RMS Pay is a fully integrated payment solution in RMS that provides PCI compliant credit card storage and payment processing.

Activating RMS Pay in the Module Market will require completion of Know Your Customer (KYC) to sign-up for a merchant account to use RMS Pay as the payment gateway in RMS.

RMS Pay includes EFTPOS and eCommerce capabilities to facilitate credit card transactions with card present and card not present.

RMS Pay is the only payment gateway in RMS that includes the ability to send a secure Pay By Link, Manually Release a Pre-Authorisation and manage Chargebacks without navigating outside of the Property Management System.

Delete

Key Features

RMS Pay includes a whole host of benefits for simplifying payments in RMS including:

See the RMS Pay Features article for the full list of features and functions available with RMS Pay.

Activate the RMS Pay Module

- Contact RMS Sales.

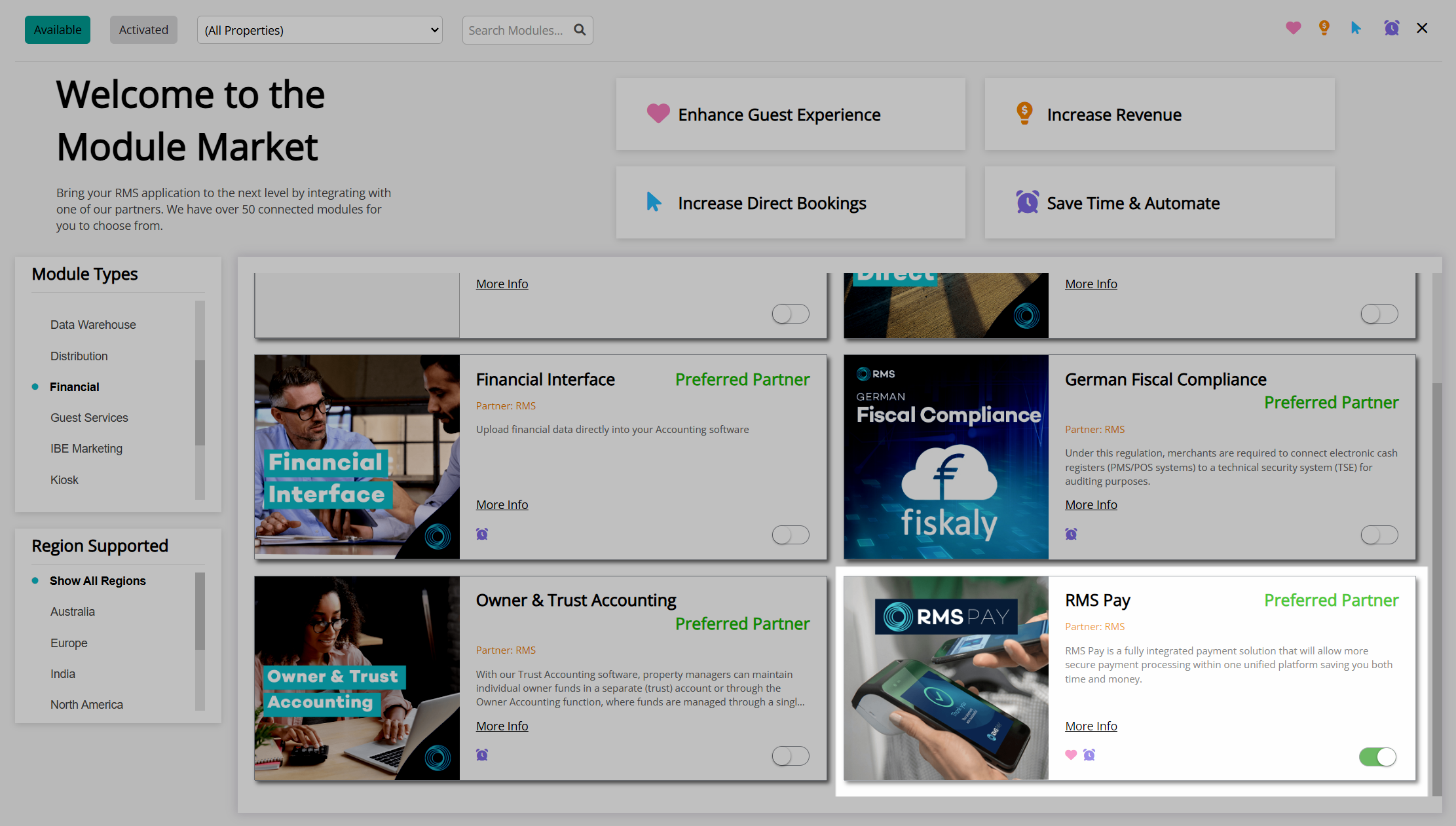

- Go to Module Market in the Side Menu of RMS.

