RMS Pay Settlement Report

Report on RMS Pay transactions, fees and payout amounts in RMS.

Table of Contents

Fees, Taxes, and DeductionsPayouts and SettlementReport TypesGenerate the RMS Pay Settlement ReportThe RMS Pay Settlement Report is available for RMS Pay customer to view the transactions, fees and payout amounts included for any RMS Pay transactions by accounting date, settlement date, or batch ID.

Transactions may take up to three business days to clear and only transactions that have cleared processing will appear on the report. RMS Pay will transfer any available payout amounts to the property one business day after the transaction has cleared.

The RMS Pay Settlement Report can be generated by accounting date, settlement date, or batch ID. The batch ID can be matched with the deposit transaction on the bank statement where a payout has occurred.

Fees, Taxes, and Deductions

The RMS Pay Settlement Report includes a breakdown of any fees and taxes associated to an RMS Pay transaction.

Only fee columns that are applicable to the RMS Pay account will be visible on the report. Information on the fee schedule for your RMS Pay account are outlined in the sales contract.

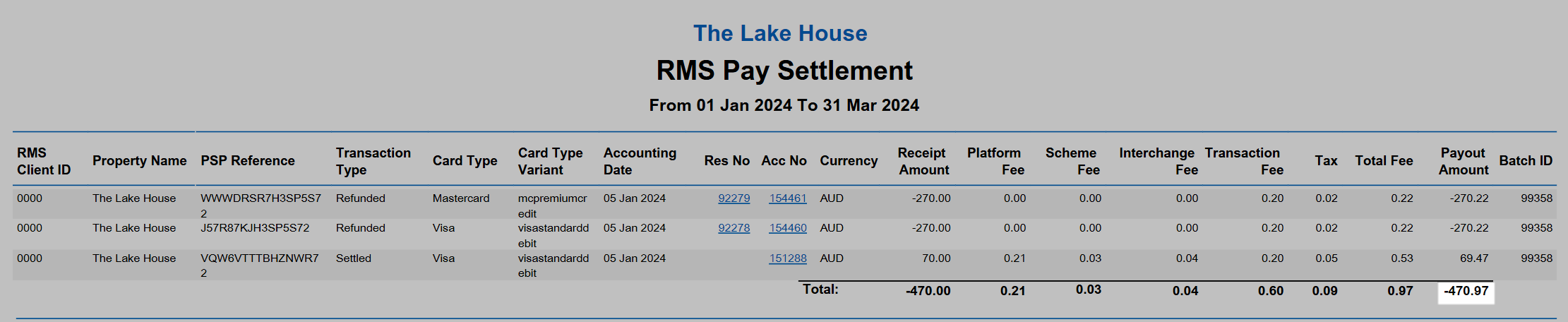

Negative values on the report can occur where the applicable fees or taxes for a transaction are greater than the transaction value, when a receipt is reversed, when a refund has been issued, or if a chargeback occurs.

The 'Tax' column will display any GST applied to the listed fees with the 'Total Fee' column a cumulative total of all listed fees and including any applicable GST.

Combining the individual fee amounts and the amount shown in the 'Tax' column will match the 'Total Fee' displayed. This 'Total Fee' amount is then subtracted from the reported 'Receipt Amount' which results in the 'Payout Amount' for that transaction.

Payouts and Settlement

Transactions processed using RMS Pay will only appear on the RMS Pay Settlement Report once they have cleared processing.

Processing can take up to three business days from the time the transaction occurred in RMS, with payment issued to the nominated bank account one business day after the transaction has cleared.

Settlement Date vs Accounting Date

The RMS Pay Settlement Report can be generated by settlement date, accounting date, or batch ID.

The settlement date matches the actual date and includes any RMS Pay transactions processed between 12:00 AM and 11.59 PM for the reported date.

The accounting date is the transaction date of when the transaction is created and will report all RMS Pay transactions for the selected accounting date grouped by settlement date on the report.

Properties using manual end of day where RMS Pay transactions occur after midnight and before the accounting date is rolled forward will see multiple settlement dates on the 'Accounting Date' version of the report.

Properties using automatic end of day with the time set after midnight will see any RMS Pay transactions that occur between midnight and the selected end of day time will see multiple settlement dates on the 'Accounting Date' version of the report.

