Third Party Charge

Setup a Sundry Charge for use with Third Parties in RMS.

A Third Party Charge is a type of Sundry Charge used to record fees for a Third Party on an account in RMS.

-

Information

-

Setup

- Add Button

Information

A Third Party Charge is a type of Sundry Charge used to record fees for a Third Party on an account in RMS.

Every Third Party must have a corresponding Third Party Charge.

A Manager Third Party Charge will deduct from the Manager's Income and a Third Party Guest Charge will deduct from the Owner's Income.

There must be sufficient Owner Income or Manager Income to cover payment of a Third Party Charge when completing Third Party Payments.

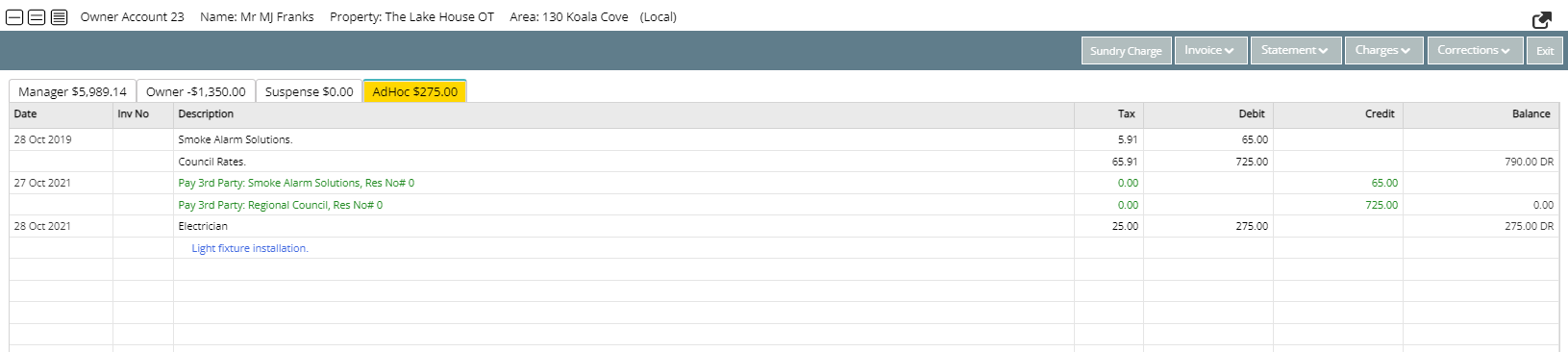

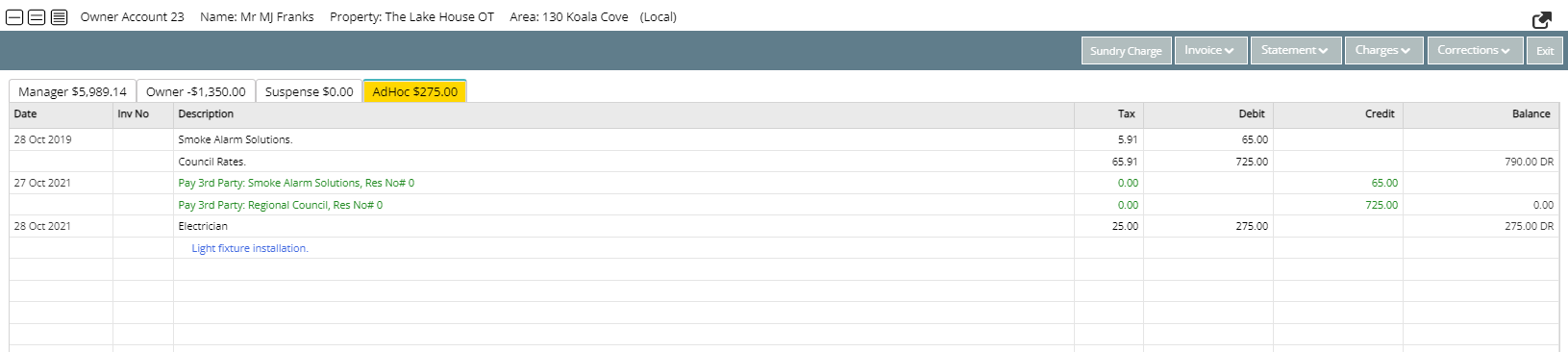

A Third Party Charge can be applied to the Adhoc view of the Owner Account or on a Reservation Account.

Third Party Charges are available for Owner & Trust Accounting properties.

Guest, Reservation, Sundry & Tax are default System Labels that can be customised.

System Administrators will require Security Profile access to use this feature.

-

Setup

- Add Button

Setup

Have your System Administrator complete the following.

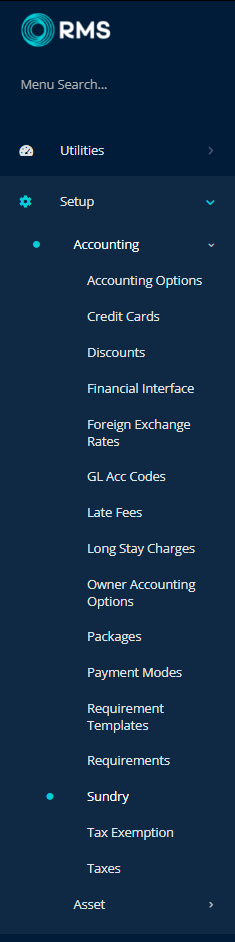

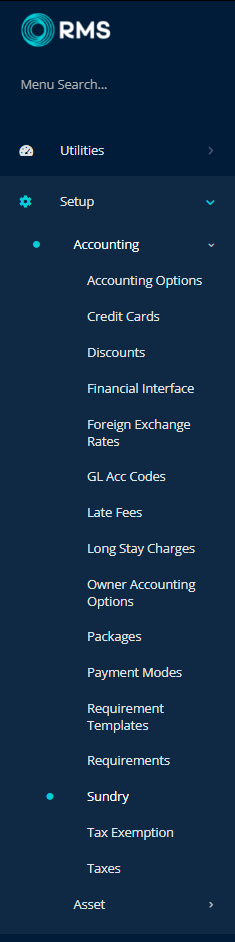

- Go to Setup > Accounting > Sundry in RMS.

