Roll Back the Accounting Date

Manually change the Accounting Date to a past date in RMS.

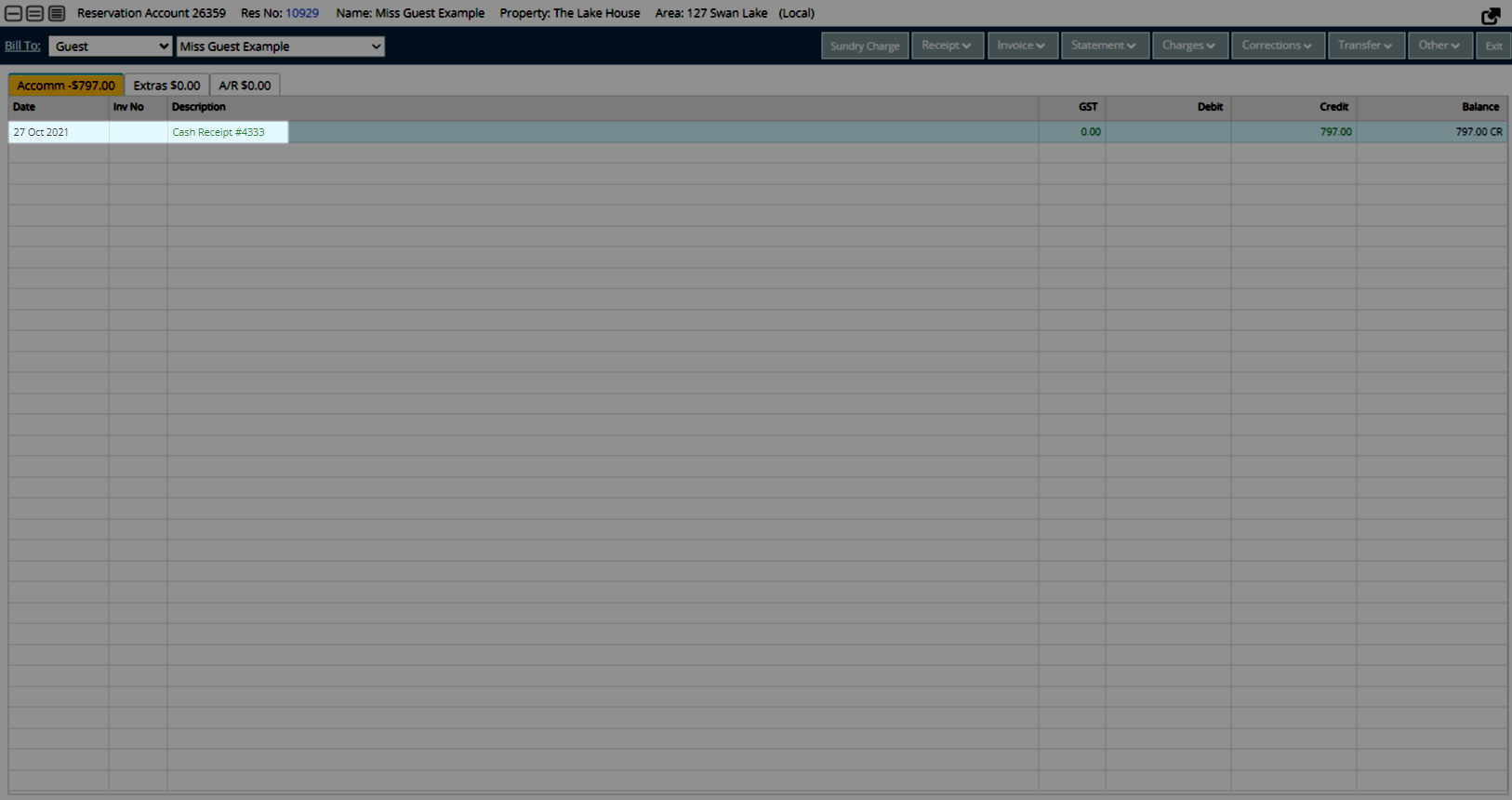

The Accounting Date is the transaction date (Financial Revenue date) for the charge or payment on an account.

