned a Credit Note Number using the Tax Invoice Number sequence. Properties in all other countries will have a separate Credit Note Number sequence assigned.

Category, Area, Reservation, Guest, Account Types, Sundry, Rate & Tax are default System Labels that can be customised.

Users will require Security Profile access to use this feature.

-

Use

- Add Button

Use

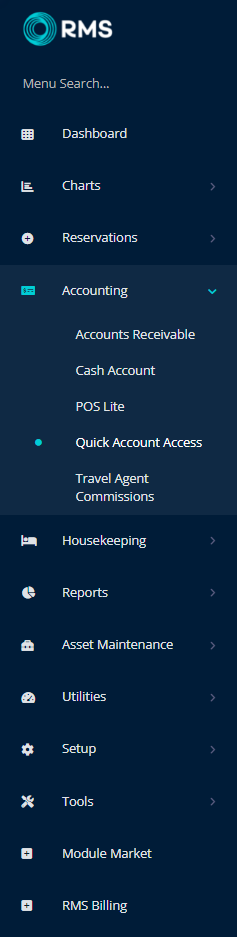

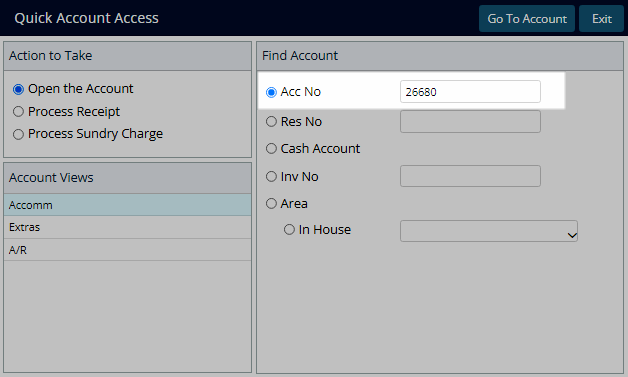

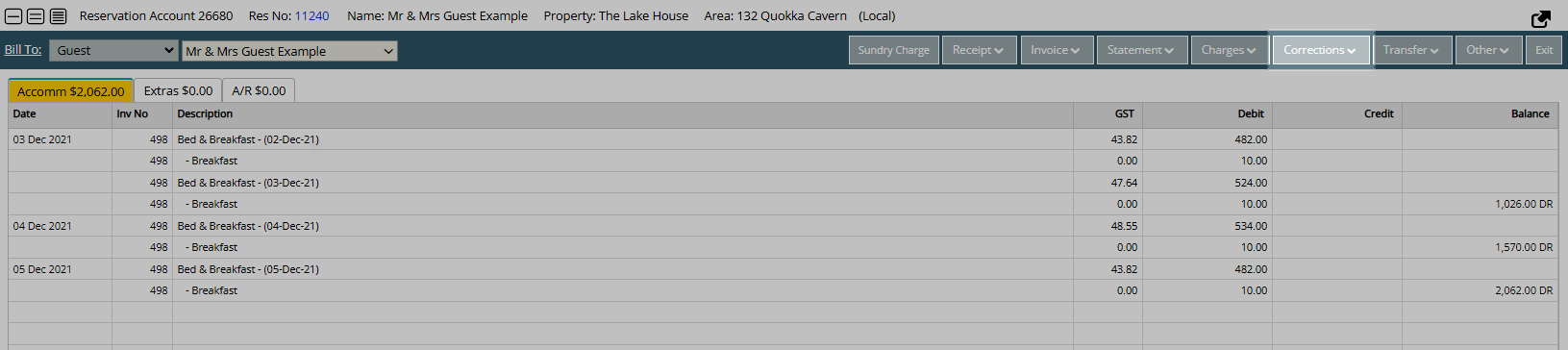

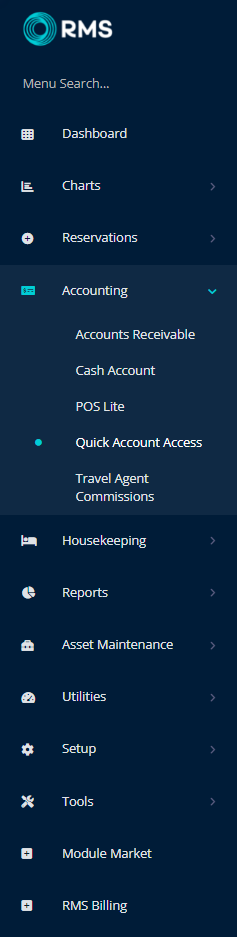

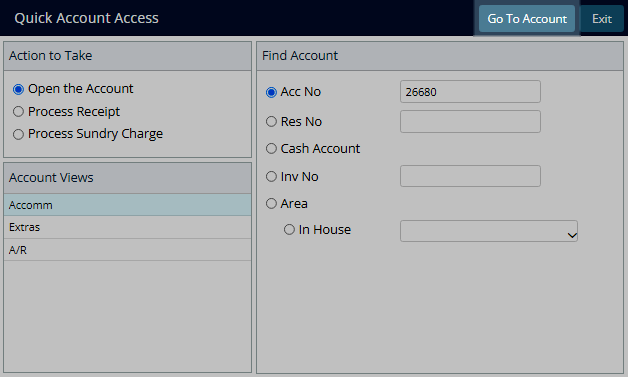

- Go to Accounting > Quick Account Access in RMS.

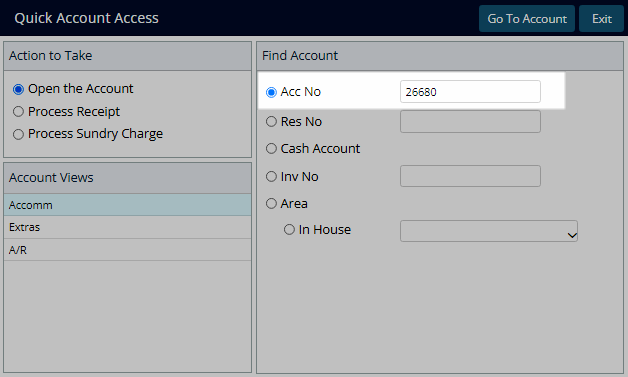

- Enter the Account or Reservation Number.

- Select 'Go to Account'.

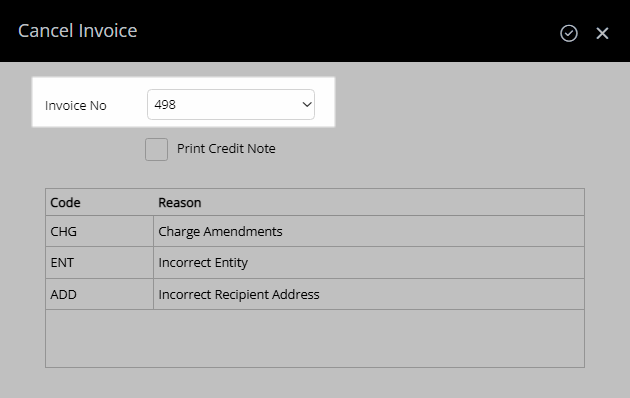

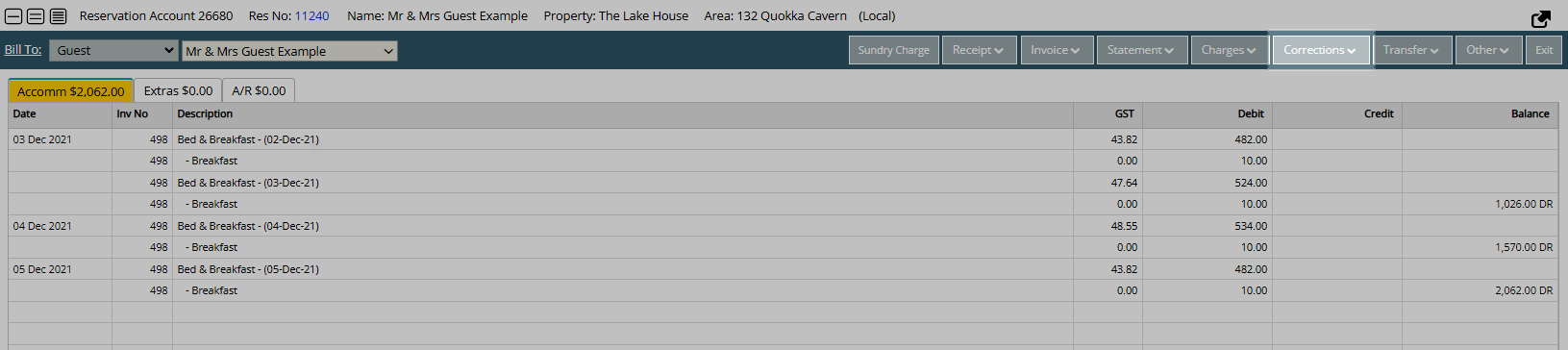

- Select 'Corrections'.