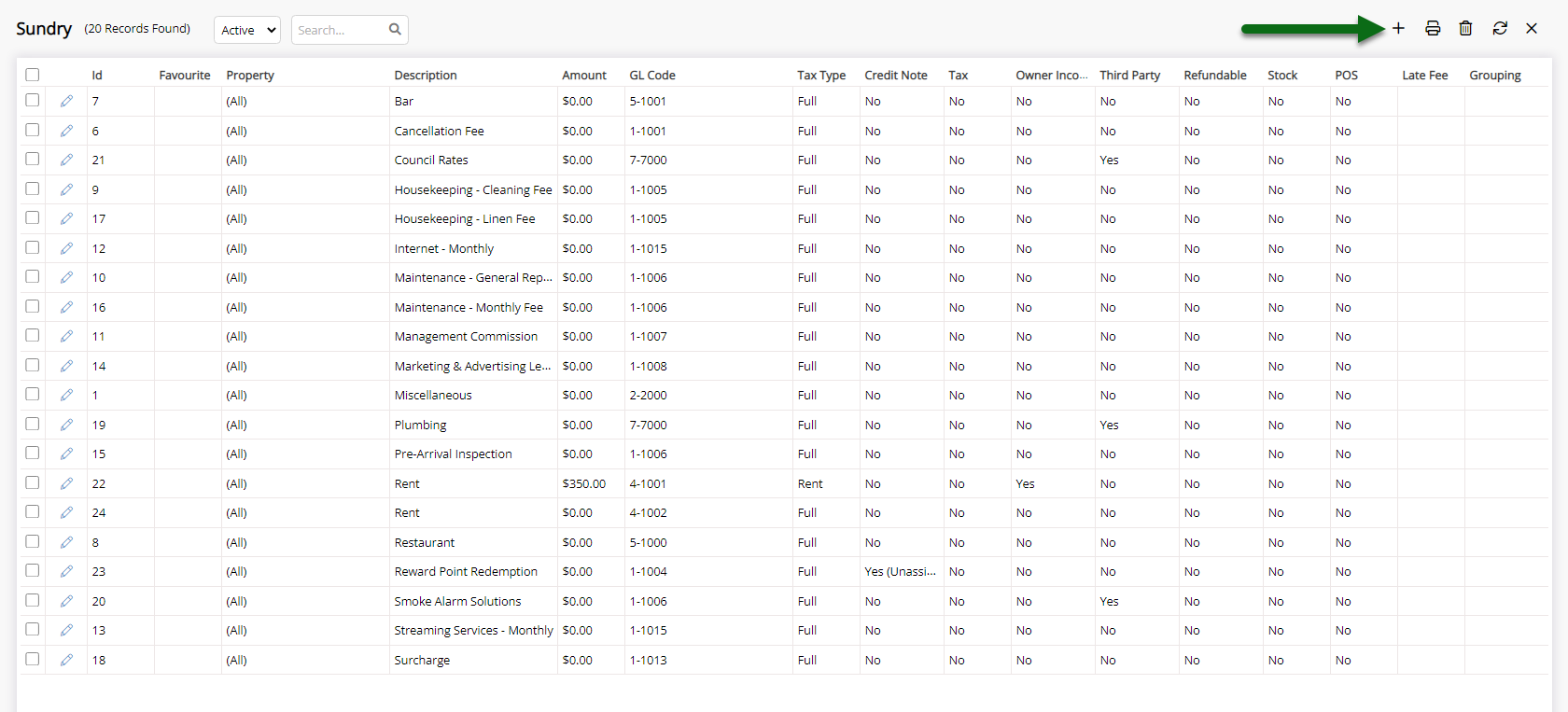

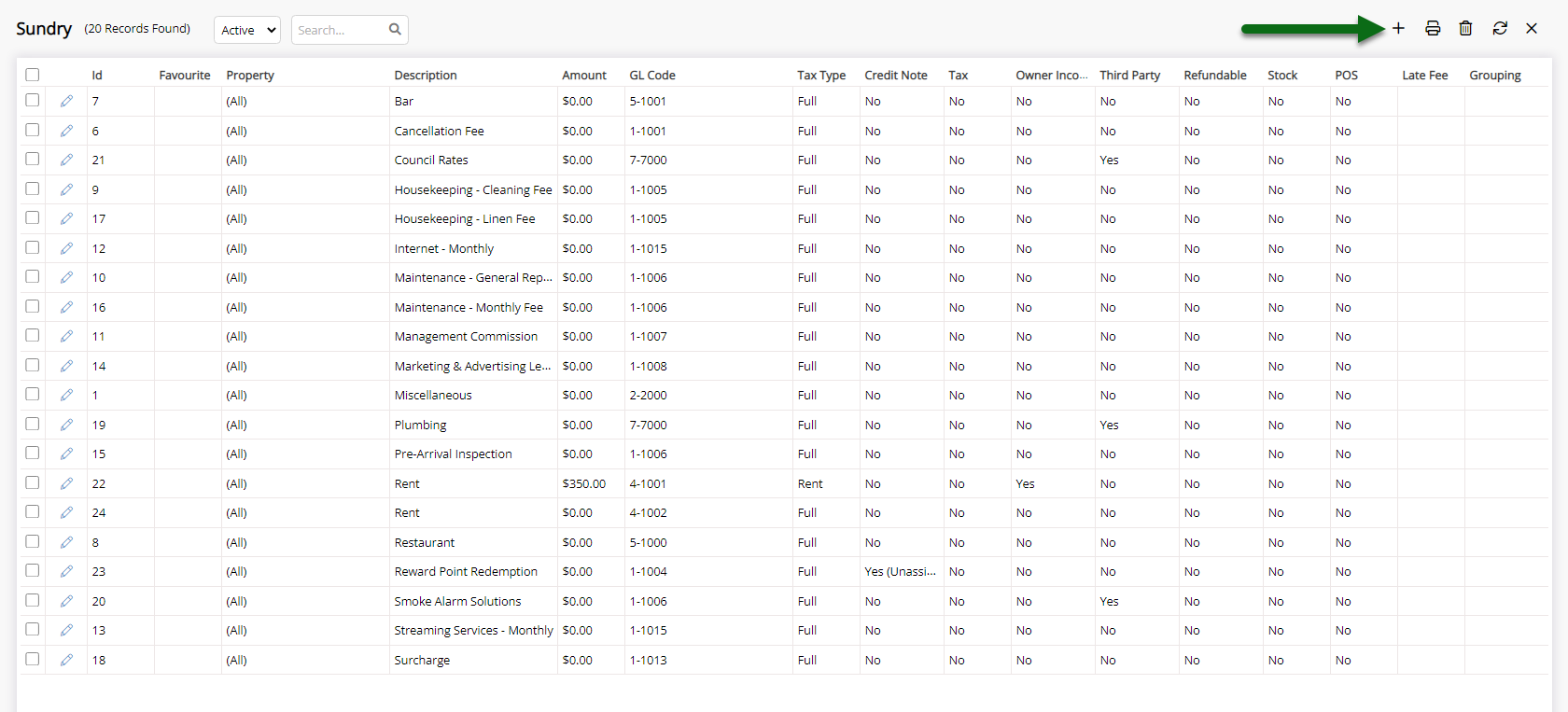

- Select the

'Add' icon.