Properties using automatic end of day with the time set to midnight will only see one accounting date on any report.

Generating the report by 'Batch ID' will include all RMS Pay transactions included in the reported batch grouped by settlement date.

Payout Amount

The RMS Pay Settlement Report details the payout amount for each cleared RMS Pay transaction on the reported accounting date, settlement date, or batch ID.

The payout amount for an individual transaction is the 'Receipt Amount' less the 'Total Fee' for that transaction.

A negative payout amount will occur if the total fee is greater than the receipt amount, when a refund is issued, when a receipt is reversed, or if a chargeback occurs.

Chargebacks

A chargeback will be reported on the settlement date it is issued and not retrospectively on the settlement date of the original transaction. When a chargeback occurs this appears as a negative value in the payout amount and will deduct from the 'Total Payout Amount' for that settlement date.

If a chargeback is successfully defended the return or release of the funds will be reported on the settlement date the chargeback defence is finalised and not the original transaction settlement date.

During the chargeback defence process certain card types may take several steps to freeze or deduct the payment that was previously taken. Each step by the card type is reflected on the settlement date the action occurs and may result in the same chargeback appearing with a negative payout amount on multiple settlement dates.

The RMS Pay Settlement Report will always accurately reflect the account movement for the reported settlement date.

Once a chargeback defence is finalised the transition of funds can be viewed across multiple RMS Pay settlement dates which will include the original payment transaction date, the chargeback issued date, the chargeback funds deducted date (if applicable), and the chargeback payment returned (if applicable).

Total Payout Amount

The 'Total Payout Amount' for a settlement date on the RMS Pay Settlement Report is the cumulative balance of the payout amounts for all transactions on that settlement date less any negative balance carried forward from a previous settlement date.

Generating the report by accounting date or multiple settlement dates will include multiple batch IDs and cannot be compared to a single deposit value on the bank statement. An actual payout from RMS Pay will only occur when the total payout amount for a single settlement date is in a credit value.

Where the total payout amount for a single settlement date is a negative value, this balance will be carried forward to a future settlement date and be deducted from future payout amounts until the account is back in credit.

The total payout amount will be a negative value if more refunds are processed than payments taken, if chargebacks occur for a value greater than payments taken, if more receipts are reversed than payments taken, if fees for reported transactions exceed the payment amount, or if a brought forward negative balance exceeds the total value of payments taken on that date.

Report Types

The RMS Pay Settlement Report can be generated by accounting date, settlement date, or batch ID as a summary or detailed version.

Information included on the report will vary based on the selected report type.