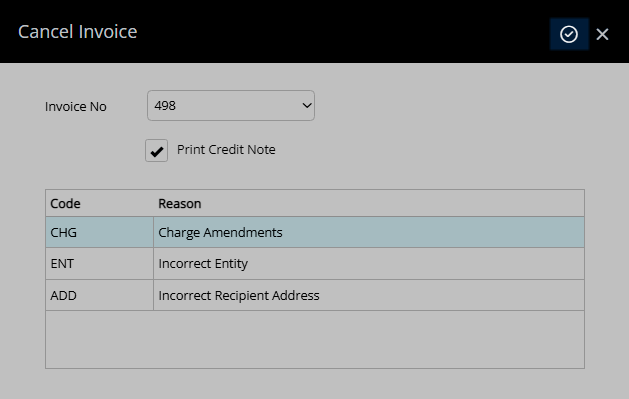

- Select 'Cancel Invoice'.

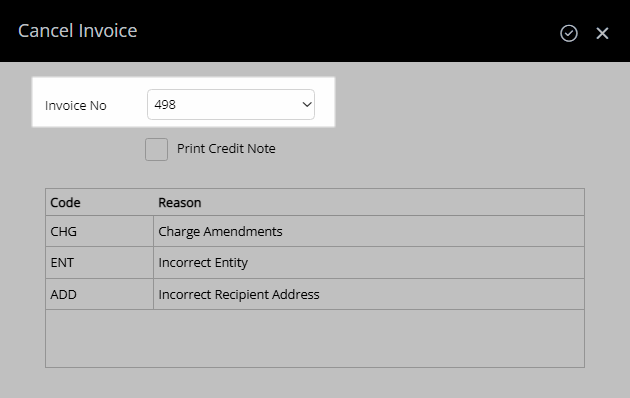

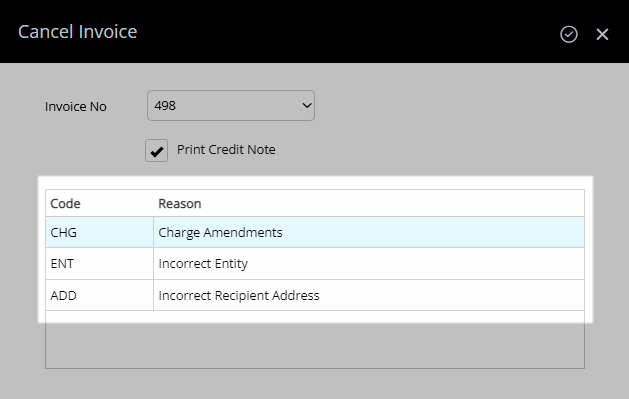

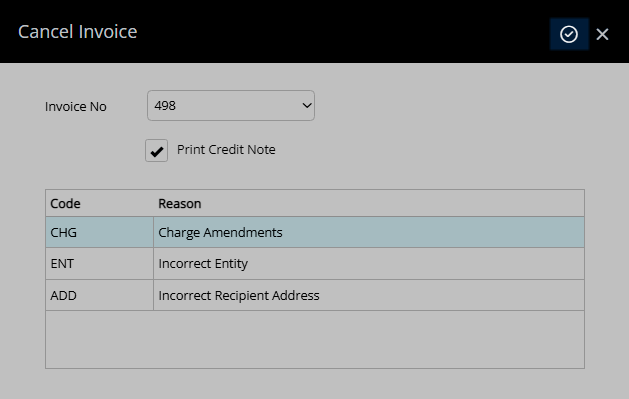

- Select the Invoice Number.