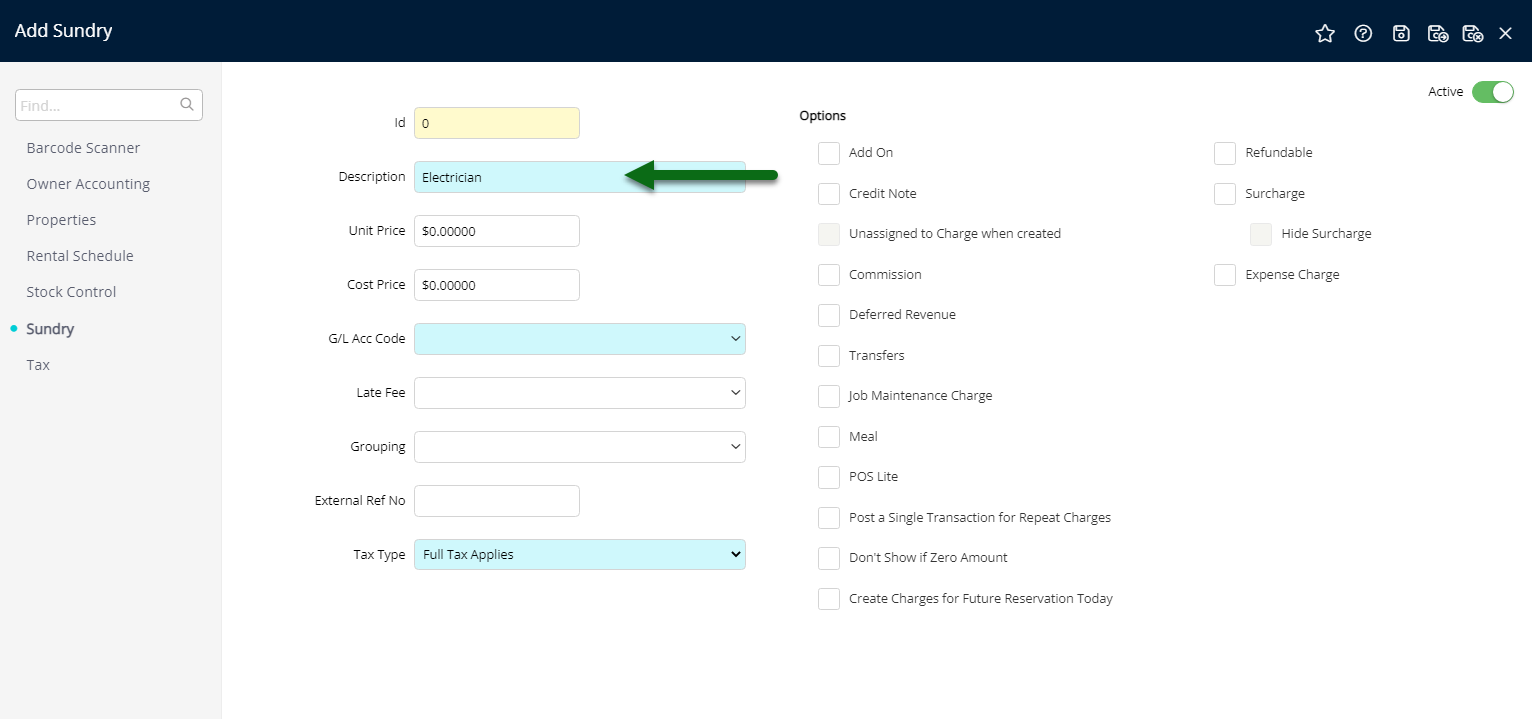

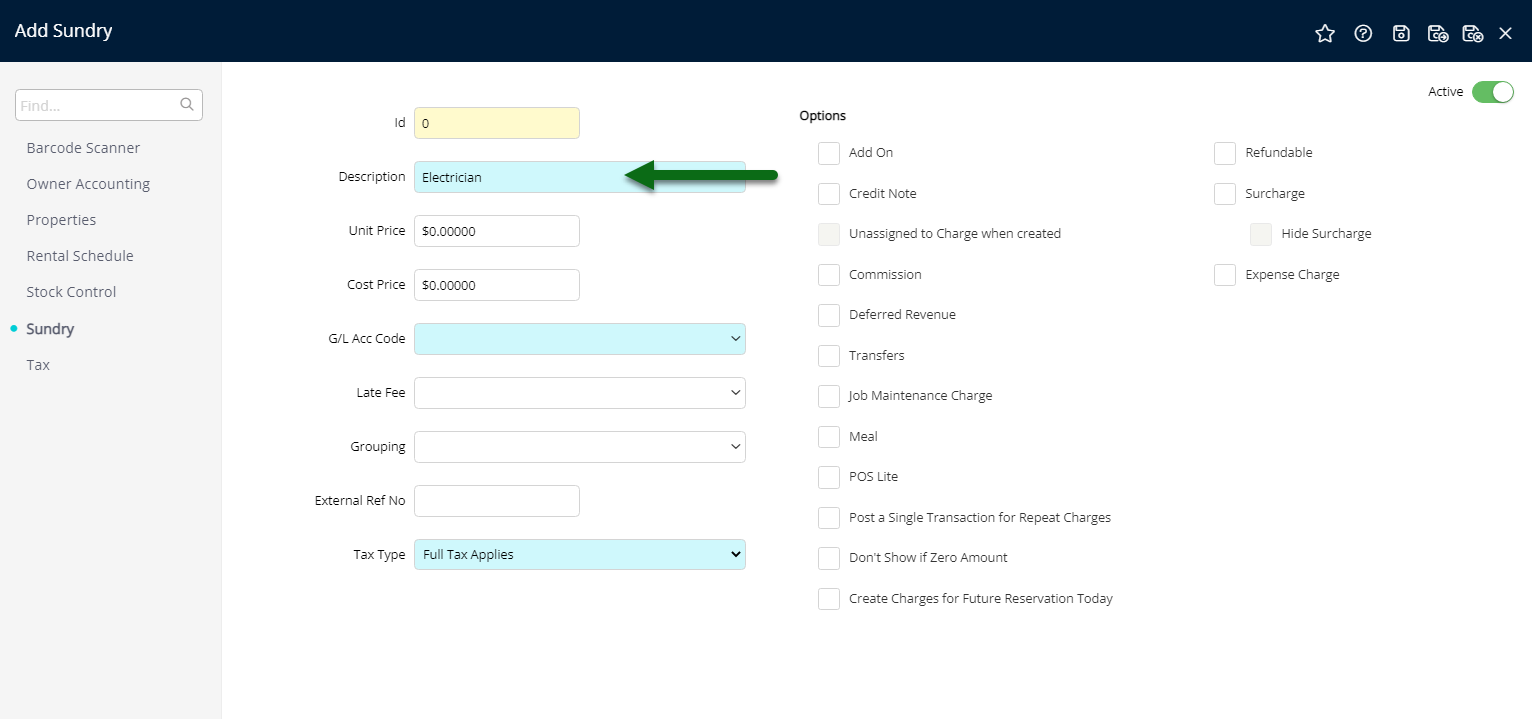

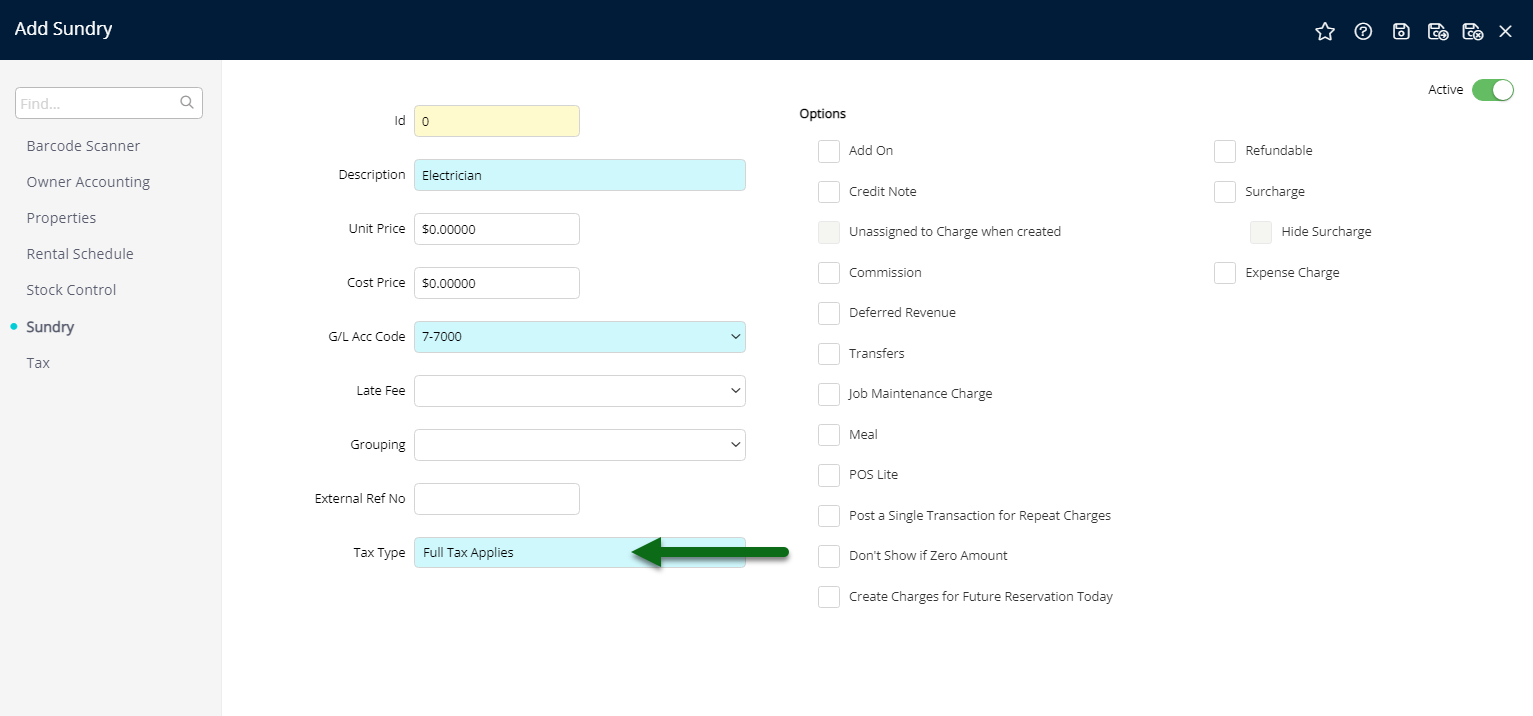

'Add' icon. - Enter a Description.