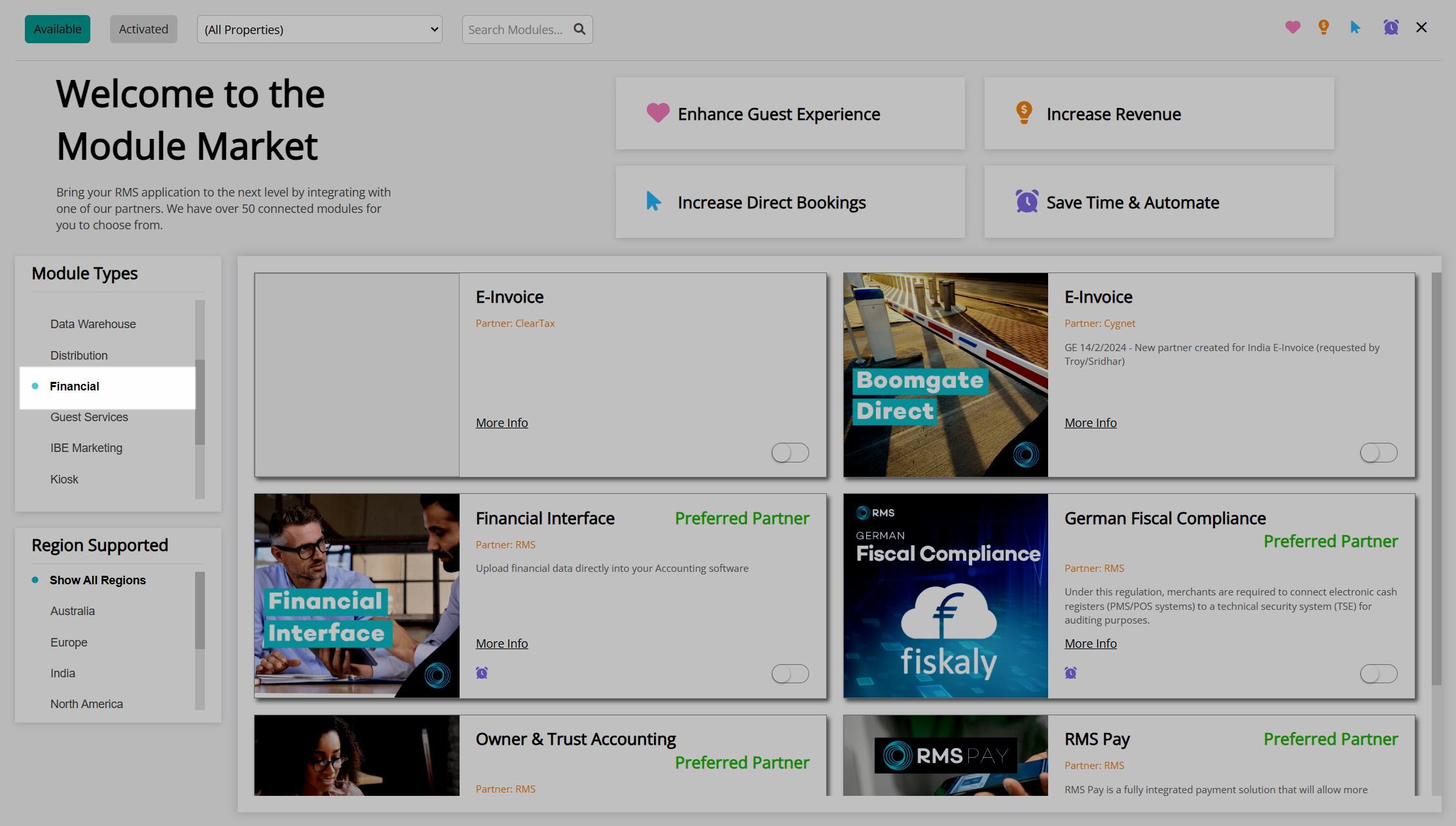

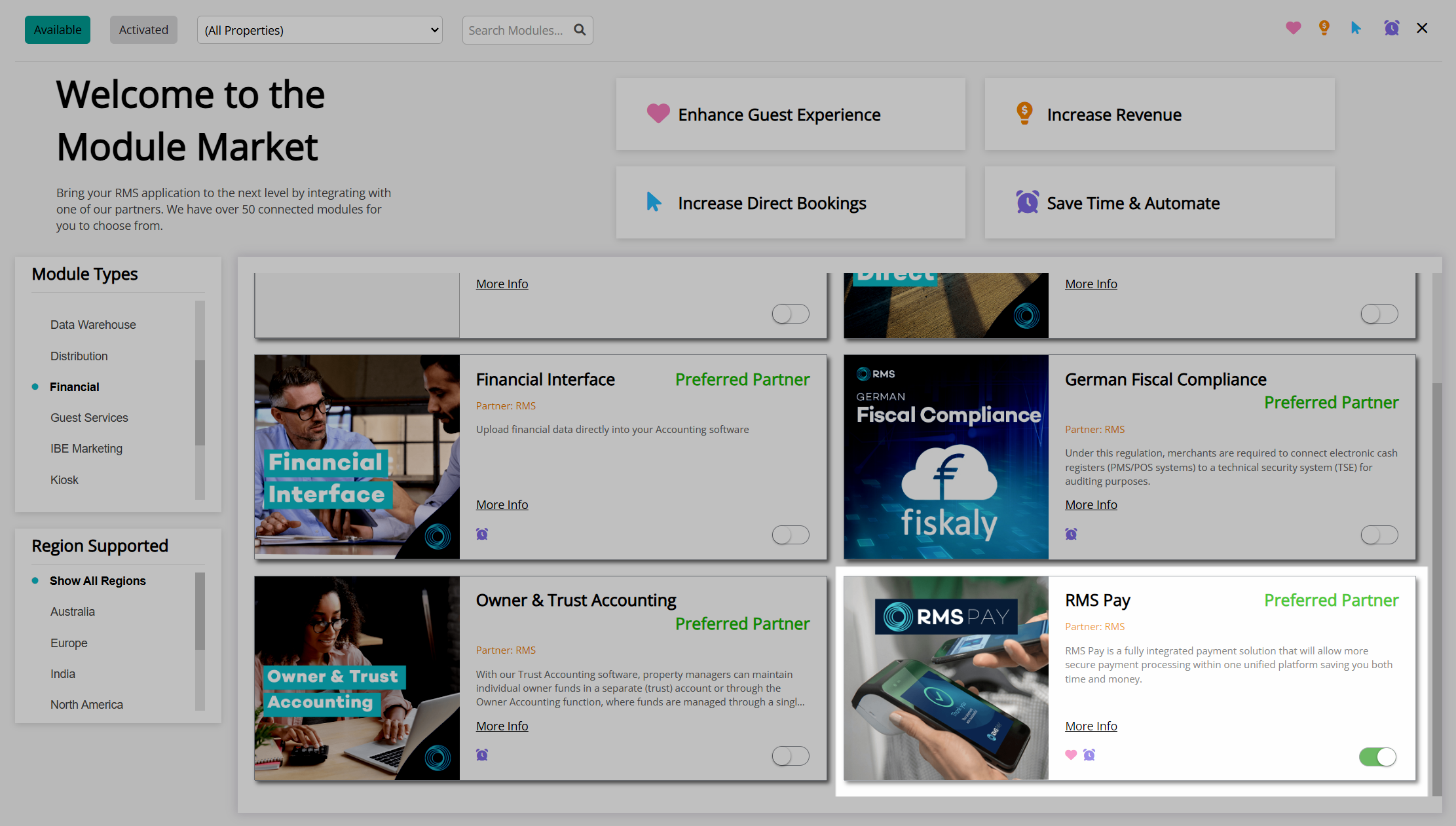

- Select the Module Type as 'Financial'.

- Select the Toggle on the RMS Pay module.

- Review the Module Information.

- Review the Module Terms & Conditions.

- Select 'Activate RMS Pay'.