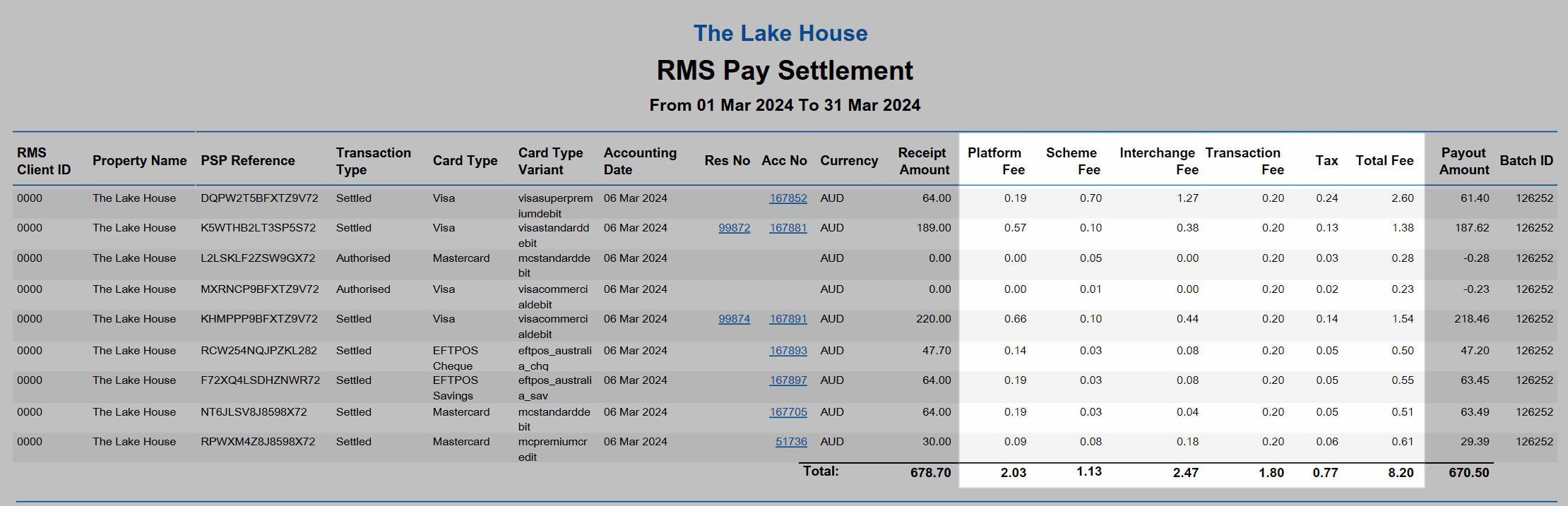

Detailed Report Type

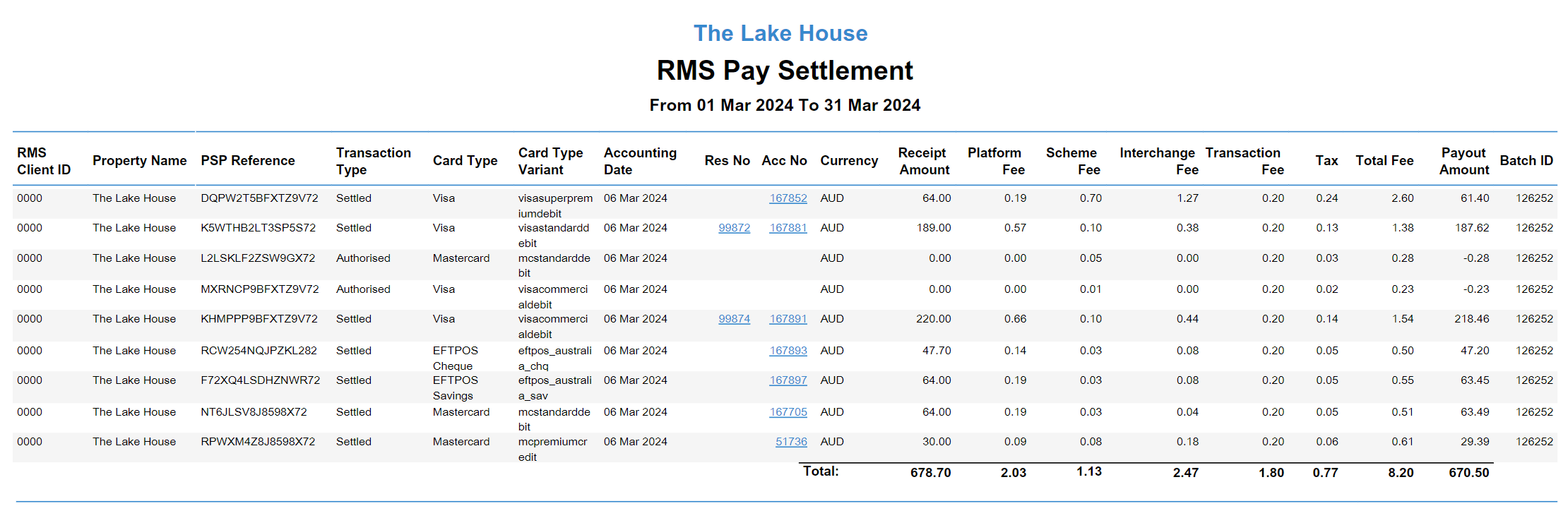

The detailed report type provides in depth transaction information for each transaction.