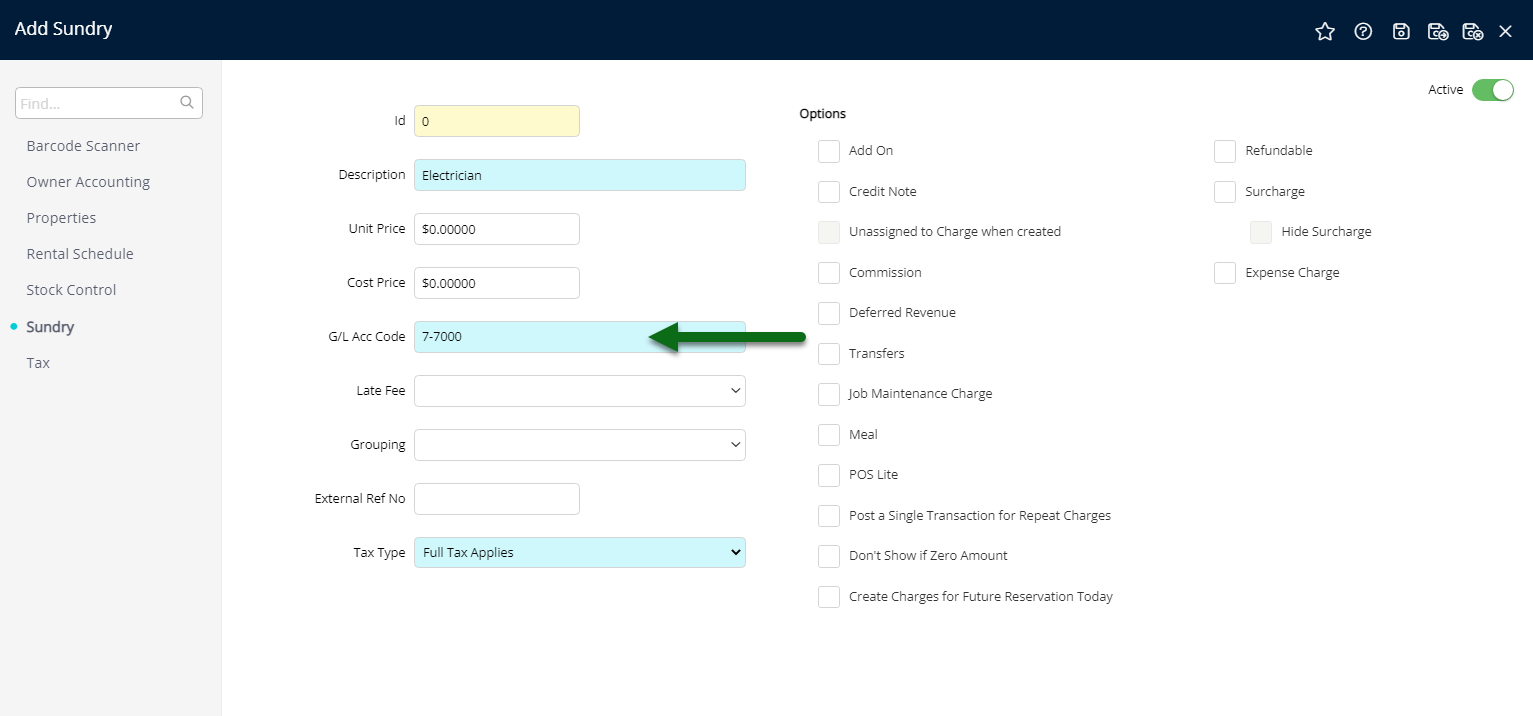

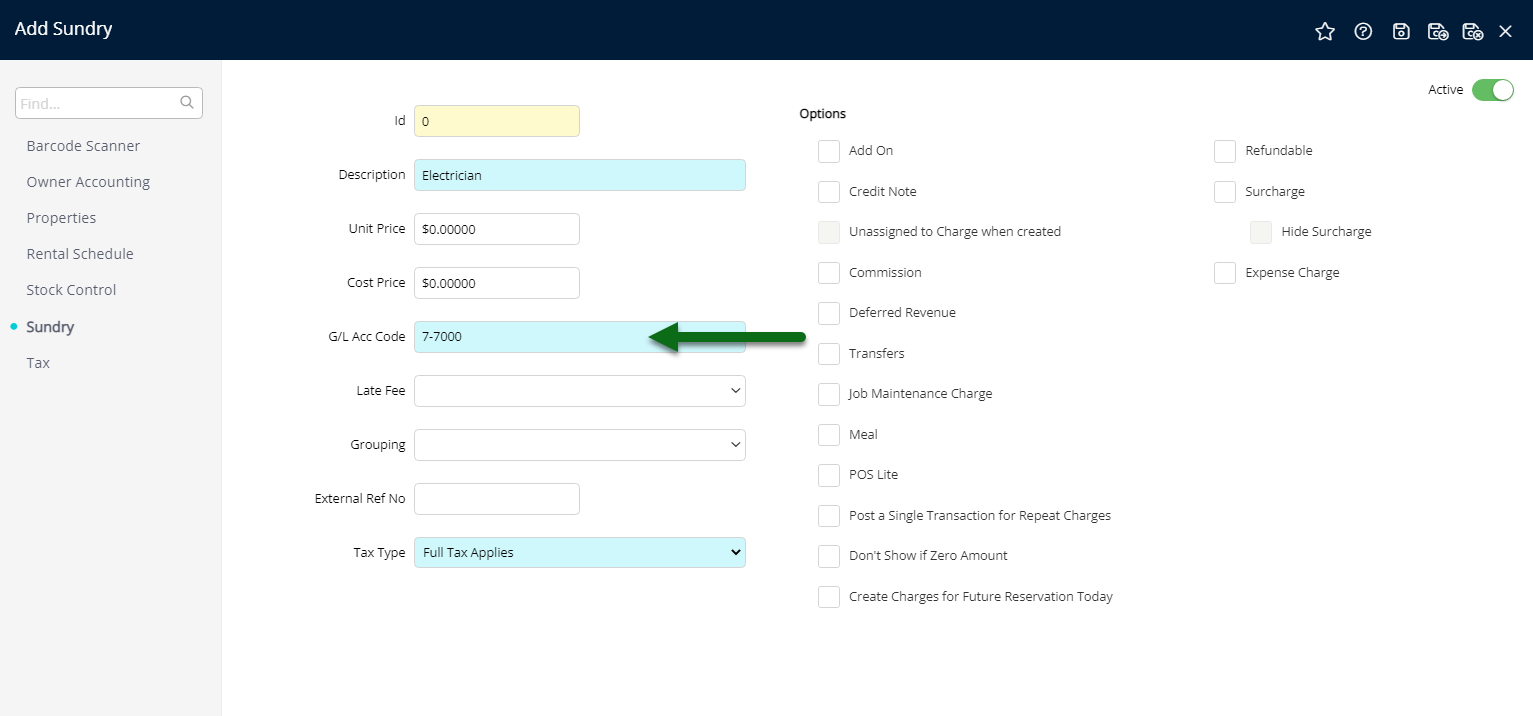

- Select a General Ledger Account Code.

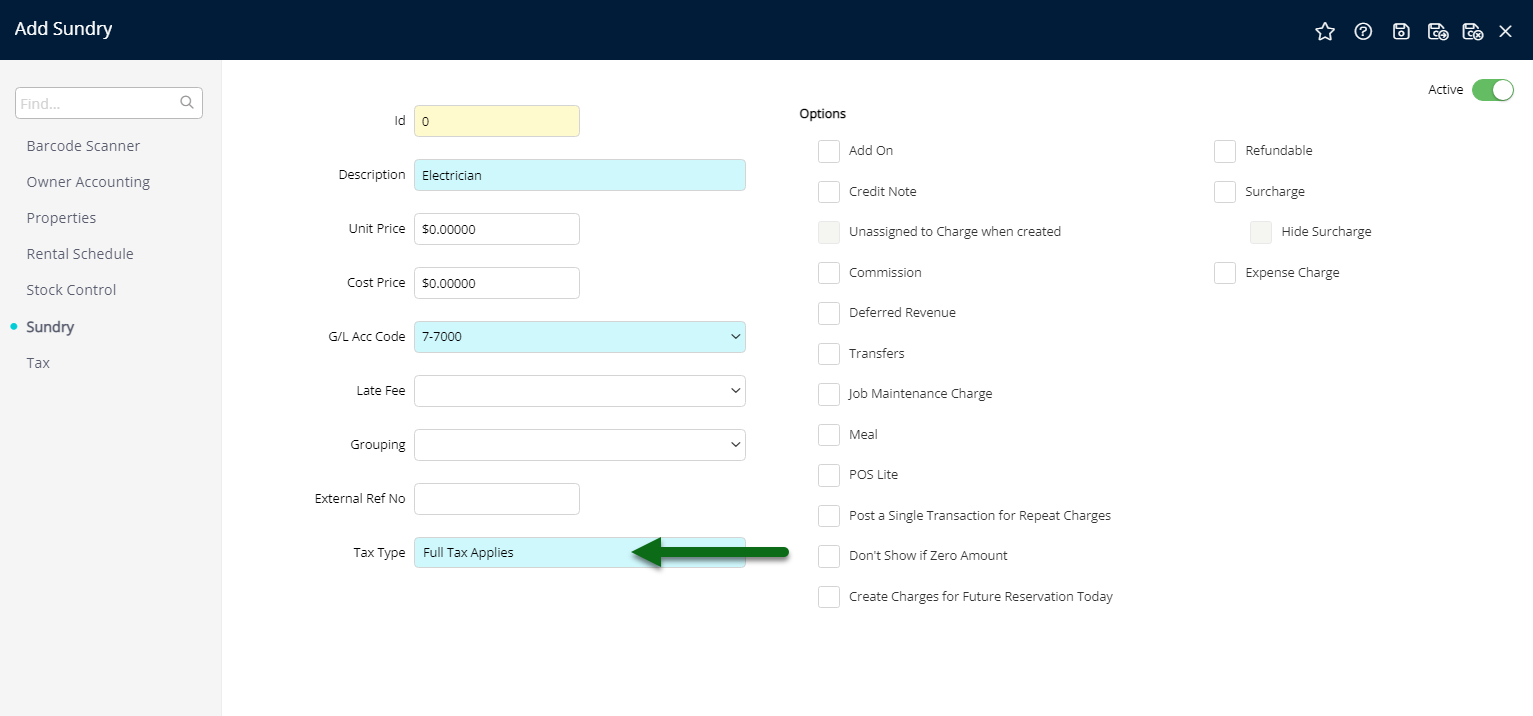

- Select the Tax Type.

