Setup Hierarchy

Information on which rules take precedence when setup in RMS.

Table of Contents

Key TermsUser FunctionsSystem FunctionsCancellation PolicyDeposit PolicyGeneral Ledger Account CodesHousekeeping Task AllocationHousekeeping Task HierarchyLength of Stay RestrictionsLength of Stay RestrictionsReservation Account Bill ToTaxesTerms & ConditionsMultiple configuration layers exist in RMS to provide flexibility and customisation that can be used to manage all operational requirements.

When a setup item can exist in multiple places, a hierarchy determines what order takes precedence with different workflows for system and user functions.

A user function is any action a person logged into RMS performs, including creating a reservation, creating a receipt on an account, or sending a form letter.

A system function is a process performed by RMS behind the scenes, including the housekeeping task schedule on a reservation, which length of stay restrictions are enforced, which taxes apply to a charge when created on an account, and which general ledger account code revenue is attributed to.

User Functions

A user function is any action a person logged into RMS performs, including creating a reservation, creating a receipt on an account, or sending a form letter.

The actions a user can perform are determined by their Security Profile. The Security Profile also determines which discounts, rates, correspondence, VIP codes, properties, and categories can be accessed.

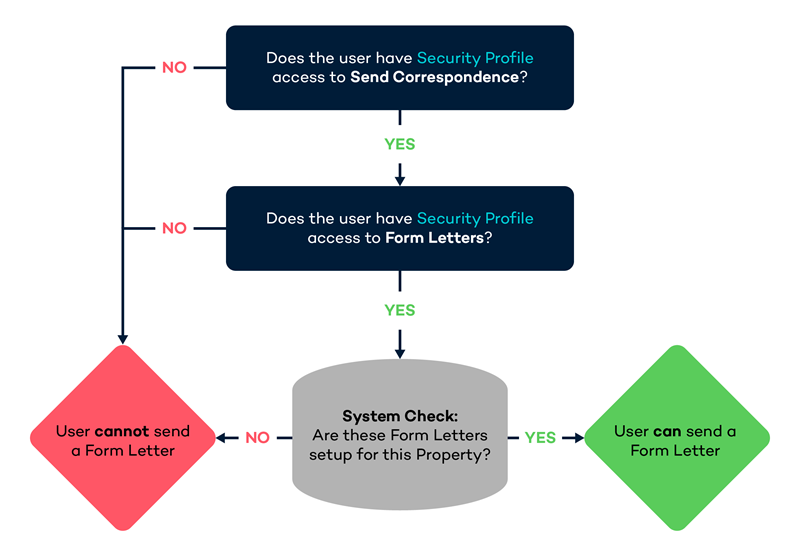

Some user actions require access to multiple security profile functions. For example, a user with the 'Send Correspondence' permission will also need security profile access to at least one form letter or SMS to complete the action and access to guest profiles and reservations.

The diagrams below demonstrate how the security profile determines if an action can be performed.

Add Reservation

Send Form Letter

System Functions

A system function is a process performed by RMS behind the scenes, including the housekeeping task schedule on a reservation, which length of stay restrictions are enforced, which taxes apply to a charge when created on an account, and which general ledger account code revenue is attributed to.

The system configuration determines the rules RMS will apply and use to run various tasks.

Many setup options can exist in multiple layers, and the system function will use the specific item hierarchy to determine which item applies when multiple layers are configured.

As a general rule, system functions use the logic below to determine which layer applies, although many include more layers than shown below:

| Reservation | ||||||||||||

| Control Panel | ||||||||||||

| Rates | ||||||||||||

| Area | ||||||||||||

| Category | ||||||||||||

| Property | ||||||||||||

| Database | ||||||||||||

Below are the individual hierarchies for each of the setup items with multiple layers of configuration in RMS.

Cancellation Policy

The Cancellation Policy applied to the reservation will be determined by the following hierarchy:

| Reservation1 | ||||||||||||||||

| Rate Type Control Panel Override | ||||||||||||||||

| Rate Type Property Rule | ||||||||||||||||

| Rate Period | ||||||||||||||||

| Rate Table | ||||||||||||||||

| Rate Type | ||||||||||||||||

| Derived Rate Type Control Panel Override | ||||||||||||||||

| Derived Rate Type Property Rule | ||||||||||||||||

| Derived Rate Type2 | ||||||||||||||||

1. Selecting or changing the cancellation policy on a reservation will ignore any policy selected on any rate setup.

2. A cancellation policy set on a Derived Rate will only apply if no cancellation policy is selected on the Rate Type or Derived Rate Type used as the 'Derived From'.

Deposit Policy

The Deposit Policy used on a reservation will be determined by the following hierarchy:

| Reservation1 | ||||||||||||

| Rate Type Control Panel Override | ||||||||||||

| Rate Type Property Rule | ||||||||||||

| Rate Table | ||||||||||||

| Derived Rate Type Control Panel Override | ||||||||||||

| Derived Rate Type Property Rule | ||||||||||||

| Derived Rate Type2 | ||||||||||||

1. Mixed Rate Reservations will use the Rate Type Deposit with the highest value to determine the deposit due for the reservation.

2. A deposit policy set on a Derived Rate will only apply if no deposit policy is selected on the Rate Type or Derived Rate Type used as the 'Derived From'.

General Ledger Account Codes

Revenue will be attributed to a general ledger account code using the below hierarchy:

| Sundry | ||||||

| Rate | ||||||

| Area | ||||||

| Category | ||||||

Housekeeping Task Allocation

Housekeeping Tasks can be setup on multiple layers to provide maximum flexibility and control over the scheduling of tasks on a reservation at the property.

To simplify housekeeping setup it is recommended to use the lowest applicable setup tier and sparingly use higher setup tiers to override the base setup.