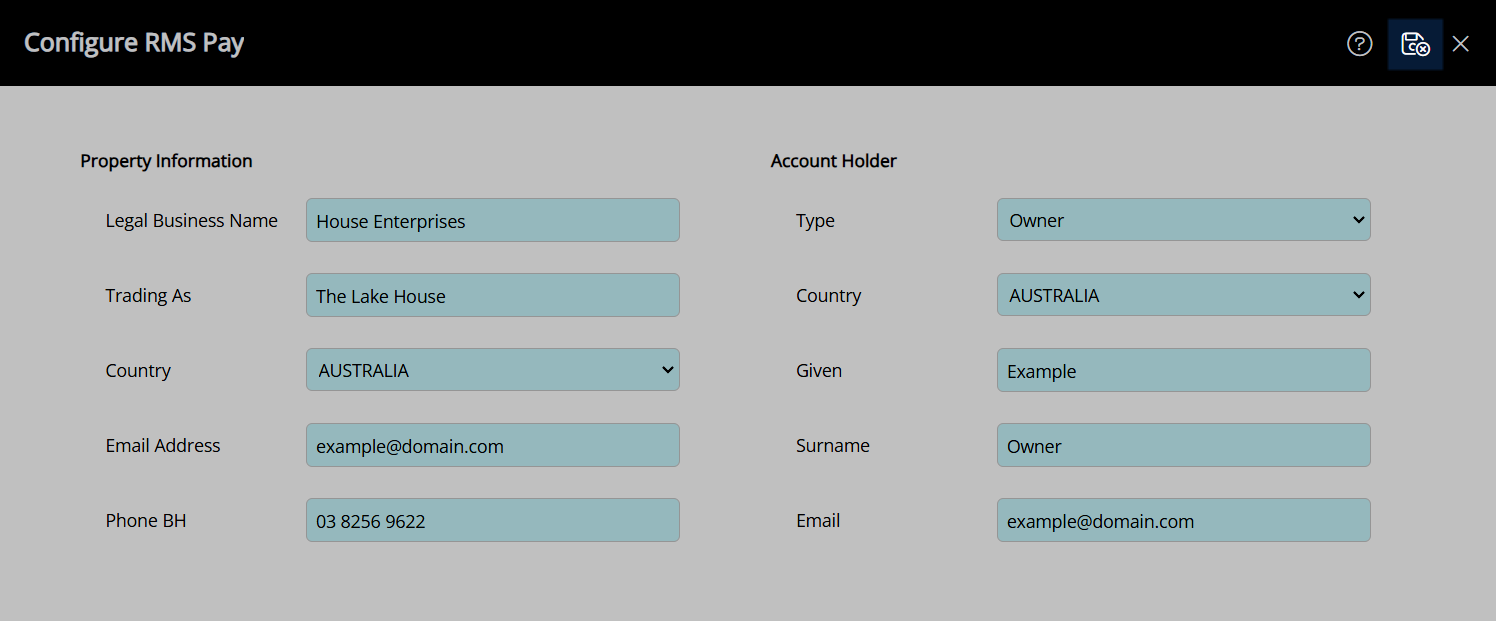

- Enter the Property Information and RMS Pay Account Holder information for RMS Pay Configuration.

-

Save/Exit.

- Complete Know Your Customer (KYC).

Delete

Know Your Customer (KYC)