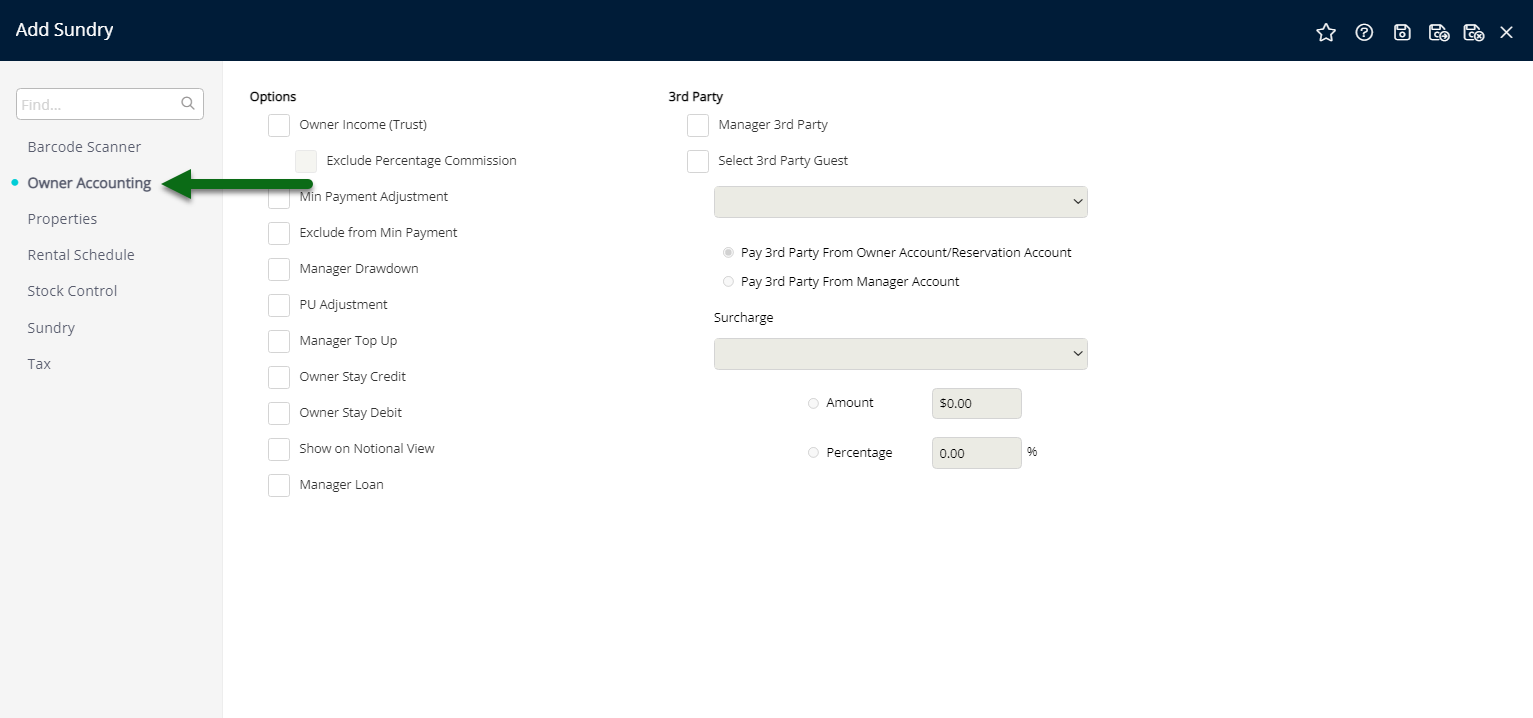

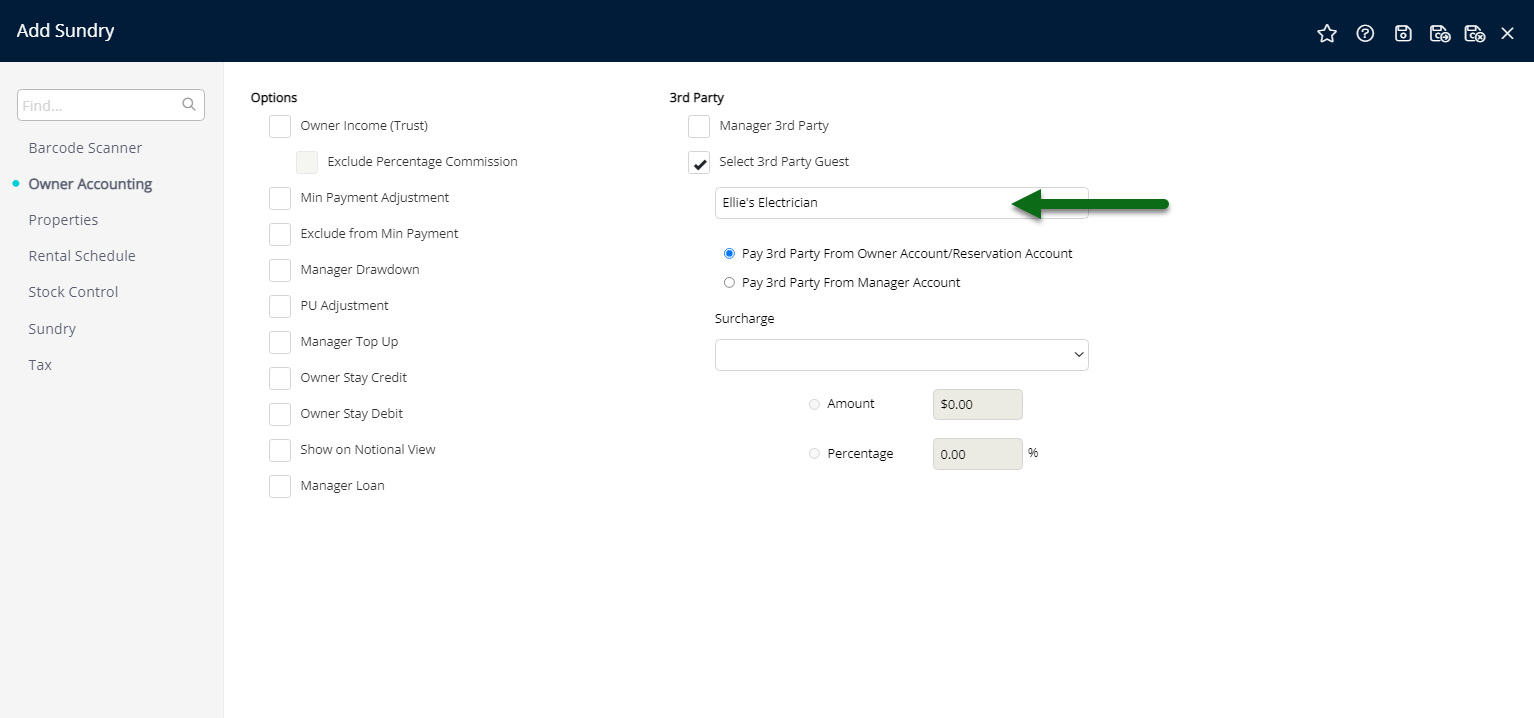

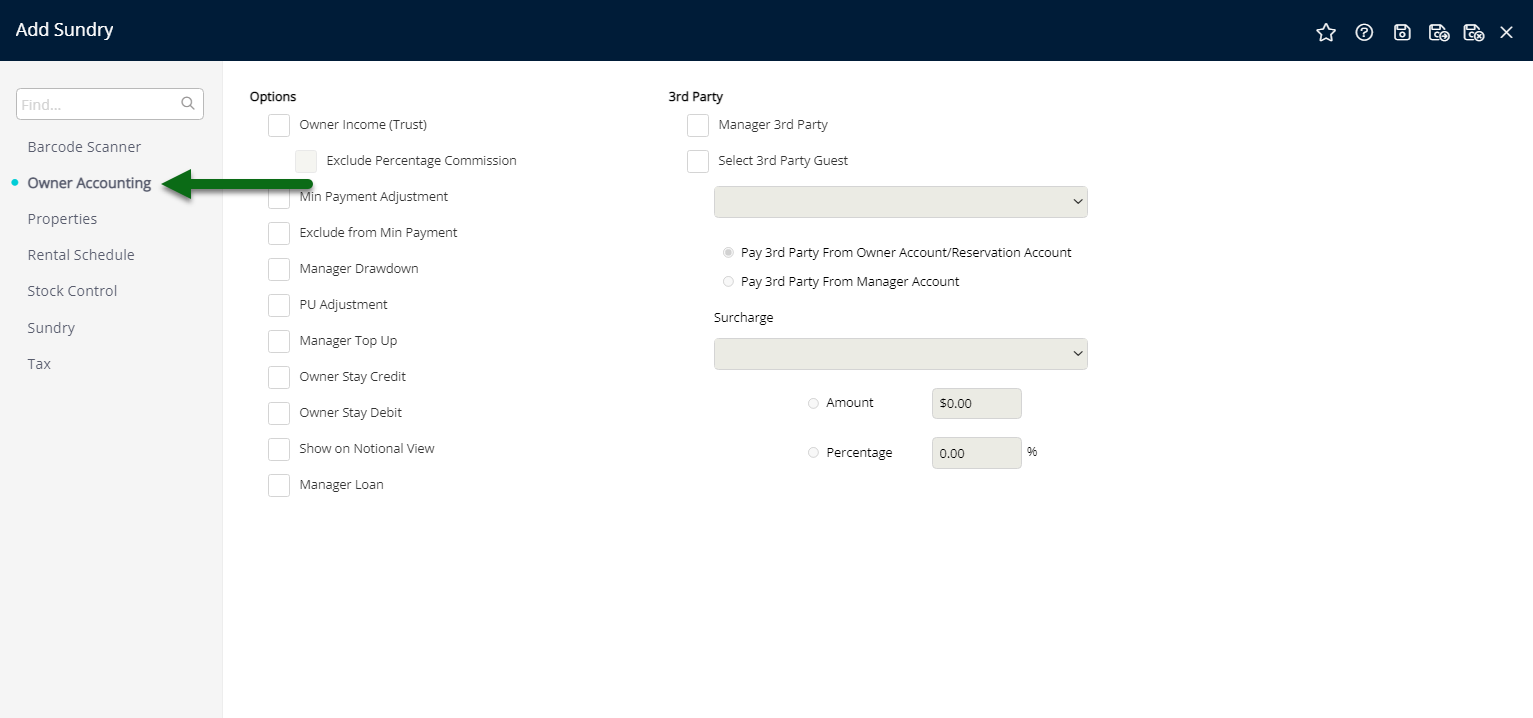