The housekeeping schedule on a reservation will only include tasks from the highest available setup tier using the below hierarchy:

|

Rate Table 1 Best for seasonal housekeeping. |

||||||||||||||||

|

Derived Property Rate Rule Best for rate specific housekeeping at a particular property. |

||||||||||||||||

|

Derived Rate Type 2 Best for rate specific housekeeping on a derived rate type. |

||||||||||||||||

|

Property Rate Rule Best for rate specific housekeeping at a particular property. |

||||||||||||||||

|

Rate Type Best for rate specific housekeeping on a standalone rate type. |

||||||||||||||||

|

Area Best for housekeeping that differs per area or for a specific area. |

||||||||||||||||

|

Category Best for housekeeping that differs per category or for a specific category. |

||||||||||||||||

|

Property Best for housekeeping across the entire property. |

||||||||||||||||

1 - Any Housekeeping Tasks setup on the Rate Table of a 'Derived From' Rate Type will not override the tasks set on the Derived Rate Type or Derived Rate Type Property Rule.

2 - Any Housekeeping Tasks setup on a Rate Table selected in the 'Adjustment Amount' tab of a Derived Rate will override any tasks set on the Derived Rate Type or Derived Rate Type Property Rule.

Length of Stay Restrictions

Length of stay restrictions (LOS) can be applied to Rates at various levels with each level of restriction taking precedence over the previous layer.

Minimum and maximum length of stay restrictions can be setup in the following areas of RMS:

| Control Panel | ||||||||||||

| Rate Table | ||||||||||||

| Rate Period | ||||||||||||

| Rate Type Property Rule | ||||||||||||

| Derived Rate Type | ||||||||||||

| Rate Type | ||||||||||||

- Control Panel Override: Overrides any Length of Stay set in Rate Setup.

- Rate Table: Overrides Length of Stay set on the Rate Period, Derived Rate or Rate Type.

- Rate Period: Overrides Length of Stay set on the Derived Rate or Rate Type as well as any Property Rate Rules.

- Rate Type Property Rule: Overrides Length of Stay setup on the Derived Rate Type, Master Rate Type or Stand Alone Rate Type for the specific Properties setup for.

- Derived Rate Type: Overrides Length of Stay setup on the Master Rate Type if selected on Derived Rate Setup.

- Rate Type: Base level restriction that will not be applied if any overlaying restriction exists.

| Month | |||||

|---|---|---|---|---|---|

| 1st | 2nd | 3rd | 4th | 5th | 6th |

| Control Panel | |||||

| Rate Table | |||||

| Rate Period | |||||

| Rate Type Property Rule | |||||

| Derived Rate Type | |||||

| Rate Type | |||||

- Reservations arriving on the 1st would use the minimum and maximum length of stay set on the Rate Type.

- Reservations arriving on the 2nd would use the minimum and maximum length of stay set on the Derived Rate Type, if selected on setup to override the Master Rate Type.

- Reservations arriving on the 3rd would use the minimum and maximum length of stay set on the Property Rate Rules.

- Reservations arriving on the 4th would use the minimum and maximum length of stay set on the Rate Period.

- Reservations arriving on the 5th would use the minimum and maximum length of stay set on the Rate Table.

- Reservations arriving on the 6th would use the minimum and maximum length of stay set as an Override in the Control Panel or on the Rate Manager Chart.

MLOS (On Arrival) & Soft Close

A Minimum Length of Stay (On Arrival) requires guests reservations to be of a certain length if choosing to arrive on a day where a MLOS is set.

A Soft Close requires guests reservations to be of a certain length if the date the Soft Close is setup is included within their stay dates.

Where a combination of a MLOS (On Arrival) and a Soft Close are setup across the dates the guest reservation is being created, provided both have been setup optimally the guest's reservation will be required to adhere to both restrictions with the greater of the two applying.

| Month | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1st | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | 10th |

| Soft Close - 4 Nights | |||||||||

| MLOS (On Arrival) - 3 Nights | |||||||||

- Reservations arriving 1st will be required to have a minimum stay of 3 nights due to the MLOS (On Arrival). They will be able to depart on 4th.

- Reservations arriving 2nd or 3rd will be required to have a minimum of 4 nights. The MLOS (On Arrival) prevents the guest departing prior to 4th when the Soft Close takes effect and requires the guest stay a minimum of 4 nights to include this date in their reservation.

Reservation Account Bill To

The Reservation Account Bill To determine the party responsible for payment on each account type, which will be the addressee on any statement or tax invoice.

The party responsible for payment will be determined by the following hierarchy:

| Reservation Account | ||||||||||

| Payment Mode | ||||||||||

| Company Rate Type Bill To | ||||||||||

| Company Bill To | ||||||||||

| Travel Agent Bill To / Channel Bill To | ||||||||||

| Default Reservation Account Bill To | ||||||||||

Taxes

Tax calculations are performed in the background when a transaction is created on an RMS account.

These tax calculations will be determined by the tax method configured in Accounting Options and any additional taxes applied to a Category or Sundry Charge.

Tax Exclusive properties can set up a category with Compound Taxes or specify the Calculation Order for taxes that will be used for Rate transactions associated with that category.

Tax Exemptions provide the flexibility to pre-configure variations to the standard tax rules, including removing specific taxes or their application. Tax Exemptions can be selected on a reservation, Company, or Travel Agent to alter the default tax rules applied to transactions on the related account.

Terms & Conditions

The following hierarchy is used when determining which Terms & Conditions apply to a reservation:

| Corporate Portal / Guest Portal / Gift Cards Portal / Passes Portal | ||||||

| Category Terms & Conditions | ||||||

| Online Options Terms & Conditions | ||||||

| Property Terms & Conditions | ||||||