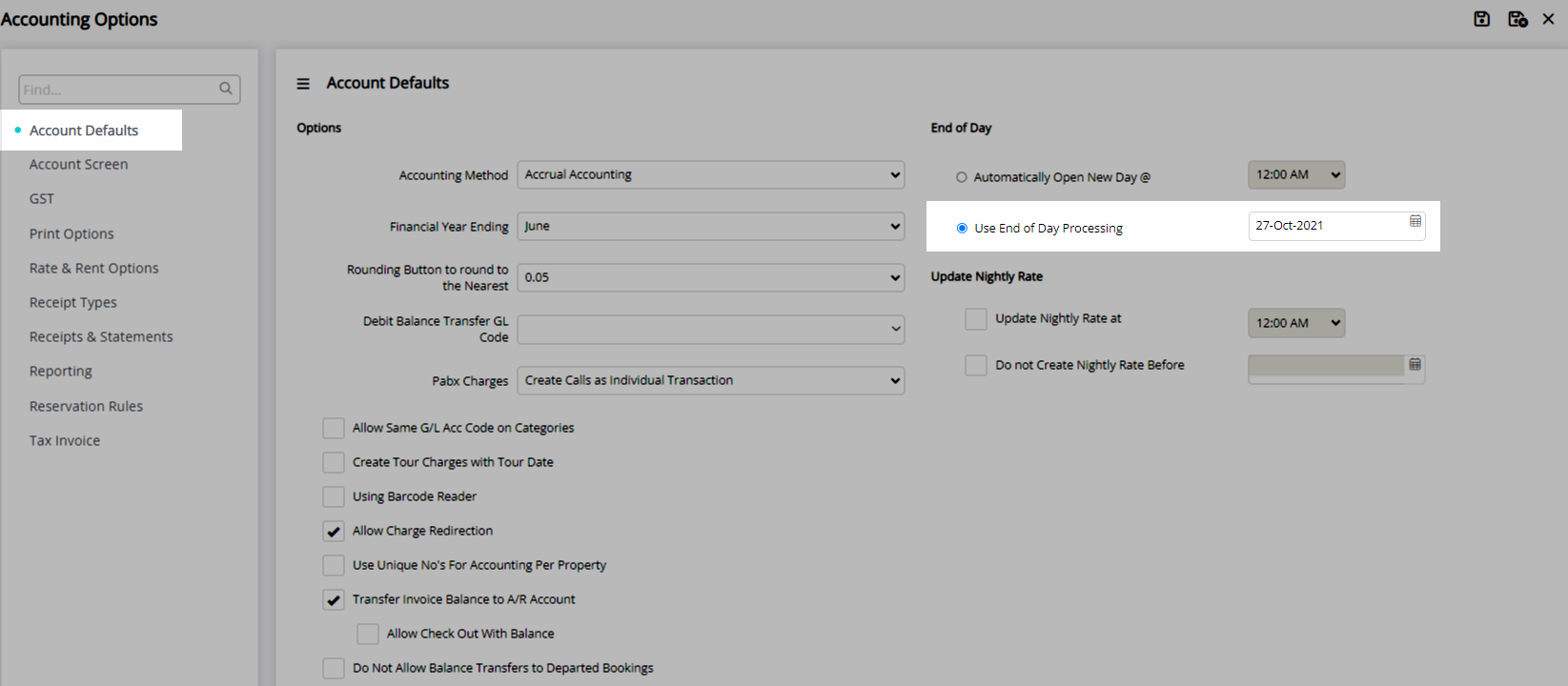

System Administrators can choose from automatic or manual End of Day Processing to determine how the Accounting Date moves forward.

End of Day Processing determines if the new Accounting Date will be rolled over automatically or manually using the New Day/Night Audit utility.

The Accounting Date can be viewed at the bottom of the side menu for single properties or under the User menu for Enterprise customers.

|

|

|

|

The Accounting Date may need to be rolled back if the New Day utility has been run multiple times, to rectify transactions created on the previous date or to create additional transactions for the correct accounting period. | |