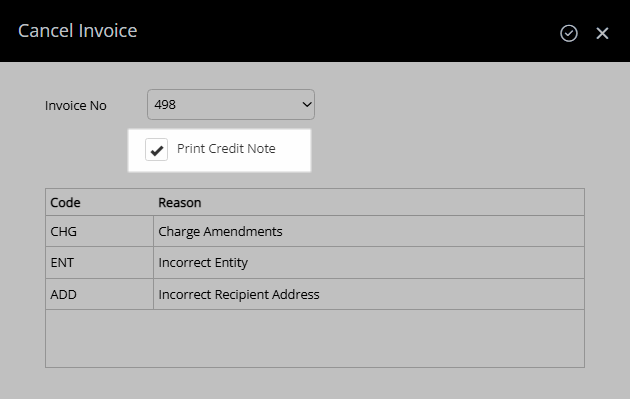

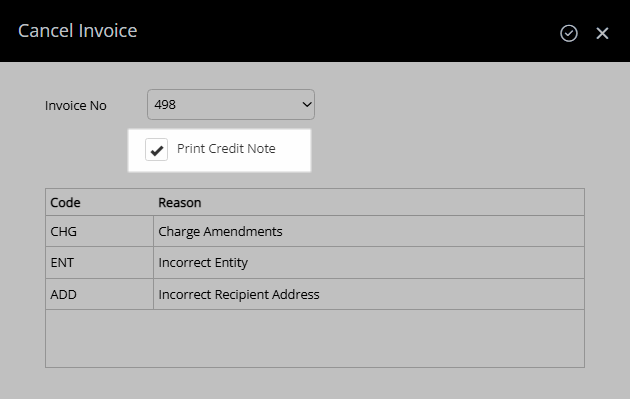

- Optional: Select the checkbox 'Print Credit Note'.

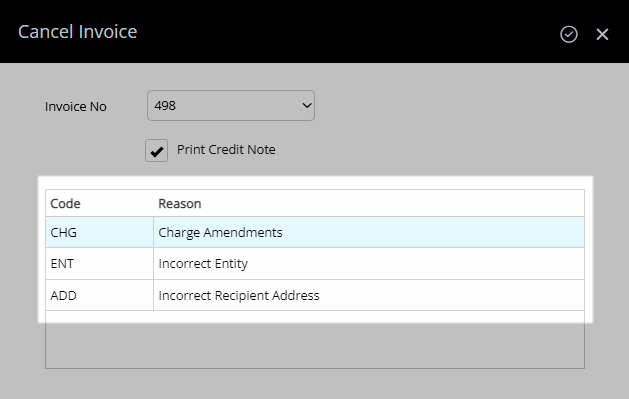

- Select a Cancel Reason.

- Select the

'Confirm' icon.

'Confirm' icon.

All transactions itemised on a Tax Invoice will be locked from changes unless the Tax Invoice is cancelled.

A Credit Note can be generated when cancelling a Tax Invoice to indicate the cancellation of the previously issued invoice and related charges.

Credit Notes generated for a Property in France will be assigned a Credit Note Number using the Tax Invoice Number sequence. Properties in all other countries will have a separate Credit Note Number sequence assigned.

-

Guide

- Add Button

Guide

Go to Accounting > Quick Account Access in RMS.

Enter the Account or Reservation Number.

Select 'Go to Account'.

Select 'Corrections'.

Select 'Cancel Invoice'.

Select the Invoice Number.

Optional: Select the checkbox 'Print Credit Note'.

Select a Cancel Reason.

Select the ![]() 'Confirm' icon.

'Confirm' icon.

The Tax Invoice will be cancelled allow changes to be made to the charges on the account.

A Credit Note will be generated on screen if selected.

Use

- Go to Accounting > Quick Account Access in RMS.

- Enter the Account or Reservation Number.

- Select 'Go to Account'.

- Select 'Corrections'.

- Select 'Cancel Invoice'.

- Select the Invoice Number.

- Optional: Select the checkbox 'Print Credit Note'.

- Select a Cancel Reason.

- Select the

'Confirm' icon.

'Confirm' icon.

All transactions itemised on a Tax Invoice will be locked from changes unless the Tax Invoice is cancelled.

A Credit Note can be generated when cancelling a Tax Invoice to indicate the cancellation of the previously issued invoice and related charges.

Credit Notes generated for a Property in France will be assigned a Credit Note Number using the Tax Invoice Number sequence. Properties in all other countries will have a separate Credit Note Number sequence assigned.

-

Guide

- Add Button

Guide

Go to Accounting > Quick Account Access in RMS.

Enter the Account or Reservation Number.

Select 'Go to Account'.

Select 'Corrections'.

Select 'Cancel Invoice'.

Select the Invoice Number.

Optional: Select the checkbox 'Print Credit Note'.

Select a Cancel Reason.

Select the ![]() 'Confirm' icon.

'Confirm' icon.

The Tax Invoice will be cancelled allow changes to be made to the charges on the account.

A Credit Note will be generated on screen if selected.