The following information is included on the detailed report type:

| Report Column | Description |

|---|---|

| RMS Client ID | The unique identifying number for the Property in RMS. |

| Property Name | The name of the property. |

| PSP Reference | A unique identifying payment reference for the transaction that can be used when submitting a ticket or enquiry about the RMS Pay transaction. |

| Transaction Type | The type of transaction processed through RMS Pay including: Authorised, Chargeback, Chargeback Reversed, Refunded, Refused (Declined), Second Chargeback, and Settled. |

| Card Type | The card scheme used for the transaction. |

| Card Type Variant | The type of card as provided by the card issuer. |

| Accounting Date | The accounting date when the transaction was created. |

| Reservation Number | A unique identifying number for the reservation associated to the account where the transaction was created. |

| Account Number | A unique identifying number for the account where the transaction was created. |

| Currency | The currency used for the transaction. |

| Receipt Amount | The value entered as the 'Receipt Amount'. |

| Platform Fee | A variable percentage fee determined by the type of card used for the transaction as outlined in the sales agreement. |

| Scheme Fee * | A fixed fee for the transaction as outlined in the sales agreement. |

| Interchange Fee * | The value of the interchange fee applied to the transaction. |

| Transaction Fee | A fixed fee for the transaction as outlined in the sales agreement. |

| Tax | The sum of GST applied to all applicable fees for Australian properties. |

| Total Fee | The sum of fees including any GST applied to the transaction. |

| Payout Amount | The sum of the 'Receipt Amount' less 'Total Fee' included in the payout for that settlement date. |

| Batch ID | The unique identifying number for the 'Payout Batch' the transaction is included in. |