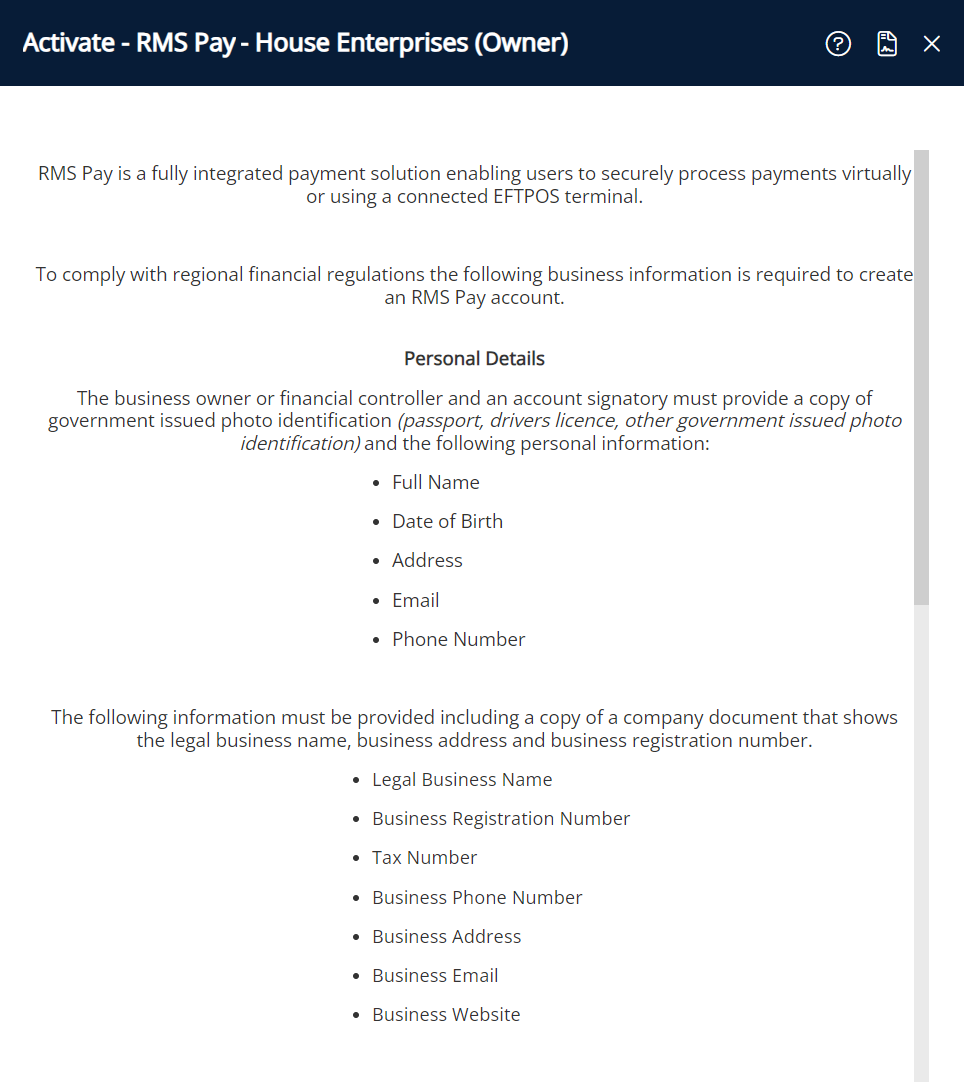

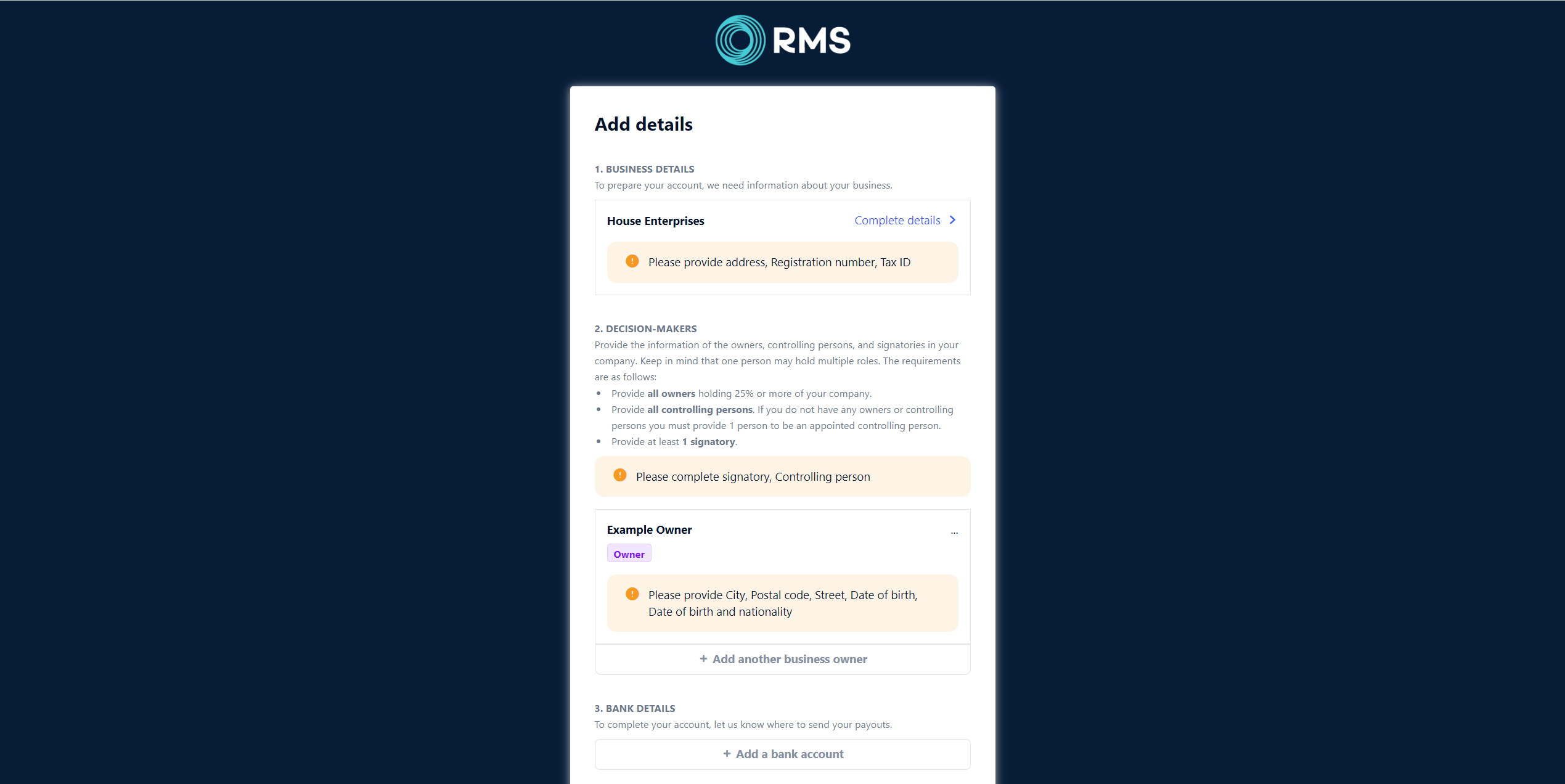

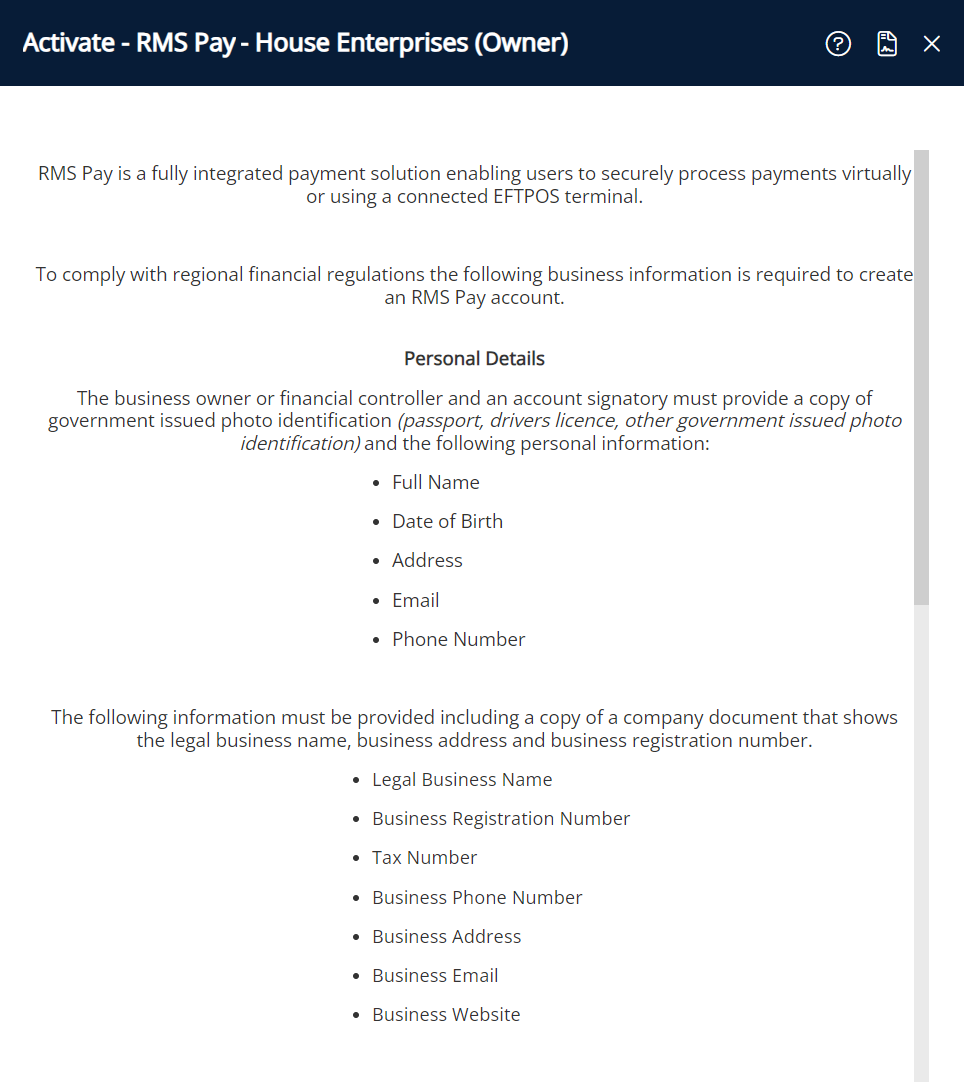

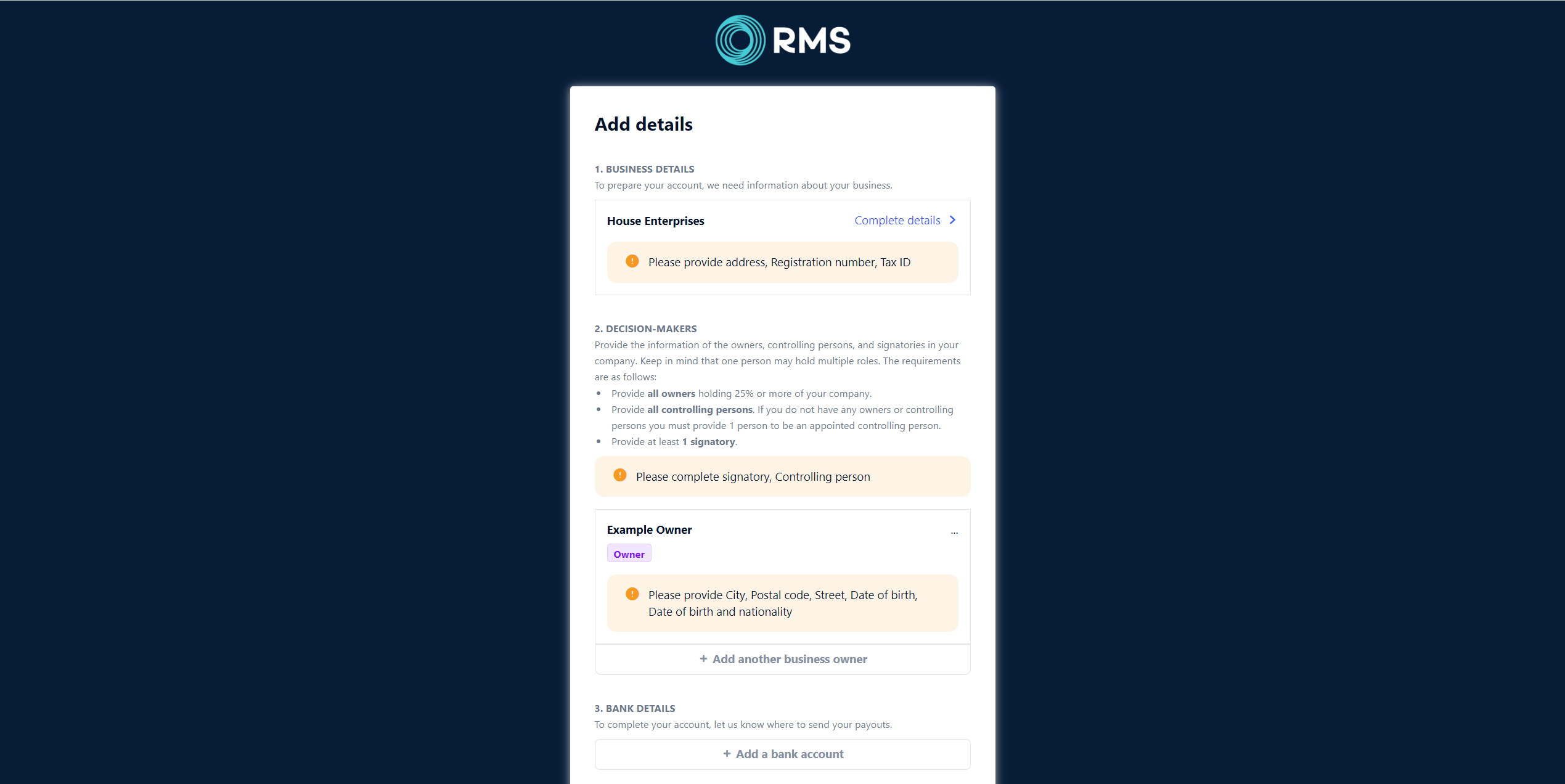

Know Your Customer must be completed by the business owner or financial controller and at least one signatory to establish a sub-merchant account and comply with regional financial regulations to use RMS Pay as the payment gateway in RMS.

The following documentation is required to complete KYC:

- Government-issued photo identification for the business owner, financial controller and at least one signatory.

- Government-issued business registration and/or tax documents verify the legal business name and registration number.