|

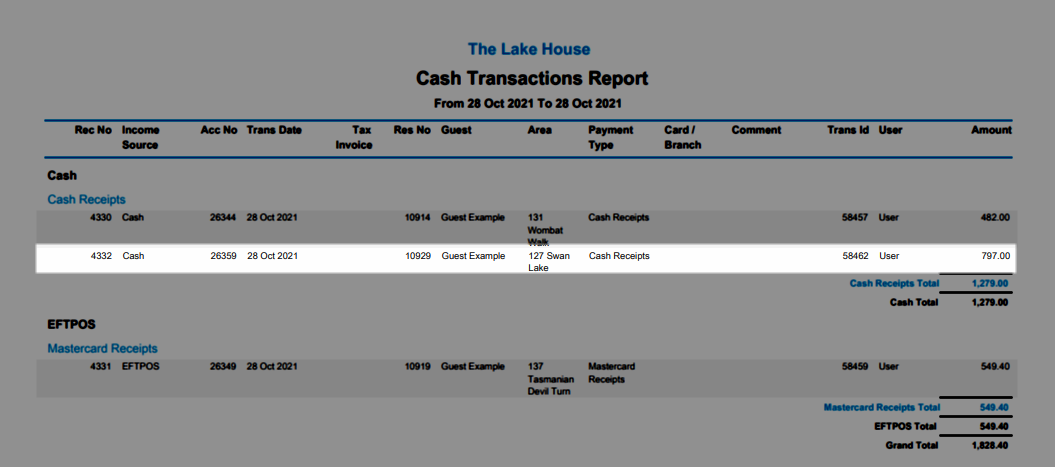

Transactions created on the incorrect Accounting Date will need to be removed using Reverse Receipt or Void Charge and recreated on the correct Accounting Date. Receipts created via a Payment Gateway will refund the credit card if the Receipt is reversed in RMS. The Cash Transaction Report or Cash/Charge Report can be generated to assist in identifying affected transactions. The Accounting Date will need to be manually adjusted to the current date if changed to a previous period. | |

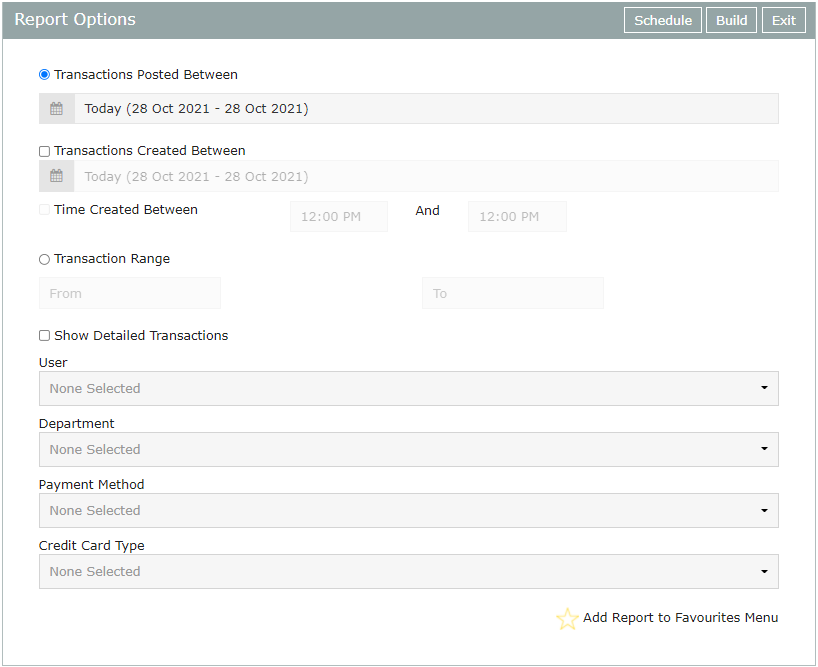

SolutionGo to Reports > Accounting > Cash Transaction Generate the Cash Transaction Report for the current Accounting Date in RMS to review transactions that have been created.