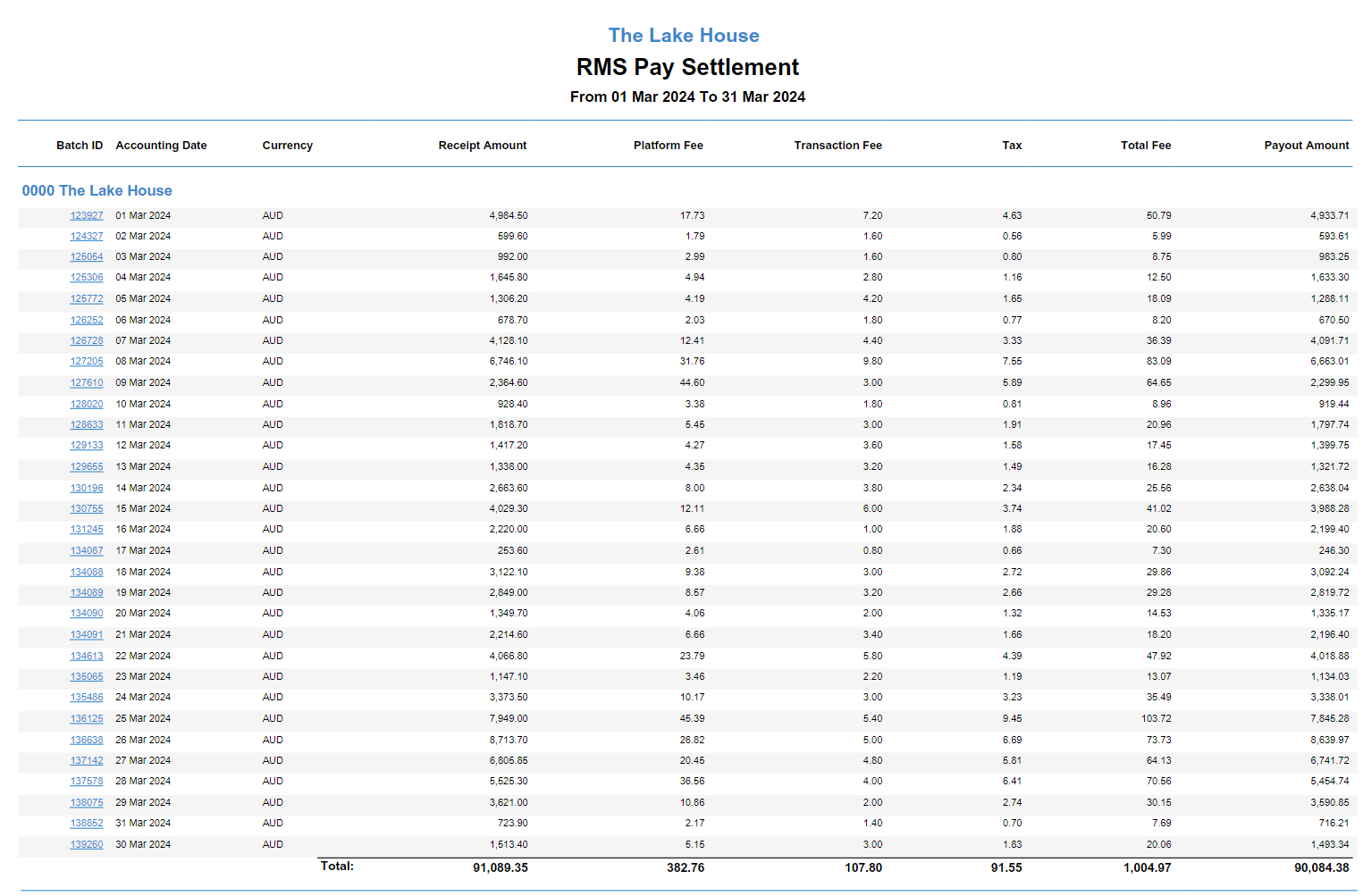

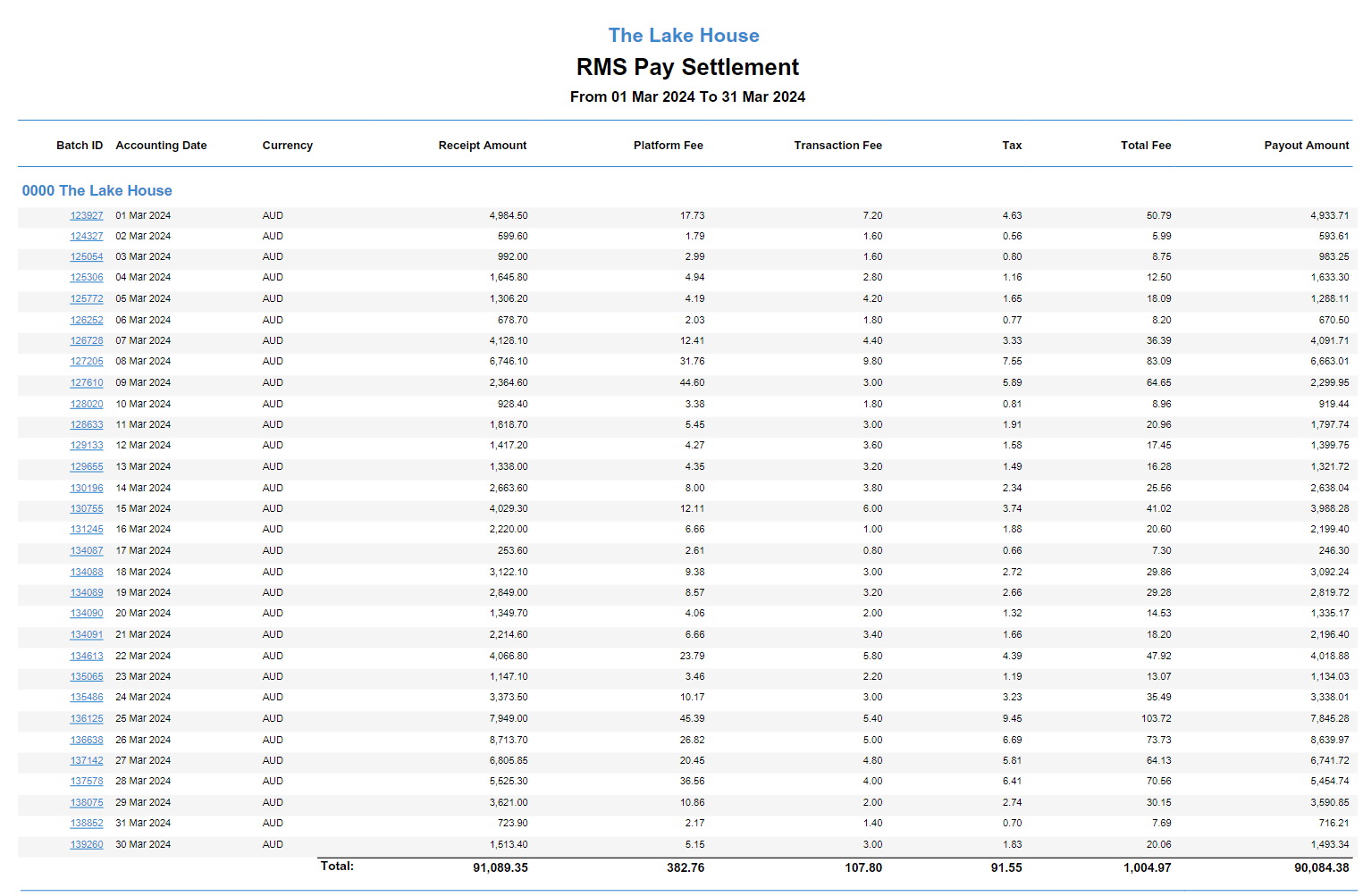

Summary Report Type

The summary report type displays the total values for each settlement date in the selected date range. Selecting a batch date will expand the report into a detailed view displaying all transactions included in that batch and their individual totals.

The following information is included on the summary report type:

| Report Column | Description |

|---|---|

| Batch ID | The unique identifying number to identify the 'Payout Batch' that transactions is included in. |

| Accounting Date | The accounting date when the transaction was created. |

| Currency | The currency used for the transaction. |

| Receipt Amount | The total value entered as the 'Receipt Amount'. |