- A bank statement or other bank letter is needed for the business bank account where deposits will be made.

- Additional official documentation establishing a link between the business bank account and/or trust with the legally registered business.

More information on the documentation required for completing sign-up and Know Your Customer can be found in the KYC article.

Delete

Access

System Administrators will require Security Profile access to the Module Market to complete this setup.

Contact RMS Sales and complete the sales process to enter a contract for RMS Pay.

Go to Module Market in the side menu of RMS.

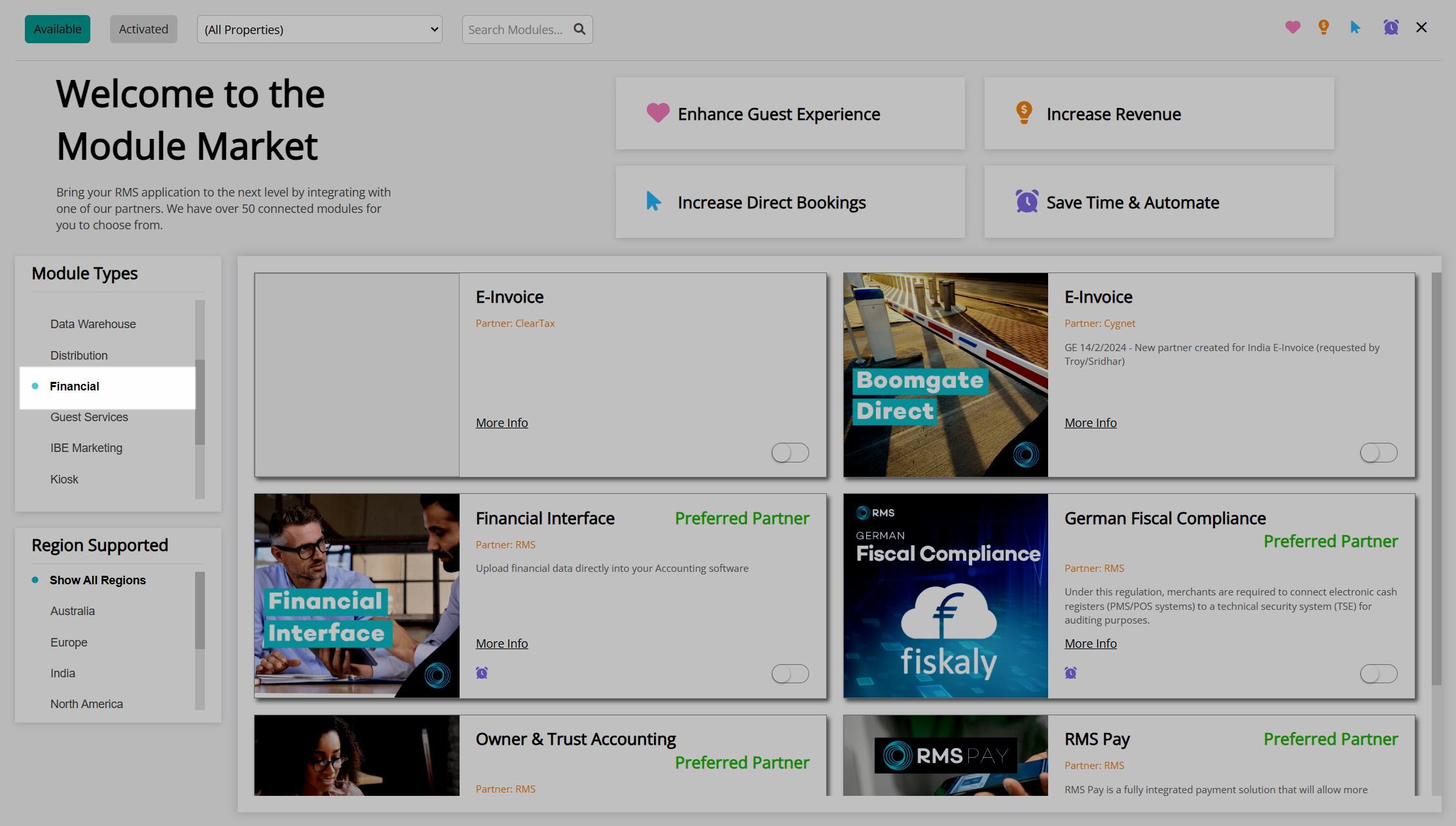

Select the Module Type as 'Financial'.

Select the toggle on the RMS Pay module.