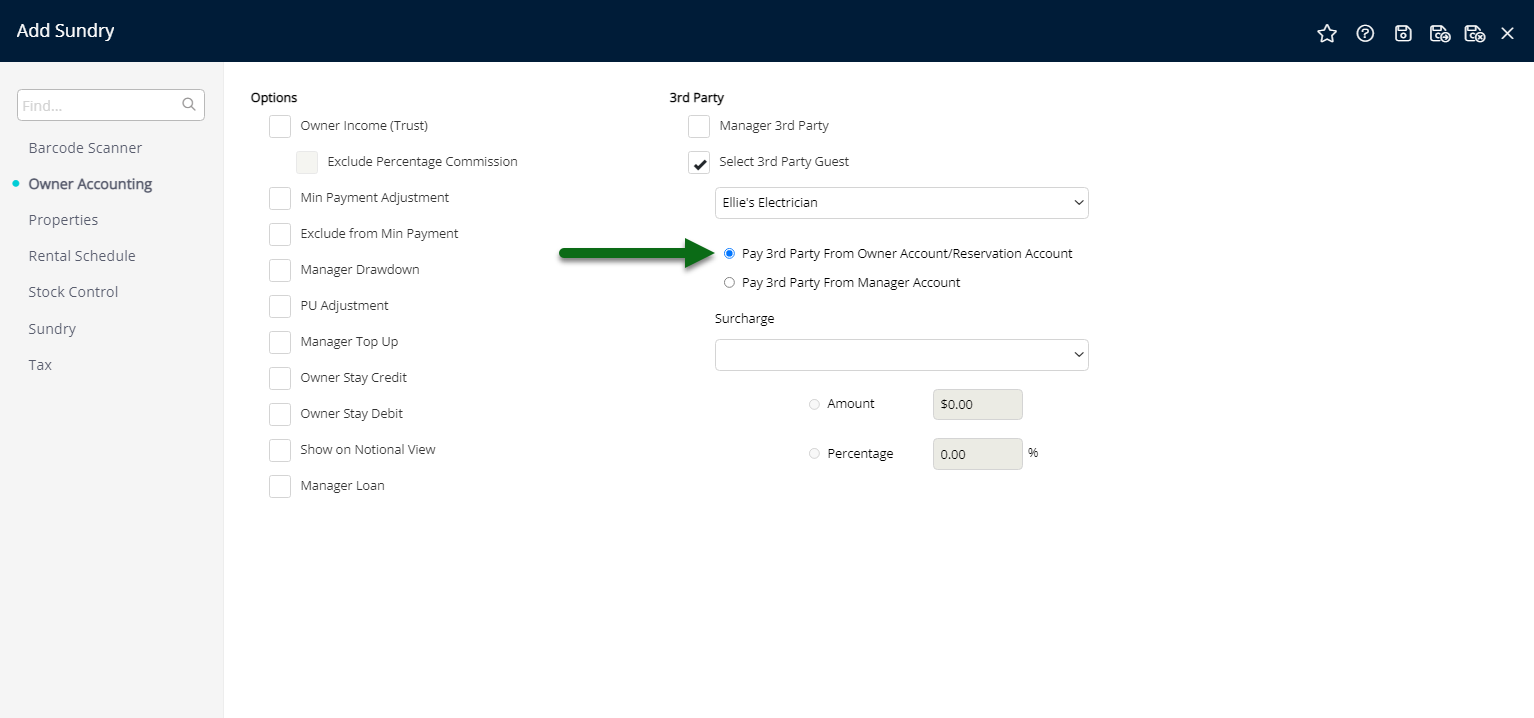

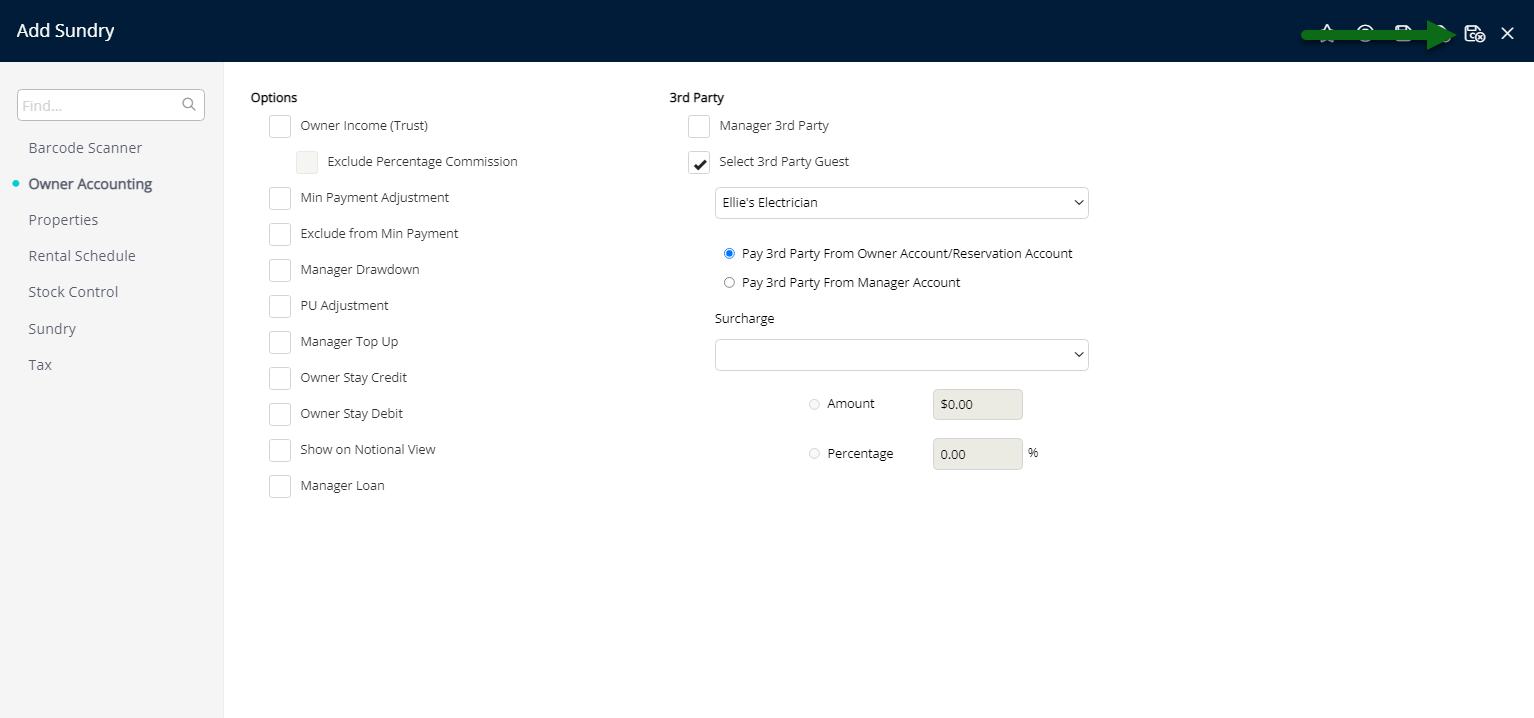

- Navigate to the 'Owner Accounting' tab.