| Platform Fee | The value of the platform fee applied to the transaction. |

| Scheme Fee * | The value of the scheme fee applied to the transaction. |

| Interchange Fee * | The value of the interchange fee applied to the transaction. |

| Transaction Fee | The value of the transaction fee applied to the transaction. |

| Tax | The sum of any taxes applied to the fees applied to the transaction. |

| Total Fee | The sum of all listed fees and any applicable taxes applied to the transaction. |

| Payout Amount | The sum of the 'Receipt Amount' less 'Total Fee' included in the payout for that settlement date. |

Generate the RMS Pay Settlement Report

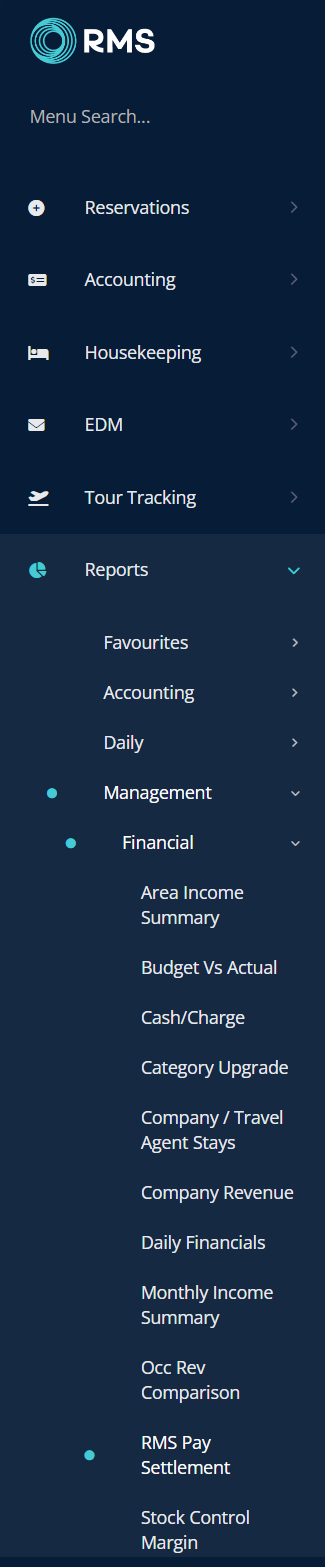

- Go to Reports > Management > Financial > RMS Pay Settlement Report in the side menu of RMS.