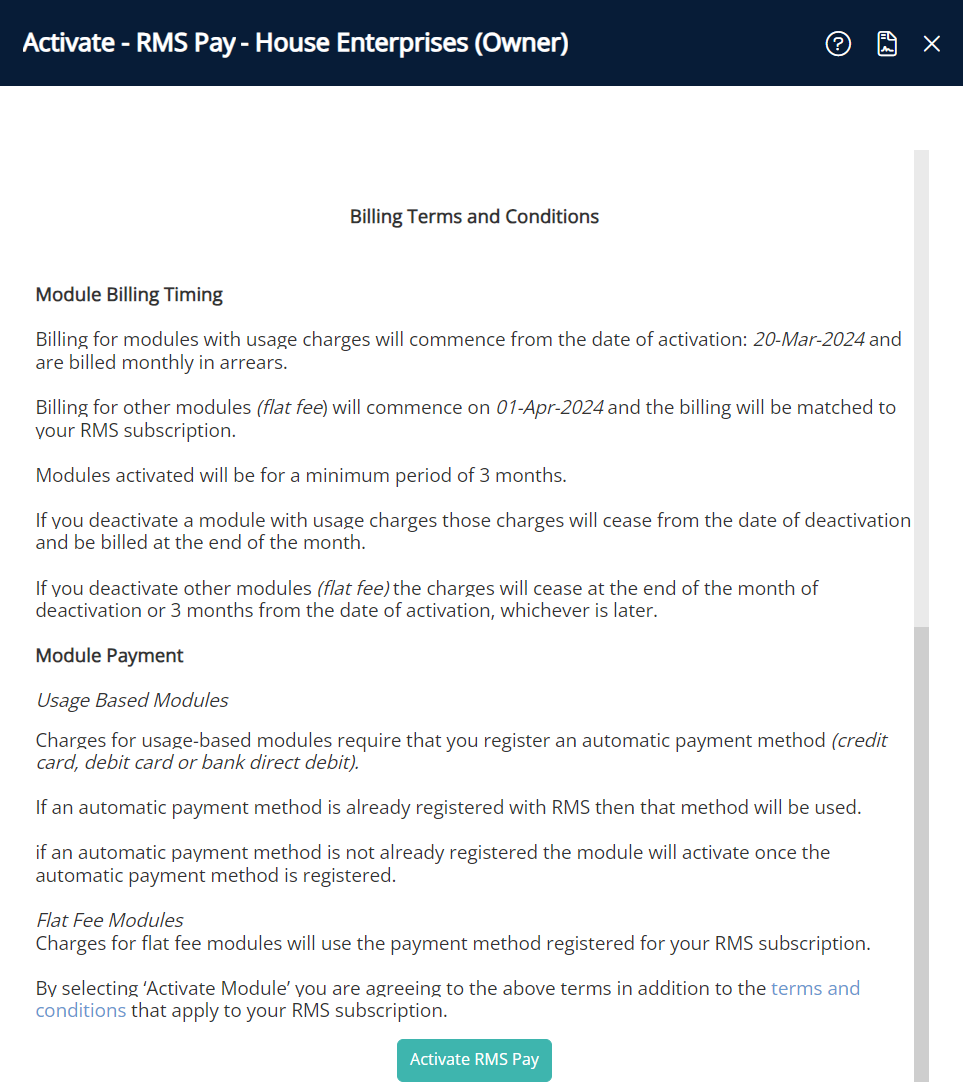

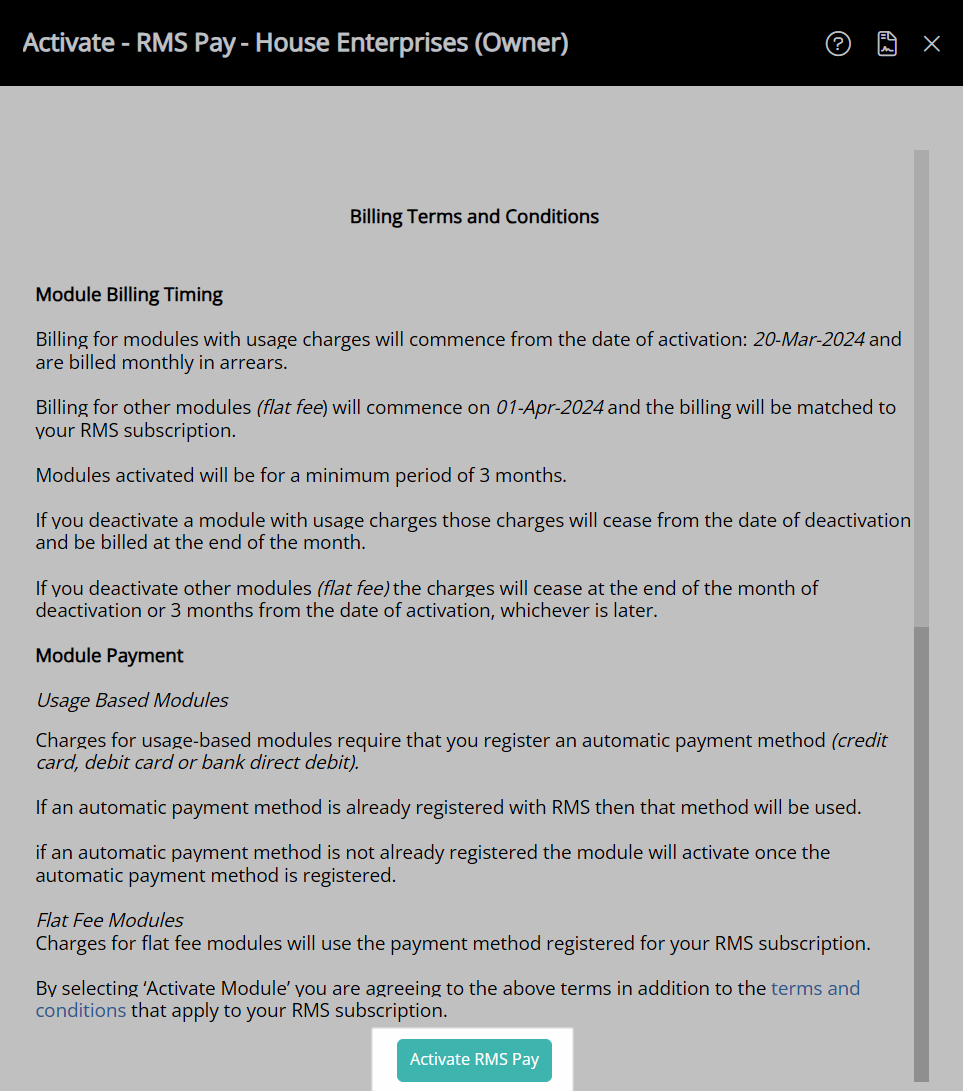

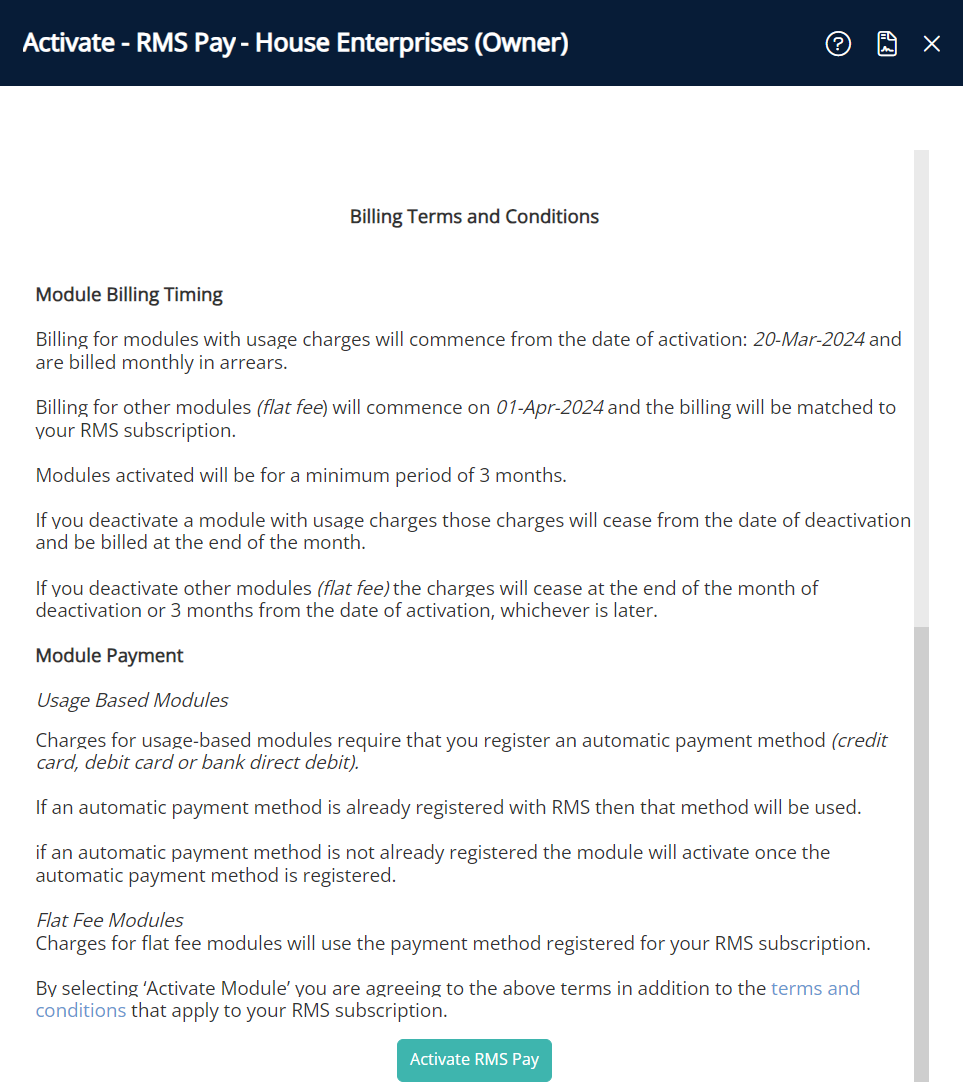

Review the module information.

Review the module terms and conditions.