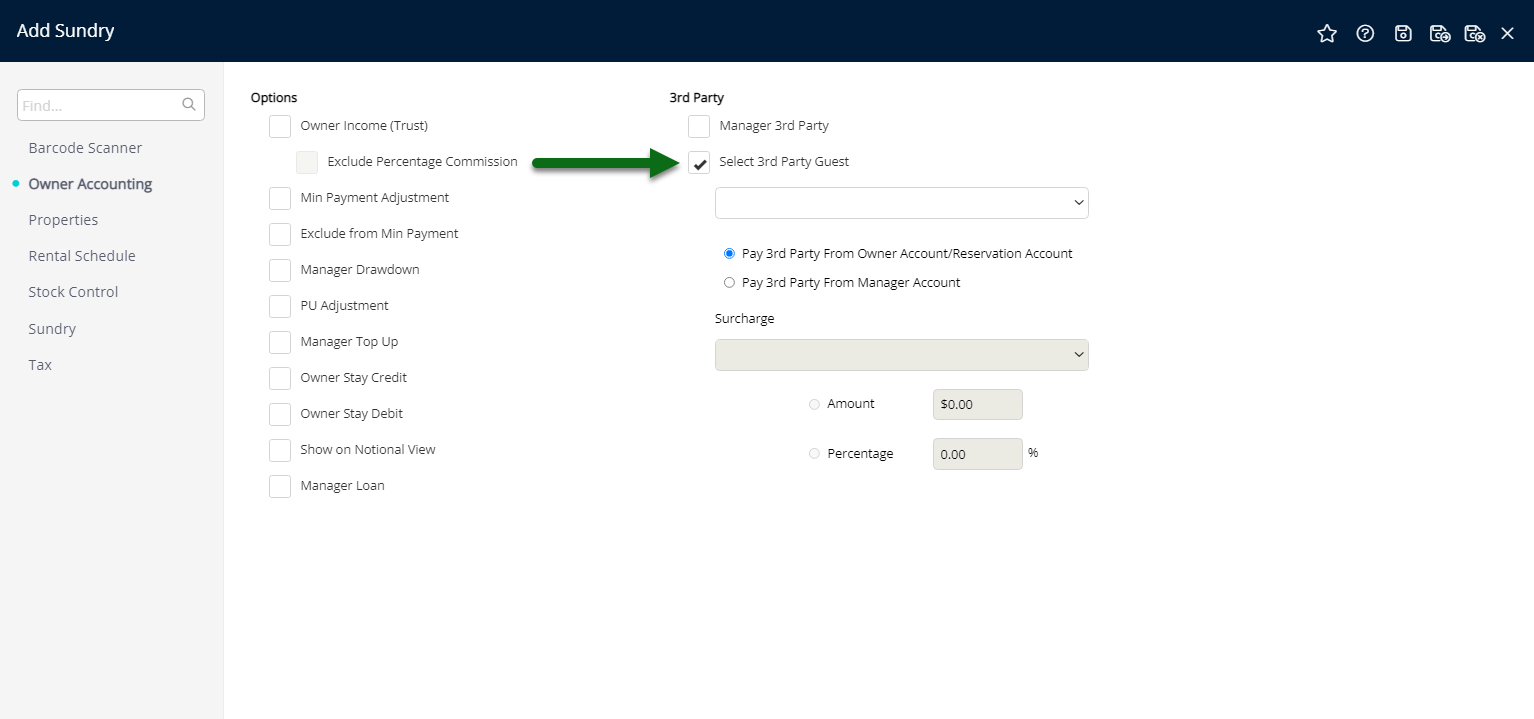

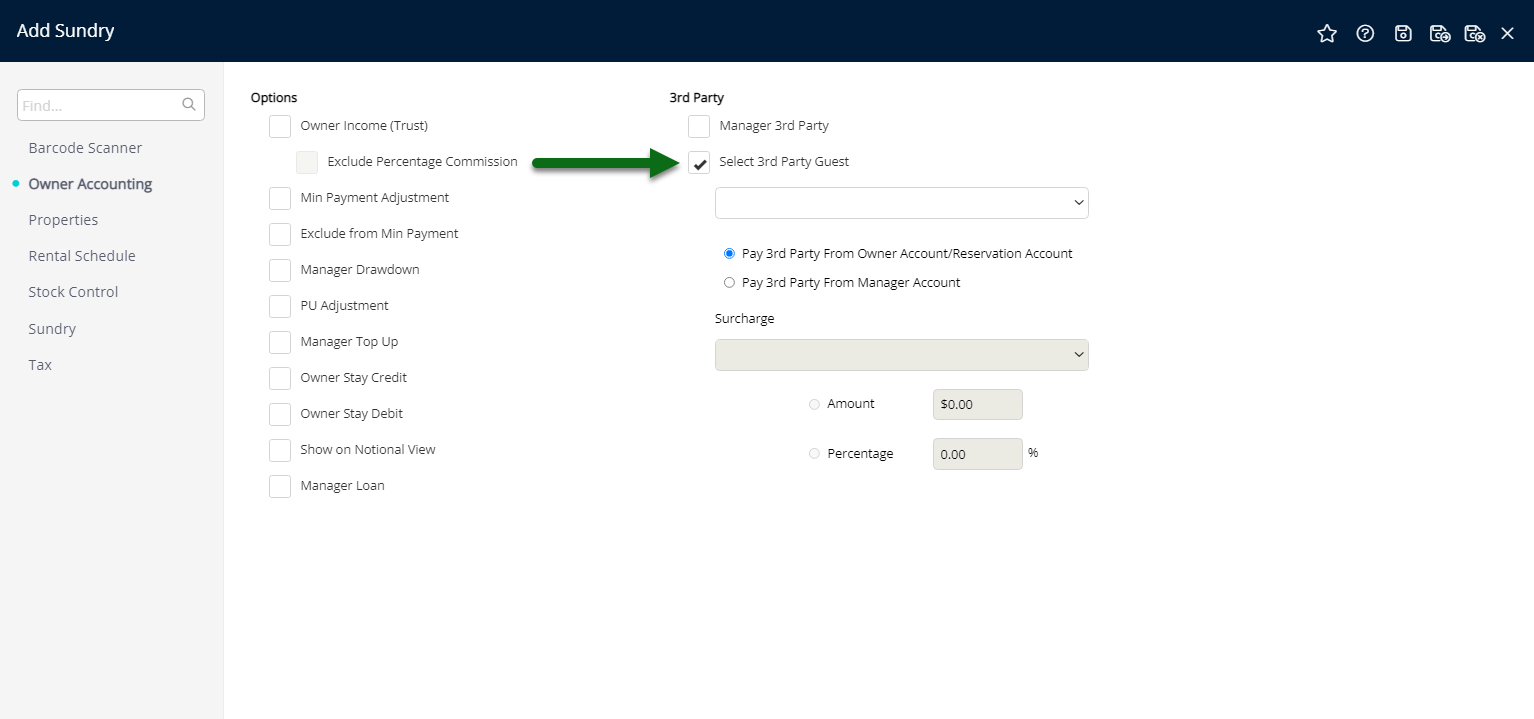

- Select the checkbox 'Third Party Guest'.

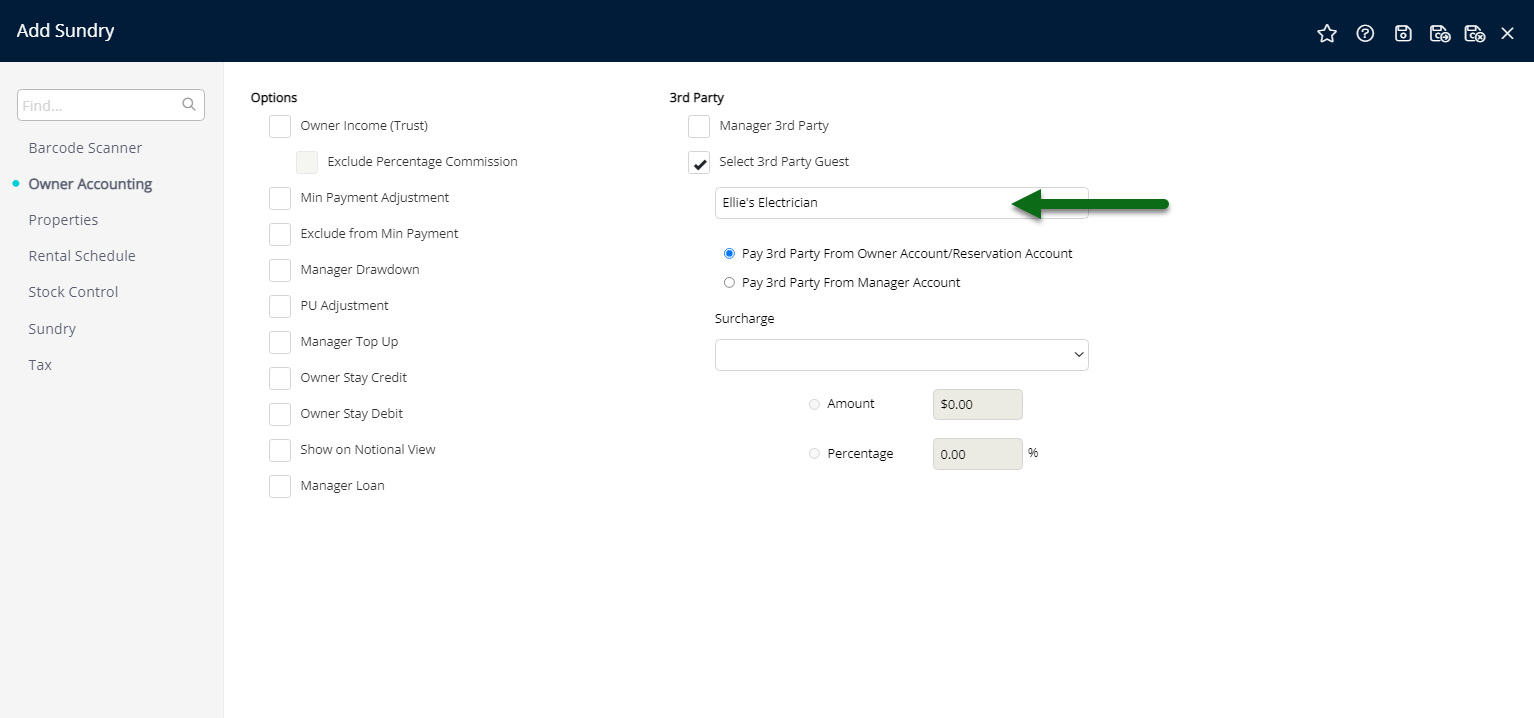

- Select the Third Party.