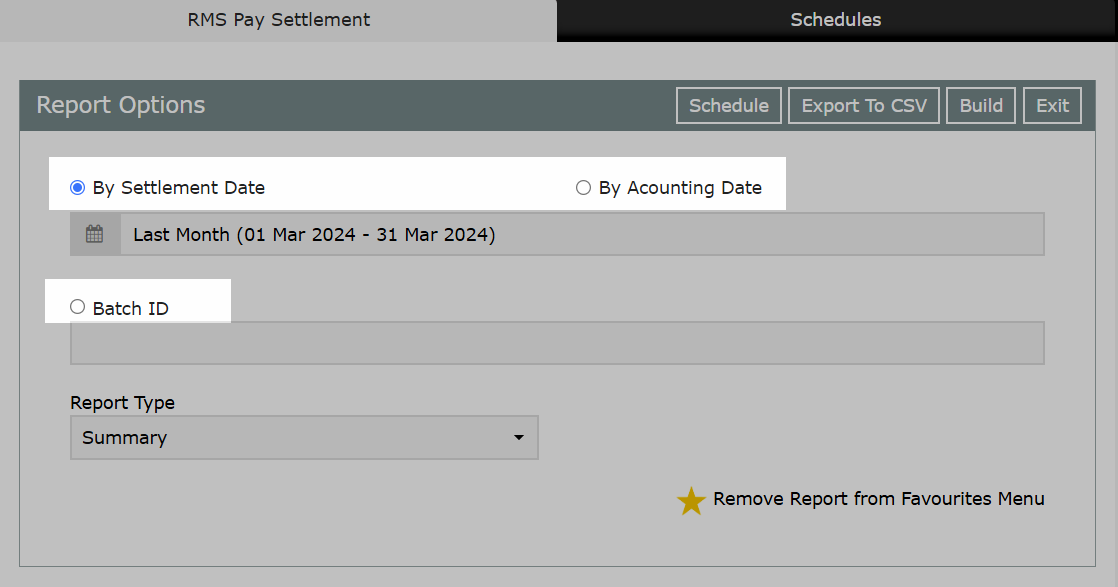

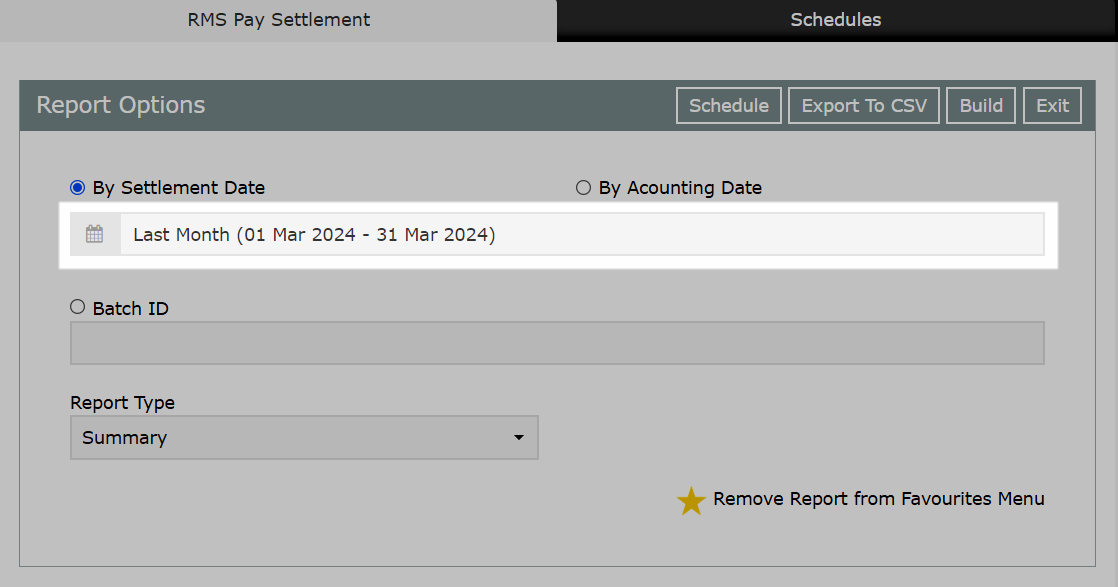

- Select a Report Option of 'By Settlement Date', 'By Accounting Date', or 'Batch ID'.

- Select a Date Range or enter the Batch ID.