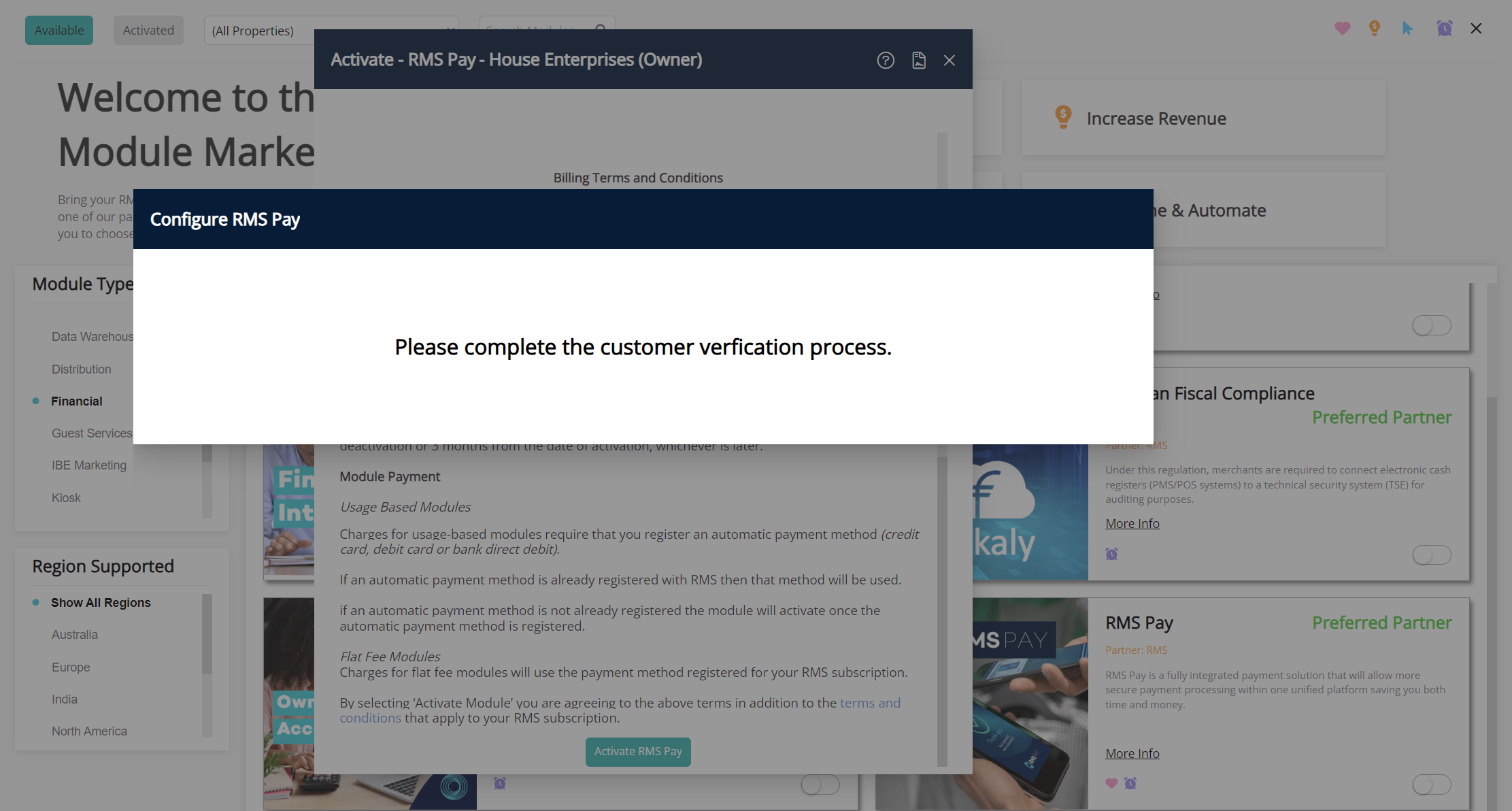

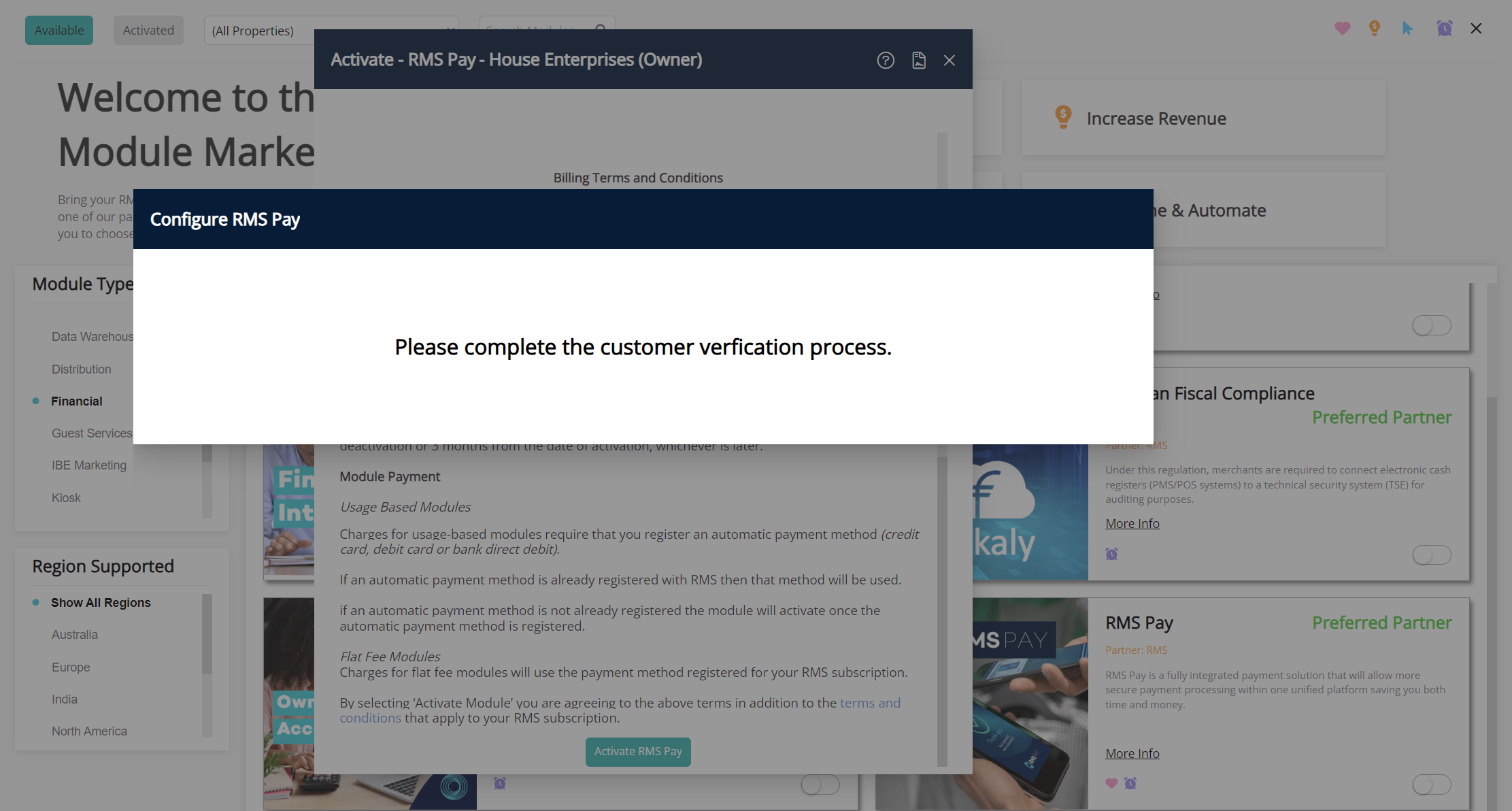

Select 'Activate RMS Pay' to confirm module activation.

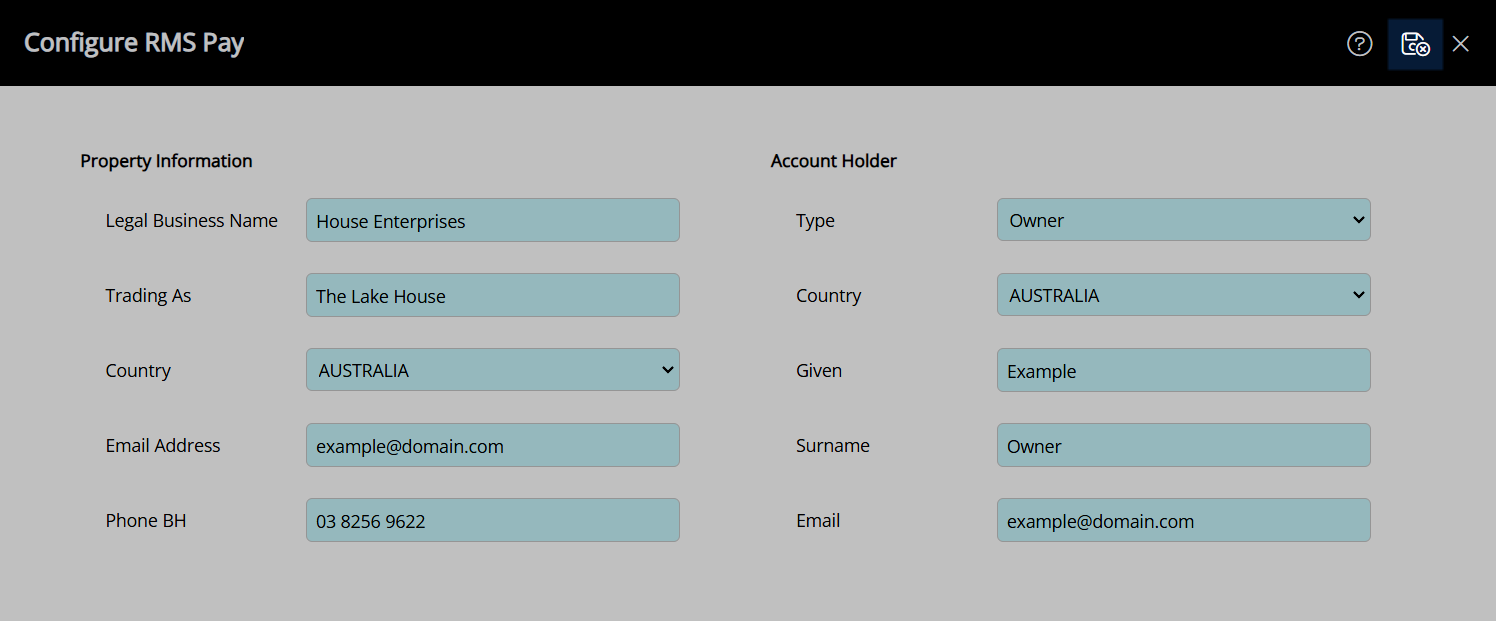

Confirm and enter the Property Information and RMS Pay Account Holder information then select the  'Save/Exit' icon to store the changes made.

'Save/Exit' icon to store the changes made.

The Know Your Customer (KYC) form will open in a new browser tab on  'Save/Exit' of RMS Pay Configuration.

'Save/Exit' of RMS Pay Configuration.

Delete

Pop-ups Blocked

If the KYC form has not opened in a new browser tab, check the RMS application or browser tab where RMS 9+ is open for a  icon indicating that pop-ups have been blocked.

icon indicating that pop-ups have been blocked.

Select the  icon and choose 'Enable pop-ups' then select 'Activate RMS Pay' again to open the KYC form in the browser.

icon and choose 'Enable pop-ups' then select 'Activate RMS Pay' again to open the KYC form in the browser.

Complete Know Your Customer (KYC) to establish a sub-merchant account required to use RMS Pay as the payment gateway in RMS.

Delete

Know Your Customer (KYC)

KYC must be completed within 30 days of module activation to comply with regional financial regulations and use RMS Pay as the payment gateway in RMS.

After the grace period expires, an incomplete or unverified KYC will cancel the account request, and a new request must be initiated.

Credit card transactions and RMS Pay features cannot be used until the KYC process is completed and the sub-merchant account is established.

Next: Know Your Customer (KYC)

'Save/Exit' icon to store the changes made.

'Save/Exit' icon to store the changes made.

'Save/Exit' of RMS Pay Configuration.

'Save/Exit' of RMS Pay Configuration.

icon indicating that pop-ups have been blocked.

icon indicating that pop-ups have been blocked. icon and choose 'Enable pop-ups' then select 'Activate RMS Pay' again to open the KYC form in the browser.

icon and choose 'Enable pop-ups' then select 'Activate RMS Pay' again to open the KYC form in the browser.