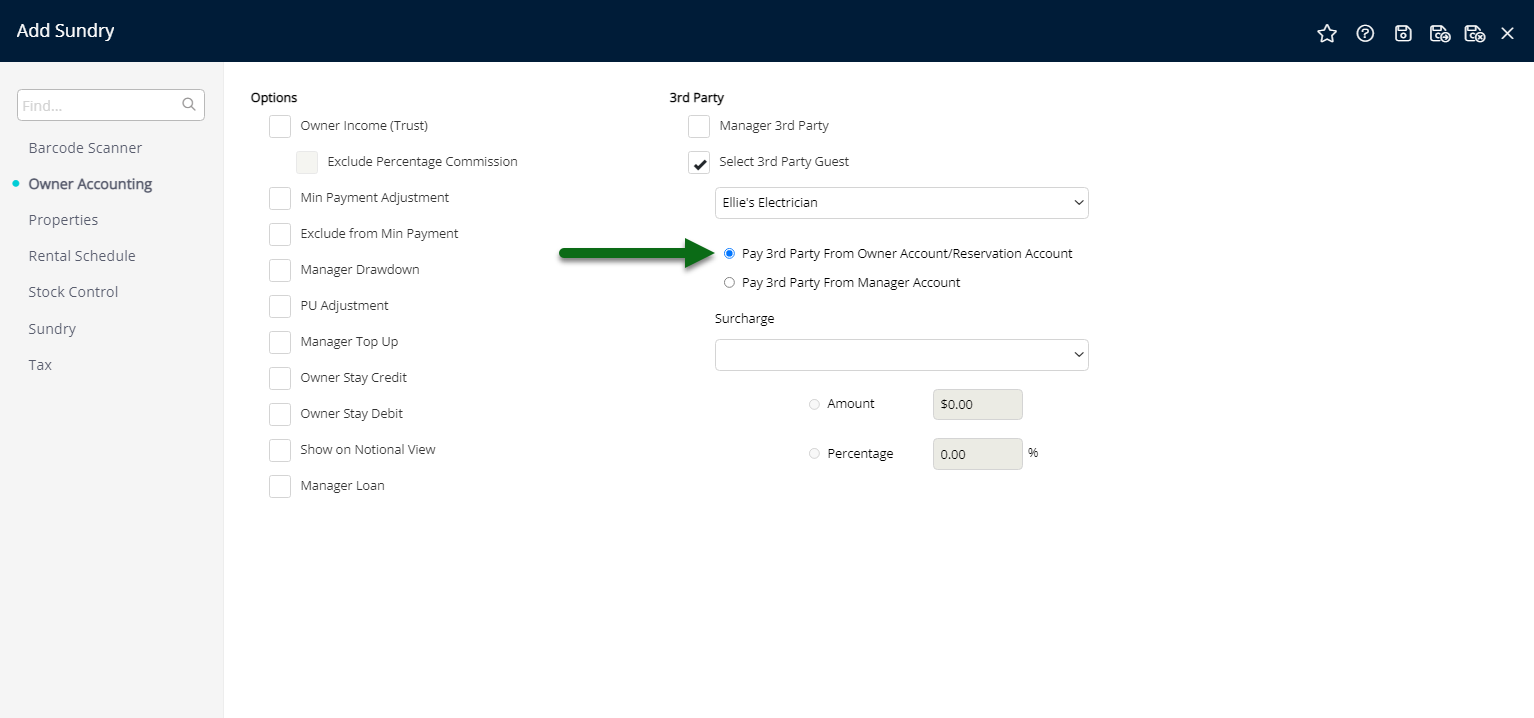

- Select the option 'Pay Third Party from Owner Account/Reservation Account'.

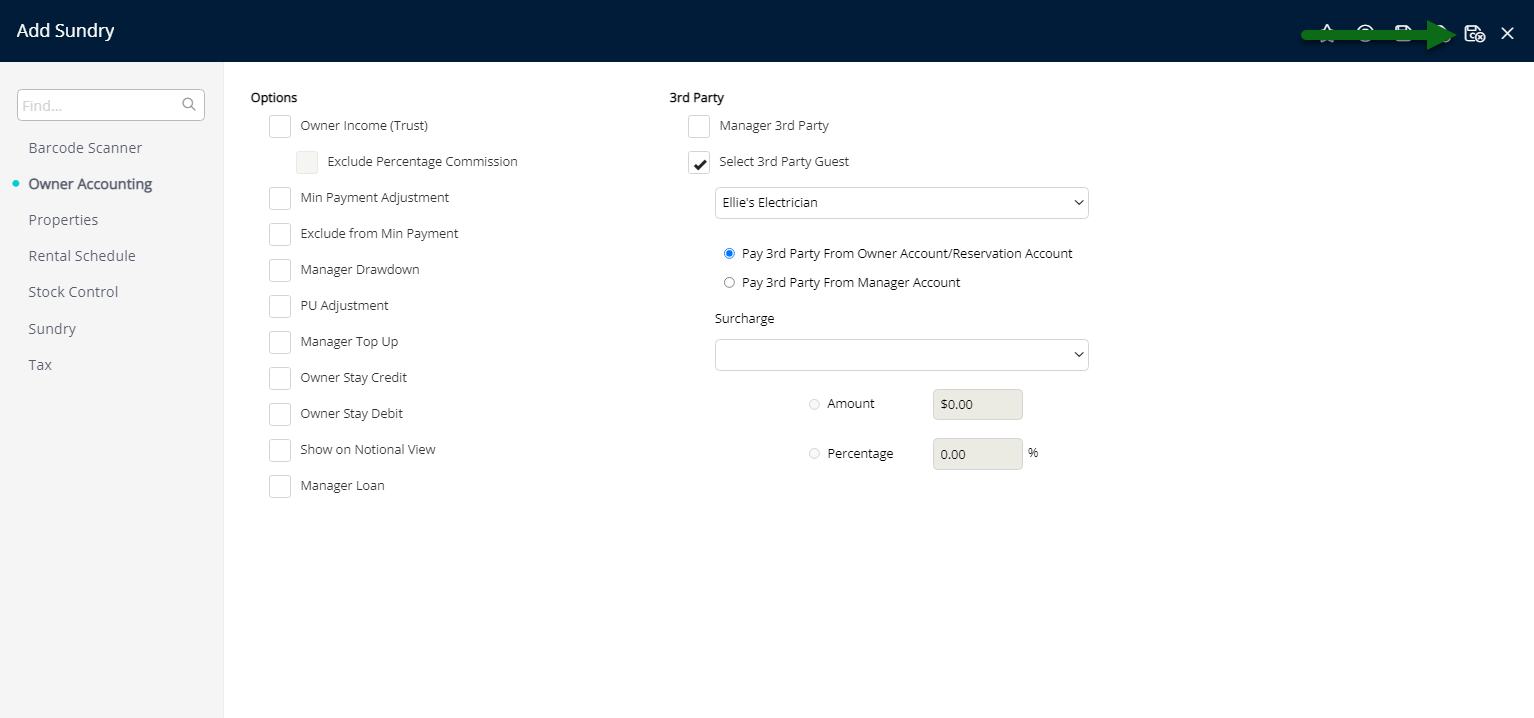

- Save/Exit.

Refer to the invoice received by a Third Party to confirm the required Tax Type.

'Full GST' must be selected for GST registered businesses and 'GST Free' can be selected for unregistered businesses.

-

Guide

- Add Button

Guide

Go to Setup > Accounting > Sundry in RMS.

Select the ![]() 'Add' icon.

'Add' icon.

Enter a Description.

Select a General Ledger Account Code.

Select the Tax Type.

Navigate to the 'Owner Accounting' tab.

Select the checkbox 'Third Party Guest'.

Select the Third Party.

Select the option 'Pay Third Party from Owner Account/Reservation Account'.

Select 'Save/Exit' to store the changes made and leave the setup.

This Third Party Charge will now be available to apply to the 'Adhoc' view of an Owner Account or a Reservation Account.

Setup

Have your System Administrator complete the following.

- Go to Setup > Accounting > Sundry in RMS.

- Select the

'Add' icon.

'Add' icon. - Enter a Description.

- Select a General Ledger Account Code.

- Select the Tax Type.

- Navigate to the 'Owner Accounting' tab.

- Select the checkbox 'Third Party Guest'.

- Select the Third Party.

- Select the option 'Pay Third Party from Owner Account/Reservation Account'.

- Save/Exit.

Refer to the invoice received by a Third Party to confirm the required Tax Type.

'Full GST' must be selected for GST registered businesses and 'GST Free' can be selected for unregistered businesses.

-

Guide

- Add Button

Guide

Go to Setup > Accounting > Sundry in RMS.

Select the ![]() 'Add' icon.

'Add' icon.

Enter a Description.

Select a General Ledger Account Code.

Select the Tax Type.

Navigate to the 'Owner Accounting' tab.

Select the checkbox 'Third Party Guest'.

Select the Third Party.

Select the option 'Pay Third Party from Owner Account/Reservation Account'.

Select 'Save/Exit' to store the changes made and leave the setup.

This Third Party Charge will now be available to apply to the 'Adhoc' view of an Owner Account or a Reservation Account.