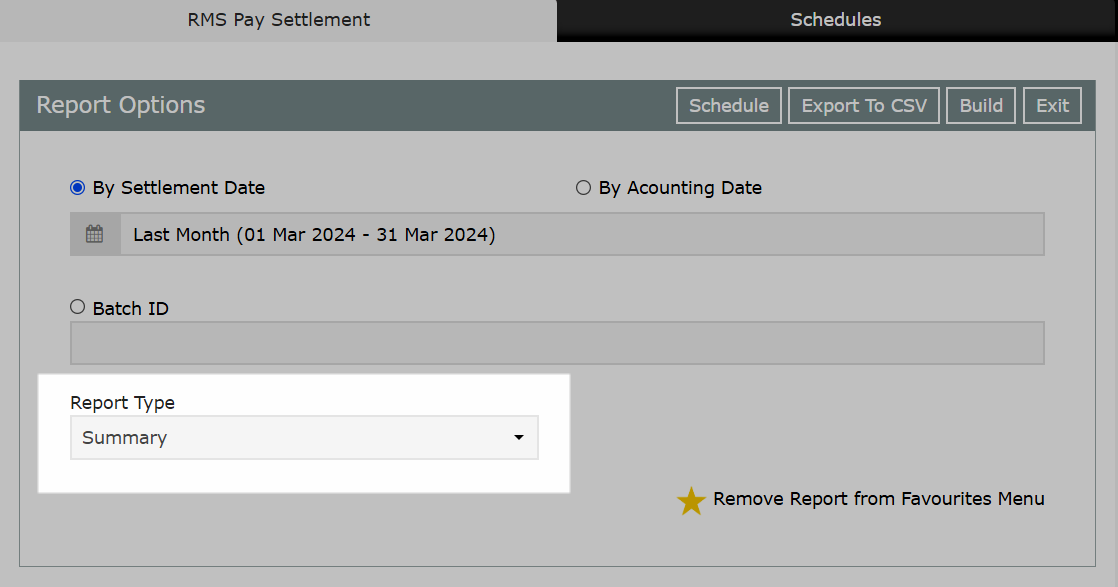

- Select a Report Type of 'Summary' or 'Detailed'.

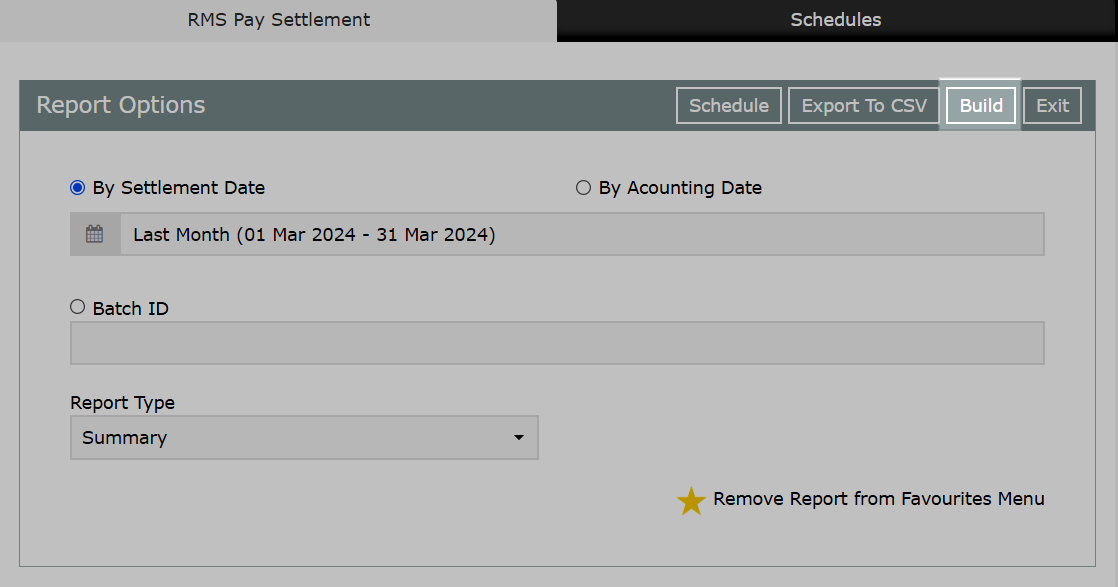

- Build.

Go to Reports > Management > Financial > RMS Pay Settlement Report in the side menu of RMS.

Select a Report Option of 'By Settlement Date', 'By Accounting Date', or 'Batch ID'.

Select a Date Range or enter the Batch ID.

Select a Report Type of 'Summary' or 'Detailed'.

Select 'Build' to generate the report.

The RMS Pay Settlement Report will display all cleared RMS Pay transactions using the selected options.