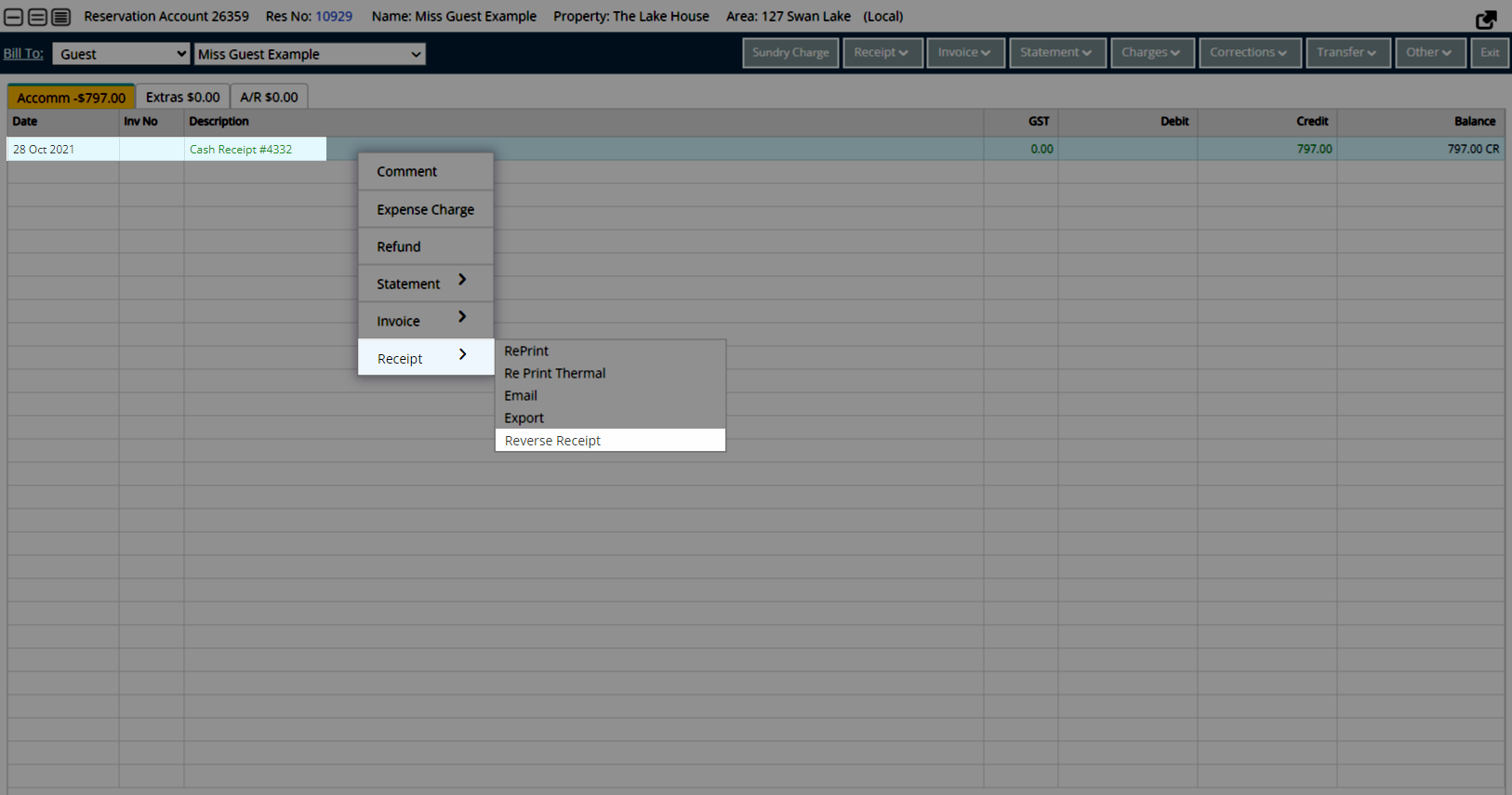

Use Reverse Receipt on any Receipts created on the incorrect Accounting Date.

Use Void Charge to remove any charge transactions where Receipt Allocation has occurred and the Receipt is going to be reversed or for any charge transactions that need to be created on the previous Accounting Date. The System Administrator can complete the following steps to change the Accounting Date.

Changing the Accounting Date when transactions exist for a future date will corrupt the transaction data. Any future transactions must be removed before changing the Accounting Date to a past date. Go to Setup > Accounting > Accounting Options in RMS.

Navigate to the 'Account Defaults' tab, select 'Use End of Day Processing' and select the required Accounting Date.

Select 'Save/Exit' and log out of RMS to allow the database to update with the changes made. All users will need to log out of RMS and log back in for the date change to take effect. Any Reversed Receipt or Voided Charge can now be recreated on the account for the new Accounting Date.

The System Administrator can now update the Accounting Date back to the current date and/or change End of Day Processing to Automatically Open New Day. | |

Account Types and Receipt Types are default System Labels that can be customised. For further assistance or for Owner & Trust Accounting log a Service Request with the RMS Customer Support team.

System Administrators will require Security Profile access to use this feature. | |